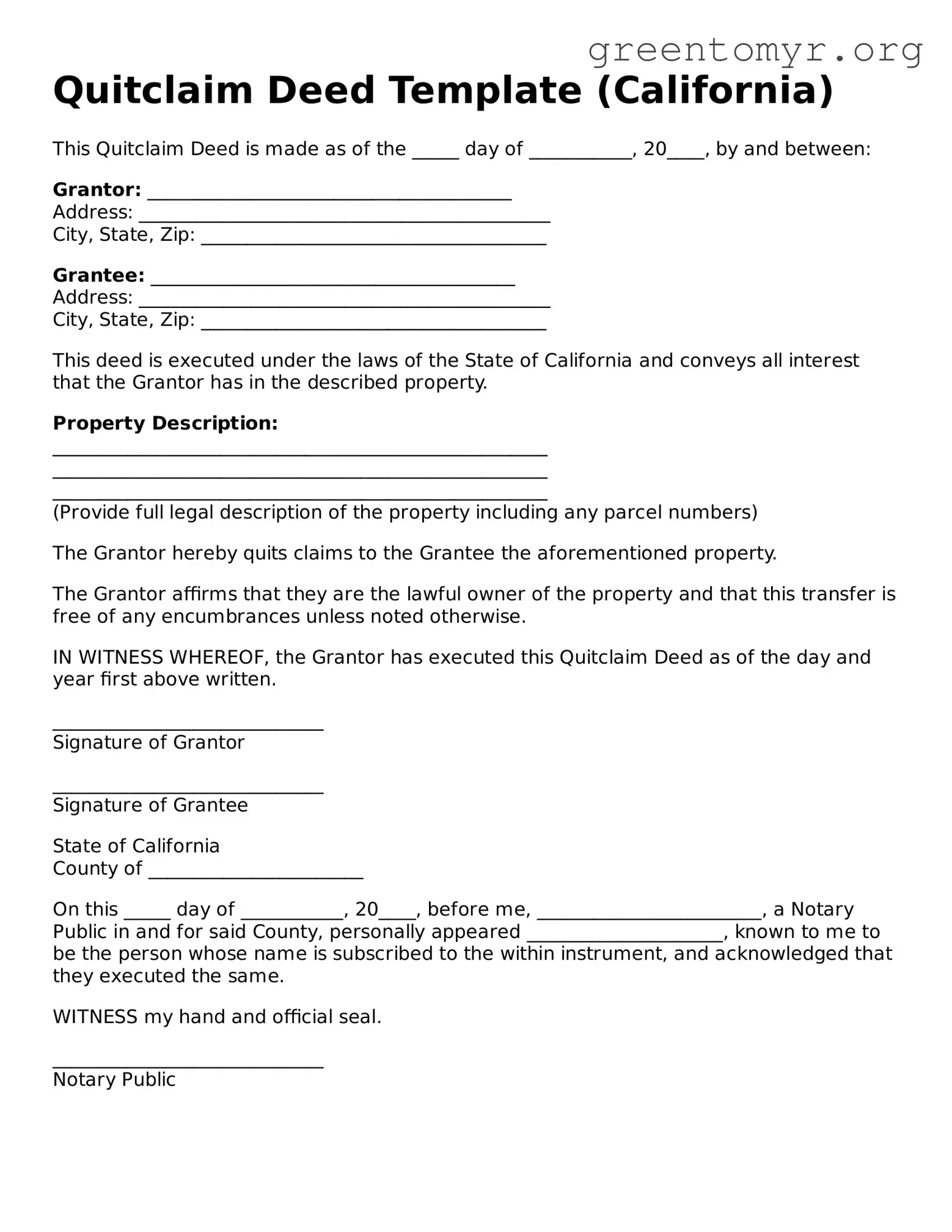

Quitclaim Deed Template (California)

This Quitclaim Deed is made as of the _____ day of ___________, 20____, by and between:

Grantor: _______________________________________

Address: ____________________________________________

City, State, Zip: _____________________________________

Grantee: _______________________________________

Address: ____________________________________________

City, State, Zip: _____________________________________

This deed is executed under the laws of the State of California and conveys all interest that the Grantor has in the described property.

Property Description:

_____________________________________________________

_____________________________________________________

_____________________________________________________

(Provide full legal description of the property including any parcel numbers)

The Grantor hereby quits claims to the Grantee the aforementioned property.

The Grantor affirms that they are the lawful owner of the property and that this transfer is free of any encumbrances unless noted otherwise.

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed as of the day and year first above written.

_____________________________

Signature of Grantor

_____________________________

Signature of Grantee

State of California

County of _______________________

On this _____ day of ___________, 20____, before me, ________________________, a Notary Public in and for said County, personally appeared _____________________, known to me to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same.

WITNESS my hand and official seal.

_____________________________

Notary Public