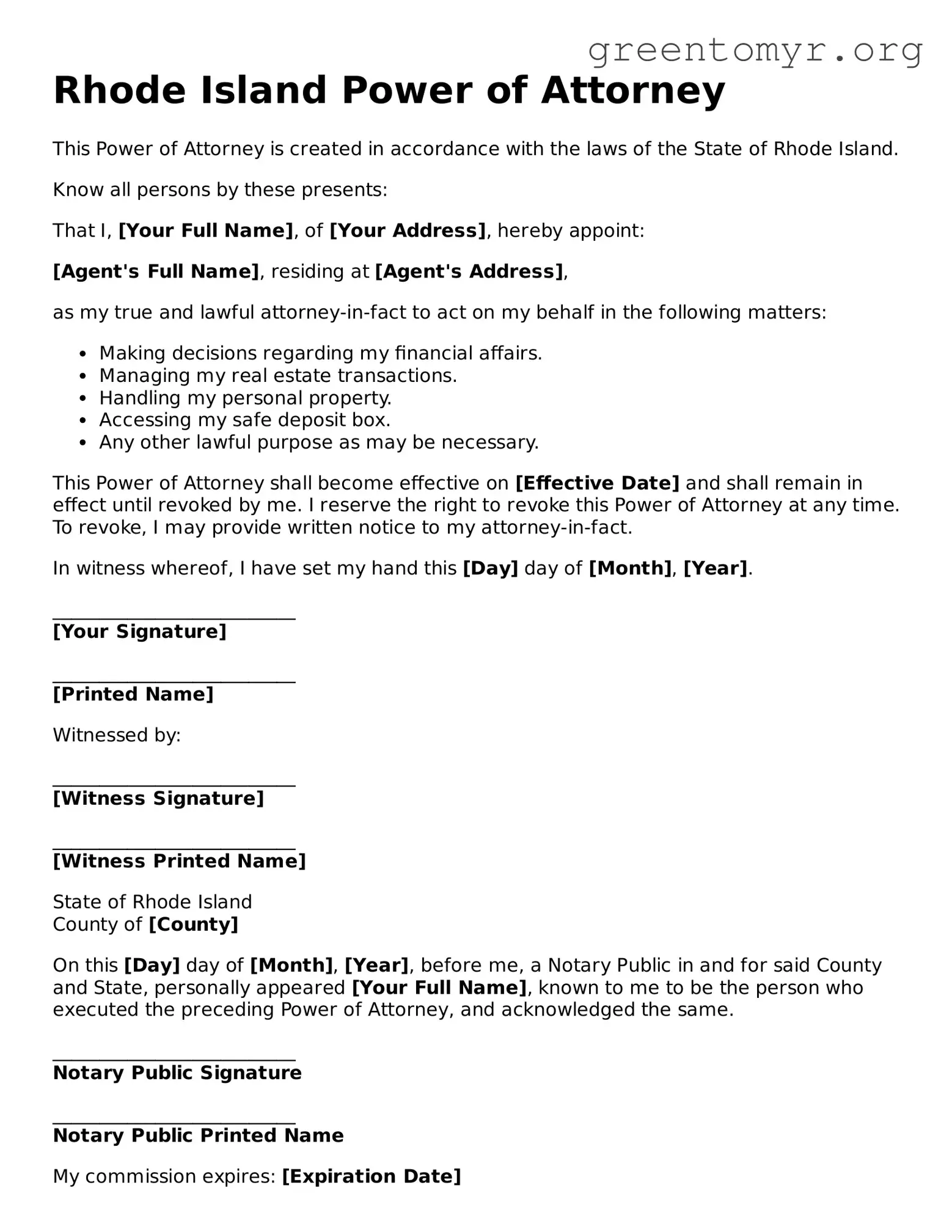

Rhode Island Power of Attorney

This Power of Attorney is created in accordance with the laws of the State of Rhode Island.

Know all persons by these presents:

That I, [Your Full Name], of [Your Address], hereby appoint:

[Agent's Full Name], residing at [Agent's Address],

as my true and lawful attorney-in-fact to act on my behalf in the following matters:

- Making decisions regarding my financial affairs.

- Managing my real estate transactions.

- Handling my personal property.

- Accessing my safe deposit box.

- Any other lawful purpose as may be necessary.

This Power of Attorney shall become effective on [Effective Date] and shall remain in effect until revoked by me. I reserve the right to revoke this Power of Attorney at any time. To revoke, I may provide written notice to my attorney-in-fact.

In witness whereof, I have set my hand this [Day] day of [Month], [Year].

__________________________

[Your Signature]

__________________________

[Printed Name]

Witnessed by:

__________________________

[Witness Signature]

__________________________

[Witness Printed Name]

State of Rhode Island

County of [County]

On this [Day] day of [Month], [Year], before me, a Notary Public in and for said County and State, personally appeared [Your Full Name], known to me to be the person who executed the preceding Power of Attorney, and acknowledged the same.

__________________________

Notary Public Signature

__________________________

Notary Public Printed Name

My commission expires: [Expiration Date]