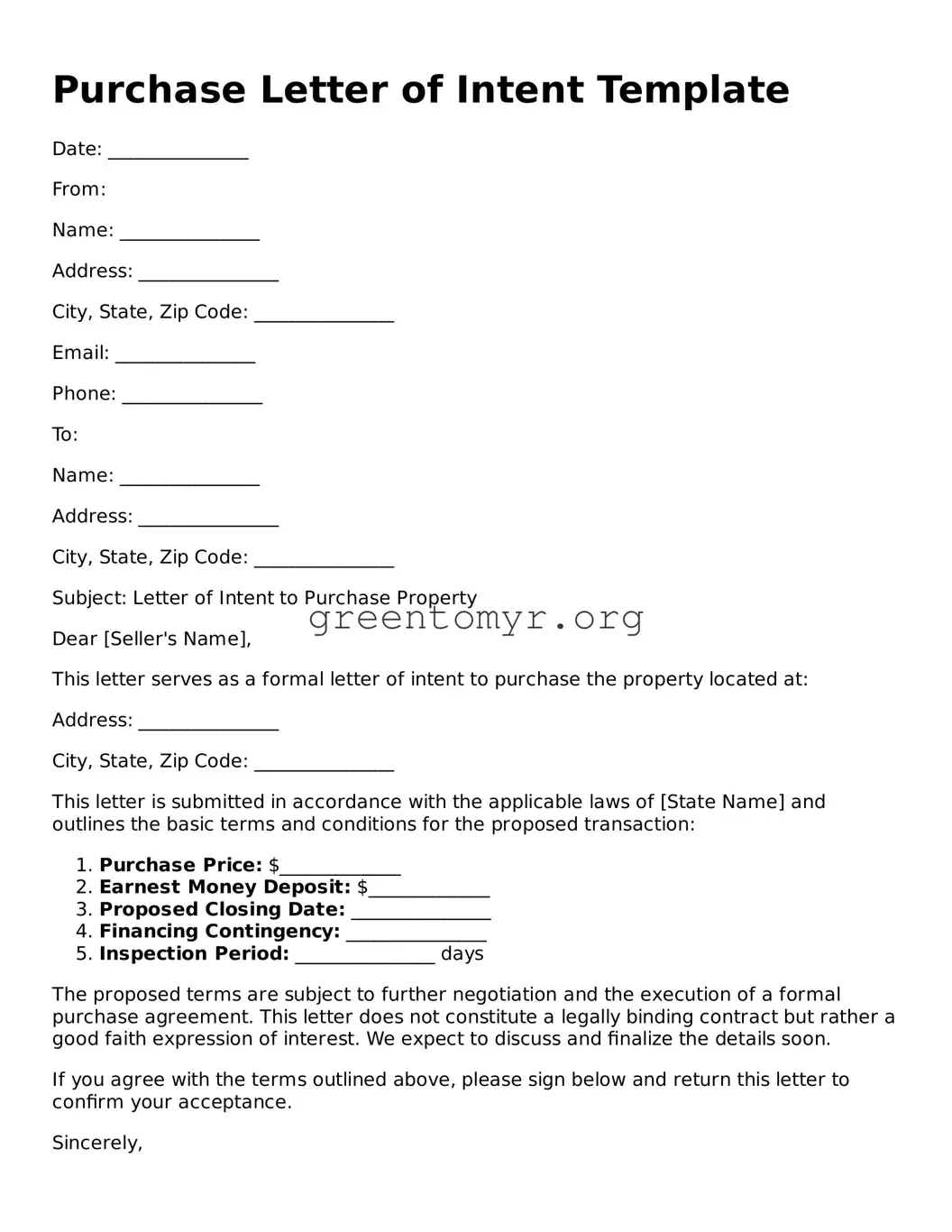

Purchase Letter of Intent Template

Date: _______________

From:

Name: _______________

Address: _______________

City, State, Zip Code: _______________

Email: _______________

Phone: _______________

To:

Name: _______________

Address: _______________

City, State, Zip Code: _______________

Subject: Letter of Intent to Purchase Property

Dear [Seller's Name],

This letter serves as a formal letter of intent to purchase the property located at:

Address: _______________

City, State, Zip Code: _______________

This letter is submitted in accordance with the applicable laws of [State Name] and outlines the basic terms and conditions for the proposed transaction:

- Purchase Price: $_____________

- Earnest Money Deposit: $_____________

- Proposed Closing Date: _______________

- Financing Contingency: _______________

- Inspection Period: _______________ days

The proposed terms are subject to further negotiation and the execution of a formal purchase agreement. This letter does not constitute a legally binding contract but rather a good faith expression of interest. We expect to discuss and finalize the details soon.

If you agree with the terms outlined above, please sign below and return this letter to confirm your acceptance.

Sincerely,

_________________________

[Your Name]

_________________________

[Your Signature]

Date: _______________

Accepted by:

_________________________

[Seller's Name]

_________________________

[Seller's Signature]

Date: _______________