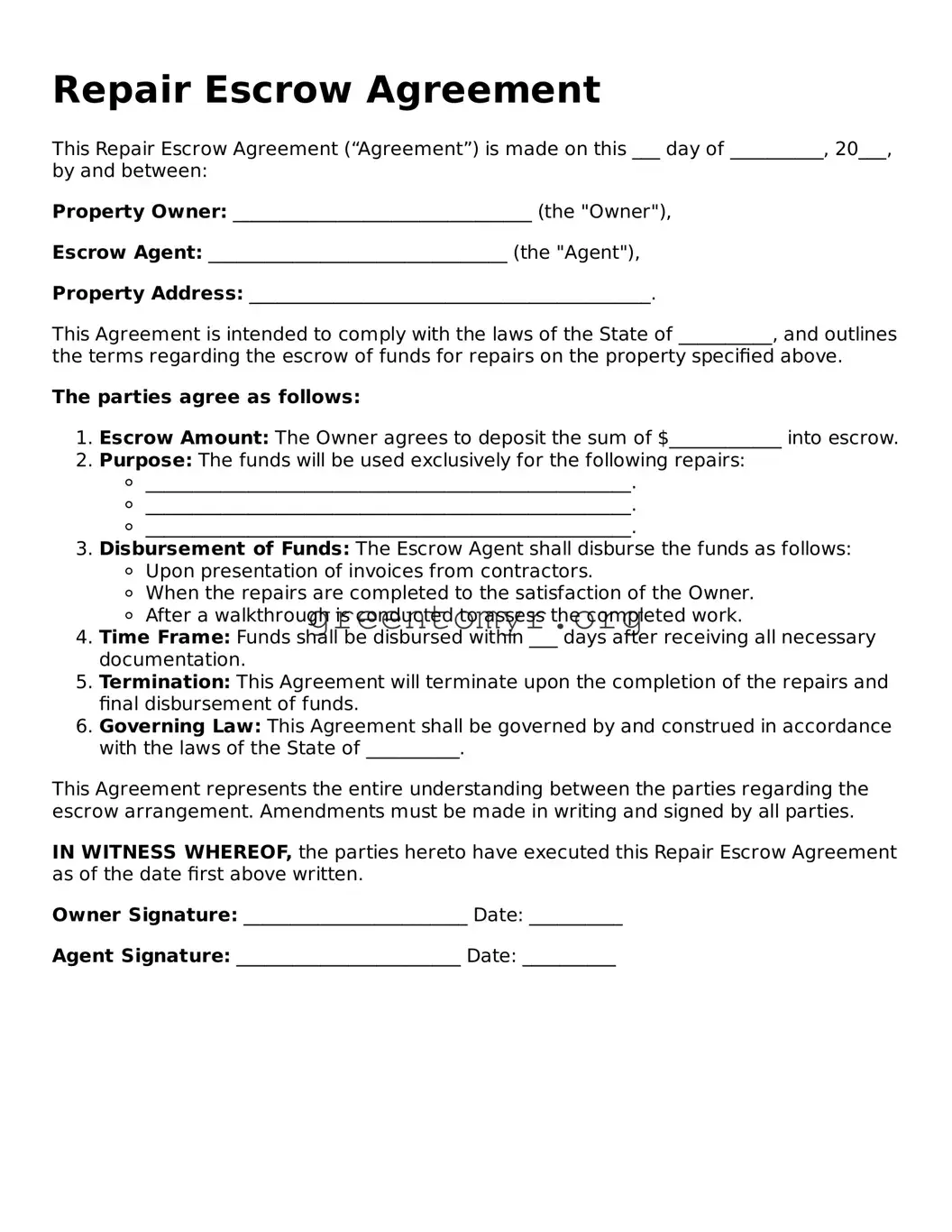

Repair Escrow Agreement

This Repair Escrow Agreement (“Agreement”) is made on this ___ day of __________, 20___, by and between:

Property Owner: ________________________________ (the "Owner"),

Escrow Agent: ________________________________ (the "Agent"),

Property Address: ___________________________________________.

This Agreement is intended to comply with the laws of the State of __________, and outlines the terms regarding the escrow of funds for repairs on the property specified above.

The parties agree as follows:

- Escrow Amount: The Owner agrees to deposit the sum of $____________ into escrow.

- Purpose: The funds will be used exclusively for the following repairs:

- ____________________________________________________.

- ____________________________________________________.

- ____________________________________________________.

- Disbursement of Funds: The Escrow Agent shall disburse the funds as follows:

- Upon presentation of invoices from contractors.

- When the repairs are completed to the satisfaction of the Owner.

- After a walkthrough is conducted to assess the completed work.

- Time Frame: Funds shall be disbursed within ___ days after receiving all necessary documentation.

- Termination: This Agreement will terminate upon the completion of the repairs and final disbursement of funds.

- Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of __________.

This Agreement represents the entire understanding between the parties regarding the escrow arrangement. Amendments must be made in writing and signed by all parties.

IN WITNESS WHEREOF, the parties hereto have executed this Repair Escrow Agreement as of the date first above written.

Owner Signature: ________________________ Date: __________

Agent Signature: ________________________ Date: __________