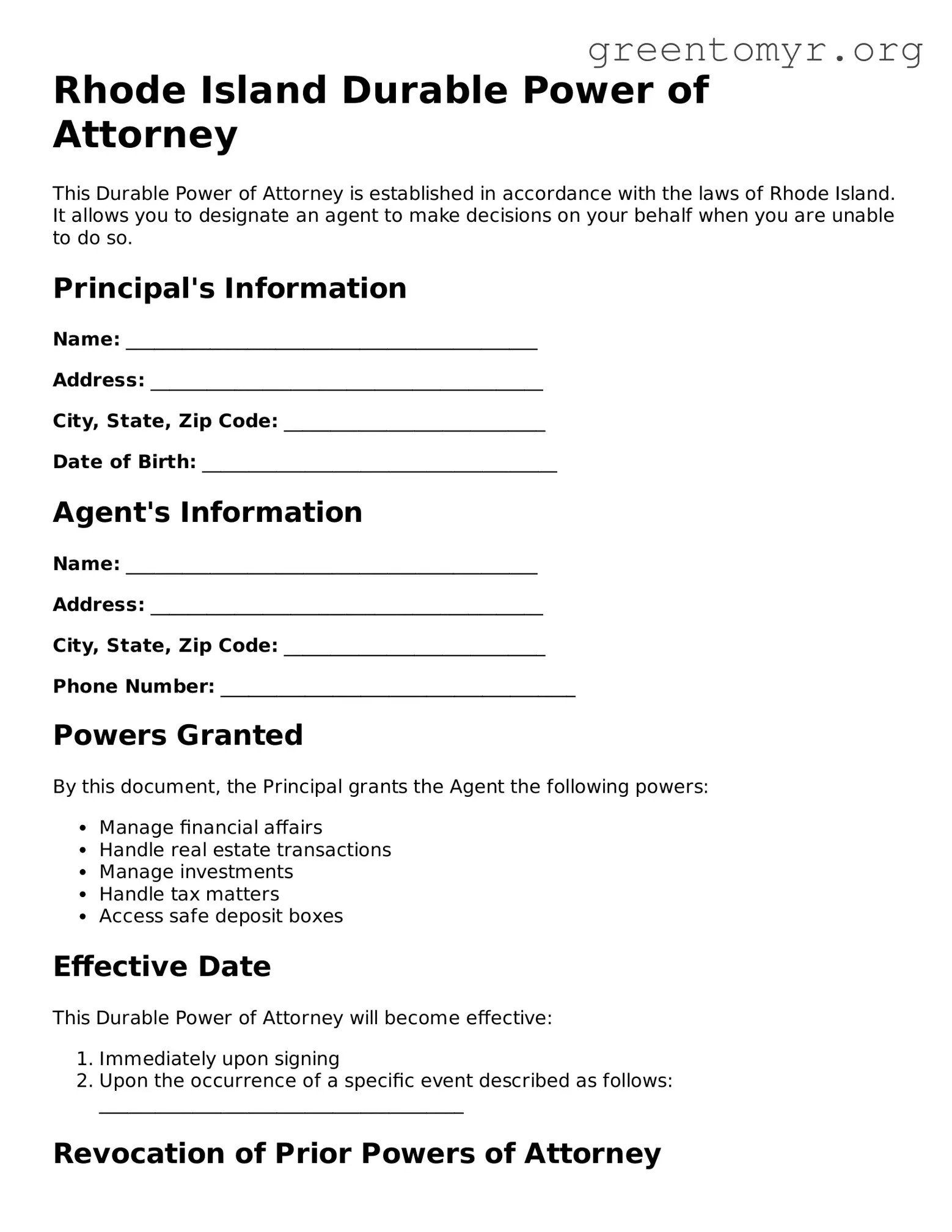

Rhode Island Durable Power of Attorney

This Durable Power of Attorney is established in accordance with the laws of Rhode Island. It allows you to designate an agent to make decisions on your behalf when you are unable to do so.

Principal's Information

Name: ____________________________________________

Address: __________________________________________

City, State, Zip Code: ____________________________

Date of Birth: ______________________________________

Agent's Information

Name: ____________________________________________

Address: __________________________________________

City, State, Zip Code: ____________________________

Phone Number: ______________________________________

Powers Granted

By this document, the Principal grants the Agent the following powers:

- Manage financial affairs

- Handle real estate transactions

- Manage investments

- Handle tax matters

- Access safe deposit boxes

Effective Date

This Durable Power of Attorney will become effective:

- Immediately upon signing

- Upon the occurrence of a specific event described as follows: _______________________________________

Revocation of Prior Powers of Attorney

All prior Power of Attorney documents are hereby revoked.

Signature

Principal's Signature: __________________________________

Date: _________________________________________________

Witnesses

This document must be signed in the presence of two witnesses:

- Witness 1 Name: ___________________________________

- Witness 1 Signature: _____________________________

- Date: _________________________________________

- Witness 2 Name: ___________________________________

- Witness 2 Signature: _____________________________

- Date: _________________________________________

Notarization

Notarization is recommended to enhance the document's validity.

Notary Public Signature: ____________________________

Date: _____________________________________________