Filling out a General Power of Attorney (POA) form in Rhode Island is a crucial task that bestows significant authority to someone else. Unfortunately, many individuals overlook critical details that can lead to complications or even invalidation of the document. One common mistake is failing to notarize the form. In Rhode Island, a POA must be notarized to be legally binding, and not having the necessary signature can render the form useless.

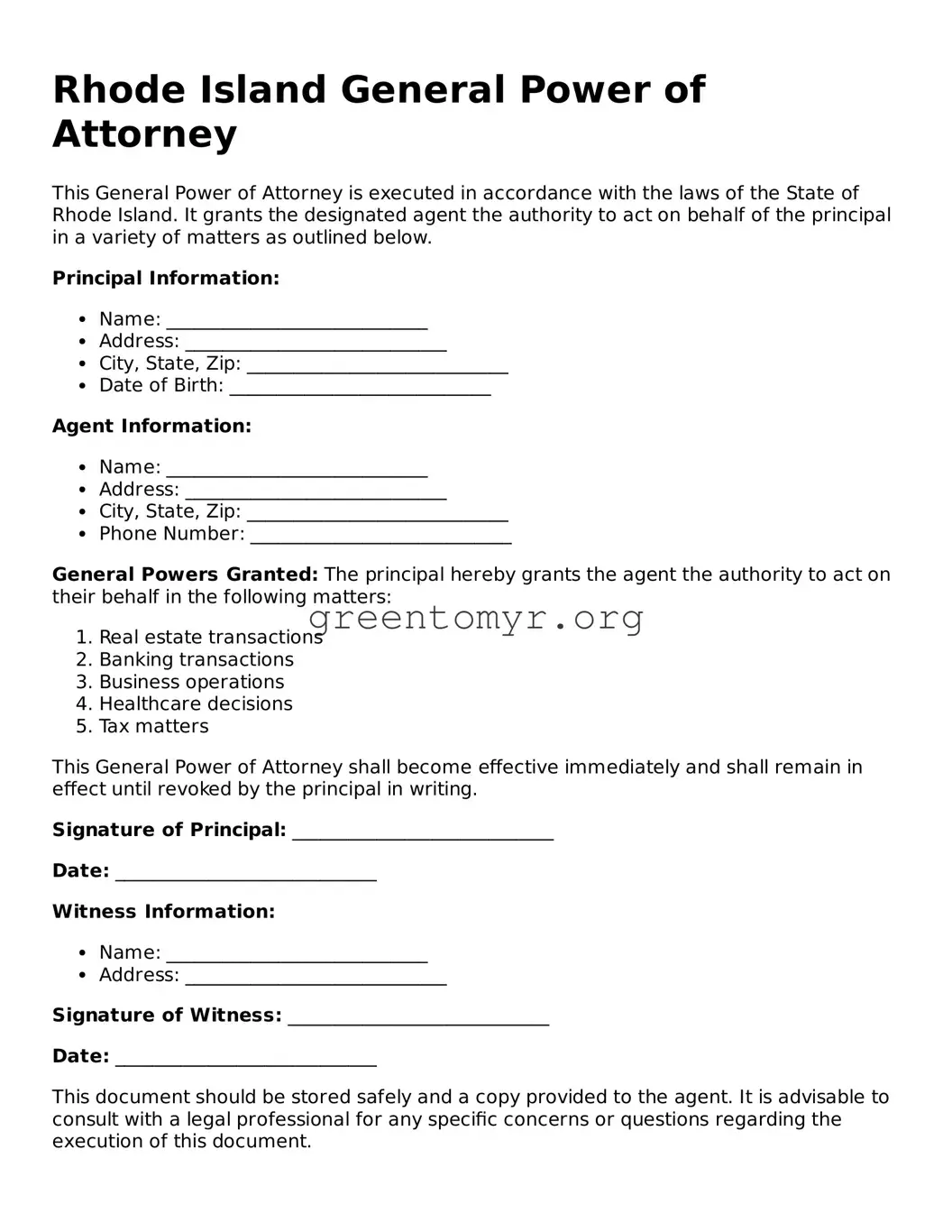

Another frequent error involves not clearly defining the powers granted to the agent. The form should explicitly state what authority the agent possesses. Vague language can lead to misunderstandings and disputes about the extent of the powers given. This oversight can create significant challenges when the agent tries to act on your behalf.

People often neglect to specify the duration of the POA. Without a clear start and end date, the document can be misinterpreted, leading to confusion about when the agent can exercise their authority. A limited POA can offer peace of mind, allowing the principal to maintain control over the timing of the agent's powers.

Another common pitfall is appointing an inappropriate or untrustworthy agent. It's essential to choose someone reliable, as they will handle important decisions on your behalf. A poor choice can result in mishandling of your affairs and lead to significant financial repercussions.

Additionally, failing to discuss the arrangement with the chosen agent can be problematic. Open lines of communication help prevent surprises later on. When the agent fully understands their responsibilities and your intentions, they can act more effectively and in alignment with your wishes.

Many individuals forget to inform key family members about the power of attorney. Without disclosure, family disputes can arise when the agent has to make decisions and others are unaware of the arrangement. Keeping everyone in the loop fosters a sense of transparency and reduces the potential for conflict.

Equally important is the mistake of neglecting to update the POA after major life events. Changes such as marriage, divorce, or relocation can impact the authority granted under the form. Reviewing and, if necessary, revising the POA periodically ensures that it remains relevant and valid.

Moreover, individuals sometimes fail to maintain copies of the executed form. It's recommended to keep several copies in safe places and provide a copy to the agent. If the need arises to present the POA, having readily available copies can streamline the process.

Lastly, many people overlook the importance of consulting with an attorney or legal professional. While DIY forms may seem straightforward, legal counsel can provide valuable guidance on the nuances of the document. Professional insight ensures that the powers bestowed meet legal standards and adequately reflect your intentions.