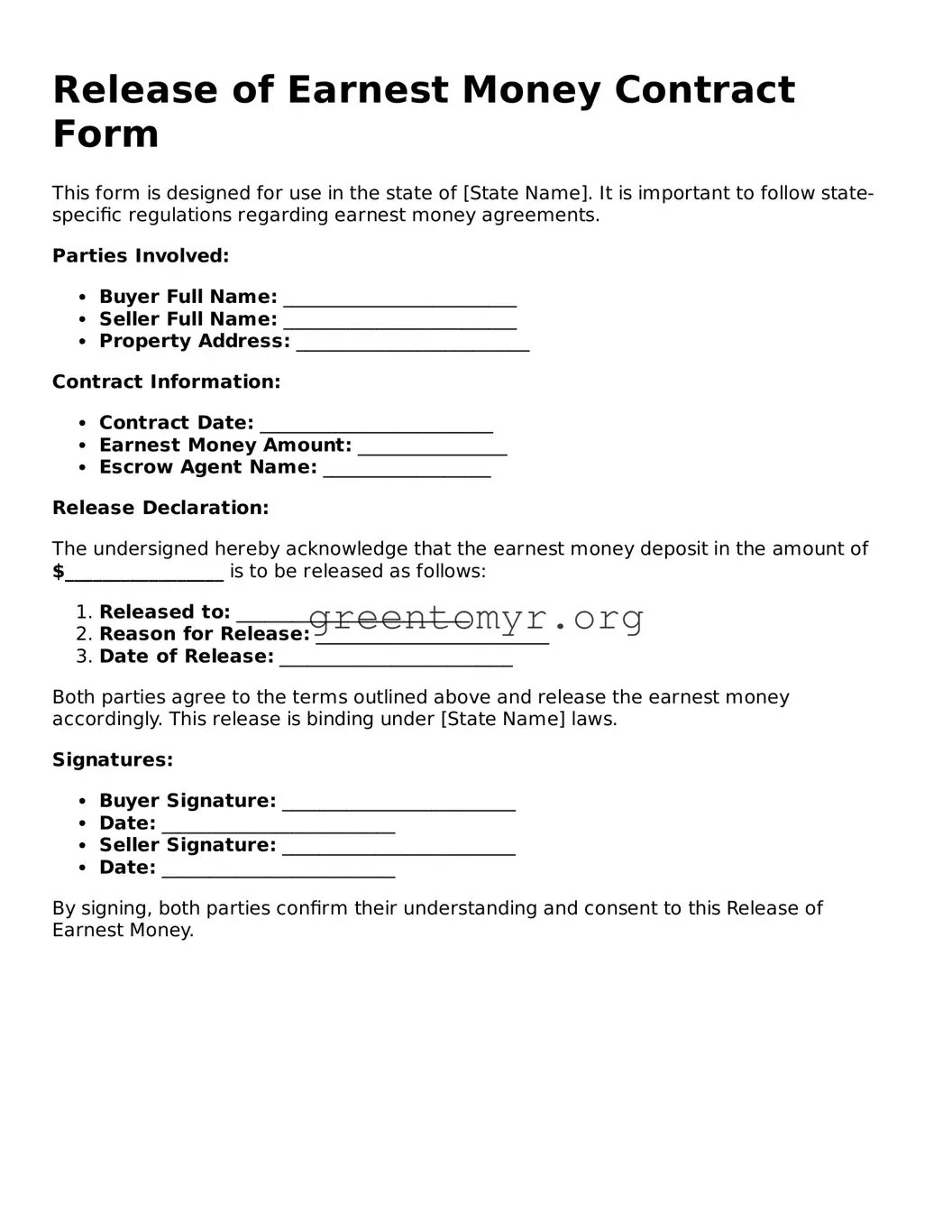

Release of Earnest Money Contract Form

This form is designed for use in the state of [State Name]. It is important to follow state-specific regulations regarding earnest money agreements.

Parties Involved:

- Buyer Full Name: _________________________

- Seller Full Name: _________________________

- Property Address: _________________________

Contract Information:

- Contract Date: _________________________

- Earnest Money Amount: ________________

- Escrow Agent Name: __________________

Release Declaration:

The undersigned hereby acknowledge that the earnest money deposit in the amount of $_________________ is to be released as follows:

- Released to: _________________________

- Reason for Release: _________________________

- Date of Release: _________________________

Both parties agree to the terms outlined above and release the earnest money accordingly. This release is binding under [State Name] laws.

Signatures:

- Buyer Signature: _________________________

- Date: _________________________

- Seller Signature: _________________________

- Date: _________________________

By signing, both parties confirm their understanding and consent to this Release of Earnest Money.