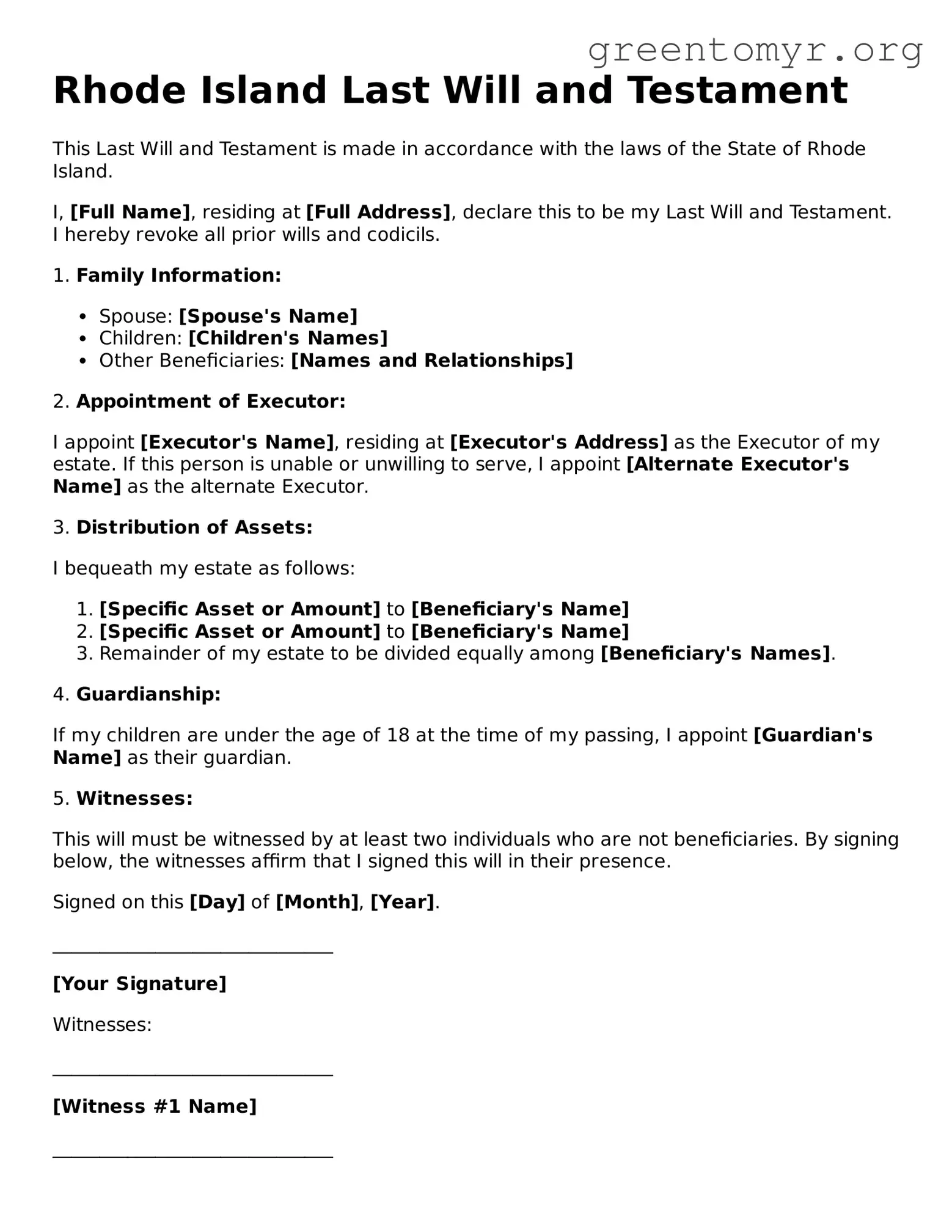

Rhode Island Last Will and Testament

This Last Will and Testament is made in accordance with the laws of the State of Rhode Island.

I, [Full Name], residing at [Full Address], declare this to be my Last Will and Testament. I hereby revoke all prior wills and codicils.

1. Family Information:

- Spouse: [Spouse's Name]

- Children: [Children's Names]

- Other Beneficiaries: [Names and Relationships]

2. Appointment of Executor:

I appoint [Executor's Name], residing at [Executor's Address] as the Executor of my estate. If this person is unable or unwilling to serve, I appoint [Alternate Executor's Name] as the alternate Executor.

3. Distribution of Assets:

I bequeath my estate as follows:

- [Specific Asset or Amount] to [Beneficiary's Name]

- [Specific Asset or Amount] to [Beneficiary's Name]

- Remainder of my estate to be divided equally among [Beneficiary's Names].

4. Guardianship:

If my children are under the age of 18 at the time of my passing, I appoint [Guardian's Name] as their guardian.

5. Witnesses:

This will must be witnessed by at least two individuals who are not beneficiaries. By signing below, the witnesses affirm that I signed this will in their presence.

Signed on this [Day] of [Month], [Year].

______________________________

[Your Signature]

Witnesses:

______________________________

[Witness #1 Name]

______________________________

[Witness #2 Name]