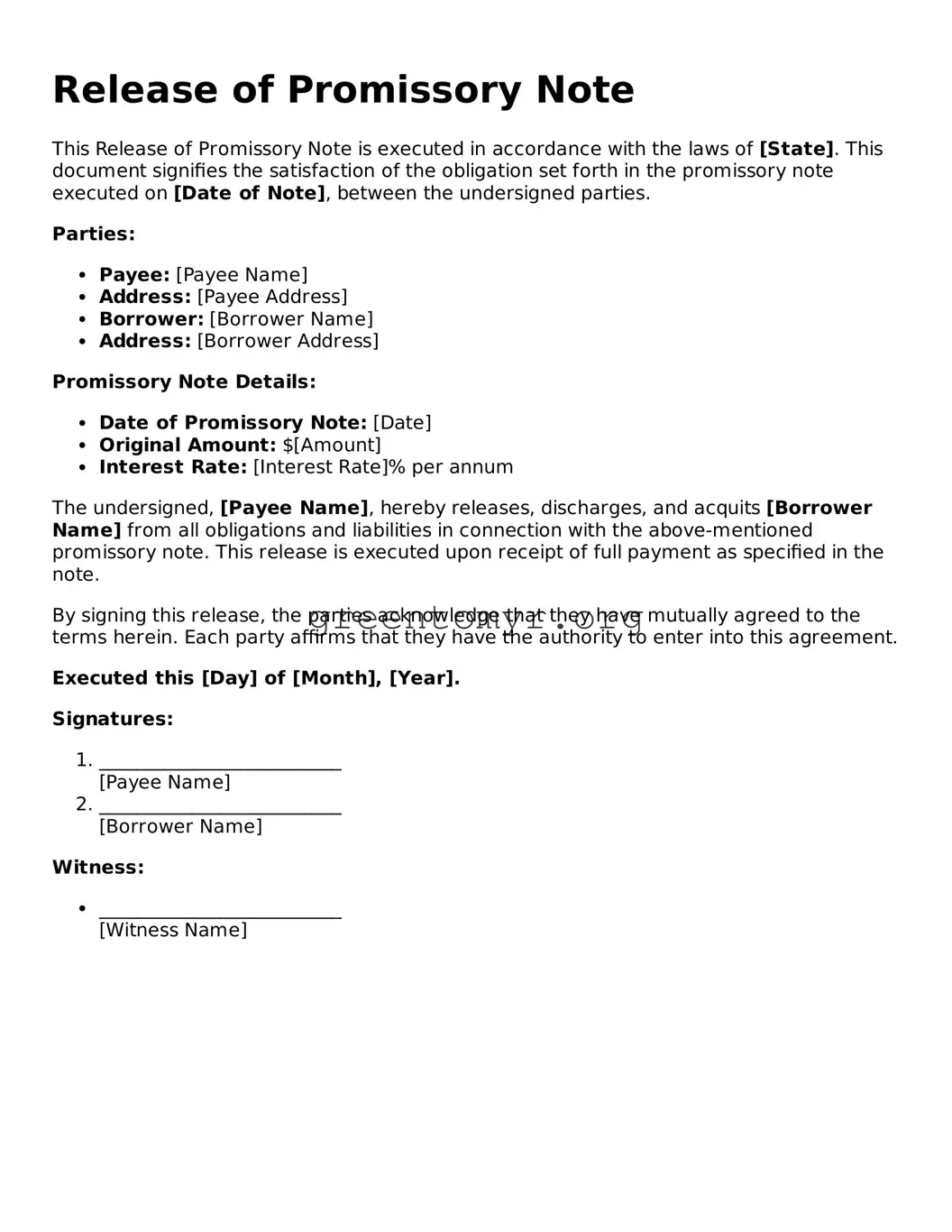

Release of Promissory Note

This Release of Promissory Note is executed in accordance with the laws of [State]. This document signifies the satisfaction of the obligation set forth in the promissory note executed on [Date of Note], between the undersigned parties.

Parties:

- Payee: [Payee Name]

- Address: [Payee Address]

- Borrower: [Borrower Name]

- Address: [Borrower Address]

Promissory Note Details:

- Date of Promissory Note: [Date]

- Original Amount: $[Amount]

- Interest Rate: [Interest Rate]% per annum

The undersigned, [Payee Name], hereby releases, discharges, and acquits [Borrower Name] from all obligations and liabilities in connection with the above-mentioned promissory note. This release is executed upon receipt of full payment as specified in the note.

By signing this release, the parties acknowledge that they have mutually agreed to the terms herein. Each party affirms that they have the authority to enter into this agreement.

Executed this [Day] of [Month], [Year].

Signatures:

- __________________________

[Payee Name]

- __________________________

[Borrower Name]

Witness:

- __________________________

[Witness Name]