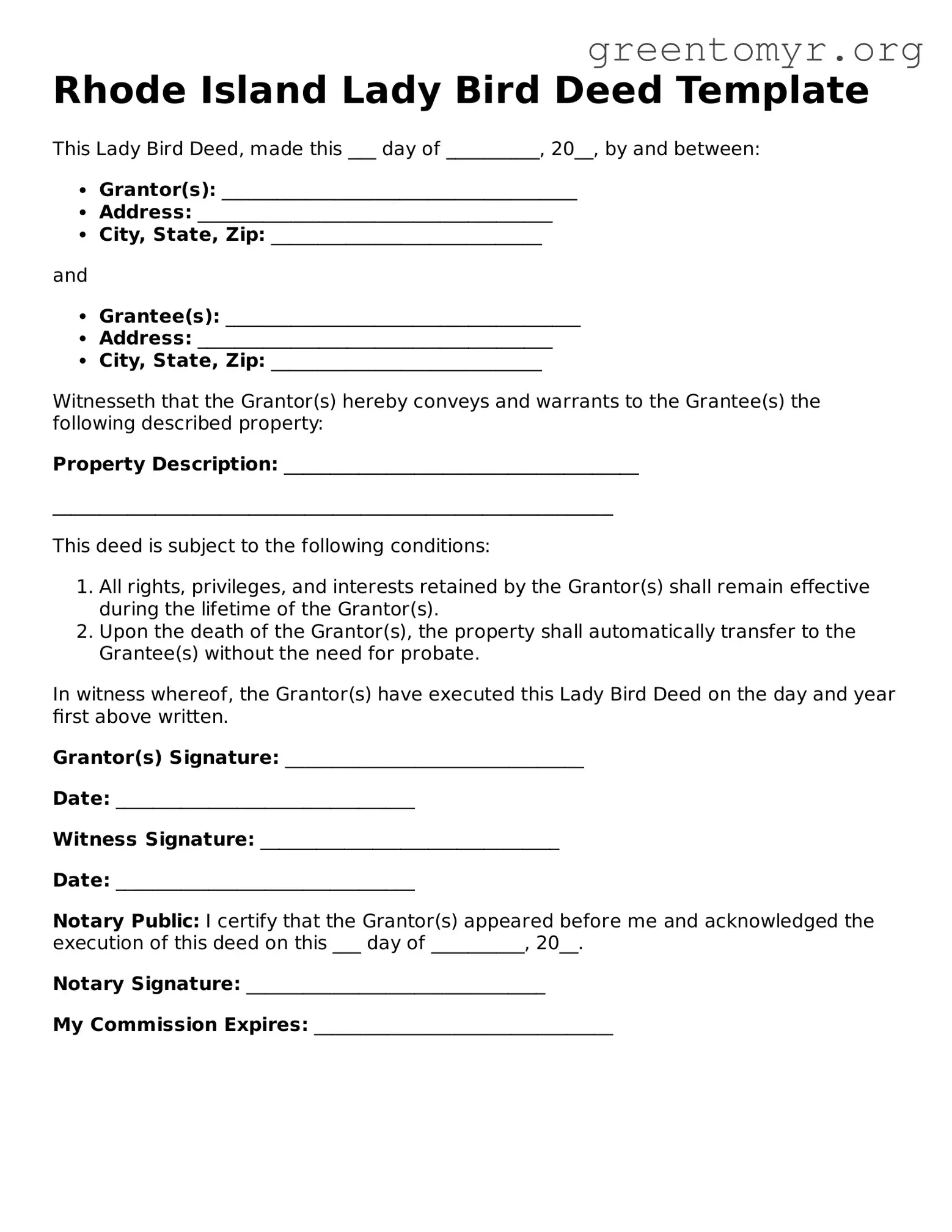

Rhode Island Lady Bird Deed Template

This Lady Bird Deed, made this ___ day of __________, 20__, by and between:

- Grantor(s): ______________________________________

- Address: ______________________________________

- City, State, Zip: _____________________________

and

- Grantee(s): ______________________________________

- Address: ______________________________________

- City, State, Zip: _____________________________

Witnesseth that the Grantor(s) hereby conveys and warrants to the Grantee(s) the following described property:

Property Description: ______________________________________

____________________________________________________________

This deed is subject to the following conditions:

- All rights, privileges, and interests retained by the Grantor(s) shall remain effective during the lifetime of the Grantor(s).

- Upon the death of the Grantor(s), the property shall automatically transfer to the Grantee(s) without the need for probate.

In witness whereof, the Grantor(s) have executed this Lady Bird Deed on the day and year first above written.

Grantor(s) Signature: ________________________________

Date: ________________________________

Witness Signature: ________________________________

Date: ________________________________

Notary Public: I certify that the Grantor(s) appeared before me and acknowledged the execution of this deed on this ___ day of __________, 20__.

Notary Signature: ________________________________

My Commission Expires: ________________________________