What is a Real Estate Purchase Agreement?

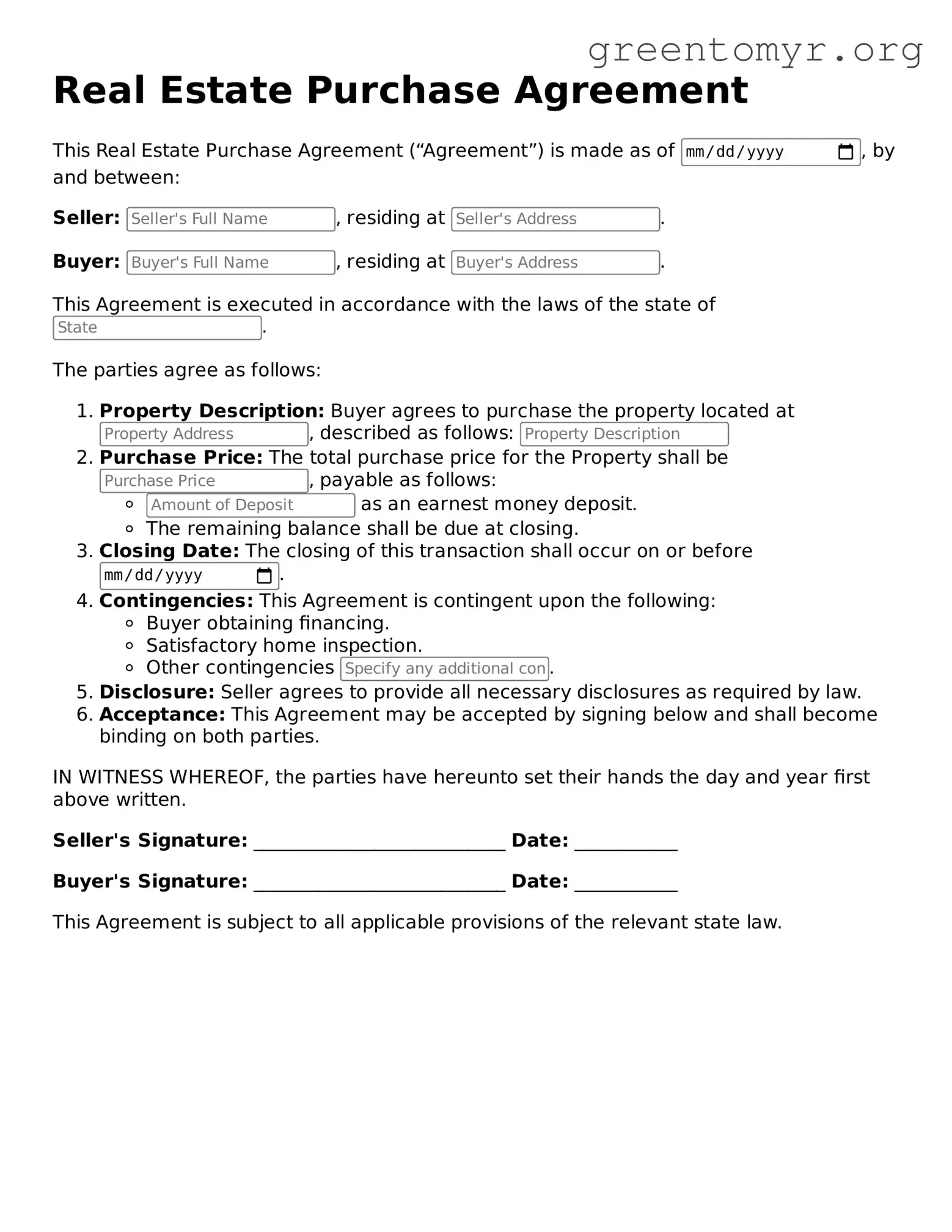

A Real Estate Purchase Agreement is a legal document outlining the terms and conditions of a real estate transaction between a buyer and a seller. It formalizes the offer to buy and outlines the sale price, financing details, property description, and any contingencies that need to be met before the sale can be completed. This document serves to protect the interests of both parties throughout the process.

Why is a Real Estate Purchase Agreement important?

This agreement is crucial for both buyers and sellers as it provides a clear framework for the transaction. It helps minimize misunderstandings and disputes by ensuring that both parties agree on key aspects of the sale. Moreover, it can serve as a reference point in case conflicts arise, making it easier to resolve any issues that may come up during the process.

What key elements should be included in the agreement?

A comprehensive Real Estate Purchase Agreement should include the following elements:

-

Property Description:

A detailed description of the property being sold, including the address and any identifying details.

-

Purchase Price:

The agreed-upon price for the property.

-

Financing Terms:

Information on how the buyer intends to pay, whether through cash, mortgage, or other means.

-

Contingencies:

Conditions that must be met for the sale to proceed, such as home inspections, financing approvals, or the sale of another property.

-

Closing Date:

The date when the sale will be finalized.

-

Signatures:

Both parties must sign to indicate their agreement to the terms.

Can the terms of the agreement be negotiated?

Yes, the terms of the Real Estate Purchase Agreement can and often are negotiated between the buyer and the seller. This can include the purchase price, closing date, and any contingencies. Open communication is key—be prepared to discuss your needs and find common ground that satisfies both parties. A written counteroffer can be provided if terms are not acceptable to one party.

What happens if one party breaches the agreement?

When one party fails to uphold their end of the agreement (this is known as a breach), it can lead to various outcomes depending on the situation. The non-breaching party may be entitled to seek a specific performance, which means enforcing the contract terms, or they may pursue damages. In some cases, the agreement might provide a timeline or stipulations for addressing breaches, so it’s important to know what the contract says.

Is it advisable to use a lawyer when drafting this agreement?

While it is possible to draft a Real Estate Purchase Agreement without a lawyer, it is highly advisable to consult with one. An experienced real estate attorney can ensure that the agreement complies with local laws, protects your interests, and addresses any specific concerns you may have. Their expertise can help you avoid potential pitfalls and ensure a smoother transaction.

Are there any costs associated with this agreement?

There may be various costs associated with a Real Estate Purchase Agreement, including but not limited to:

-

Attorney Fees:

If you choose to have an attorney assist with drafting or reviewing the agreement.

-

Title Insurance:

To protect the buyer against any title disputes.

-

Inspection Fees:

For home inspections required by contingencies in the agreement.

-

Escrow Fees:

Fees paid to the escrow company that holds funds during the transaction.

Understanding these potential costs beforehand can help you budget accordingly for the transaction.