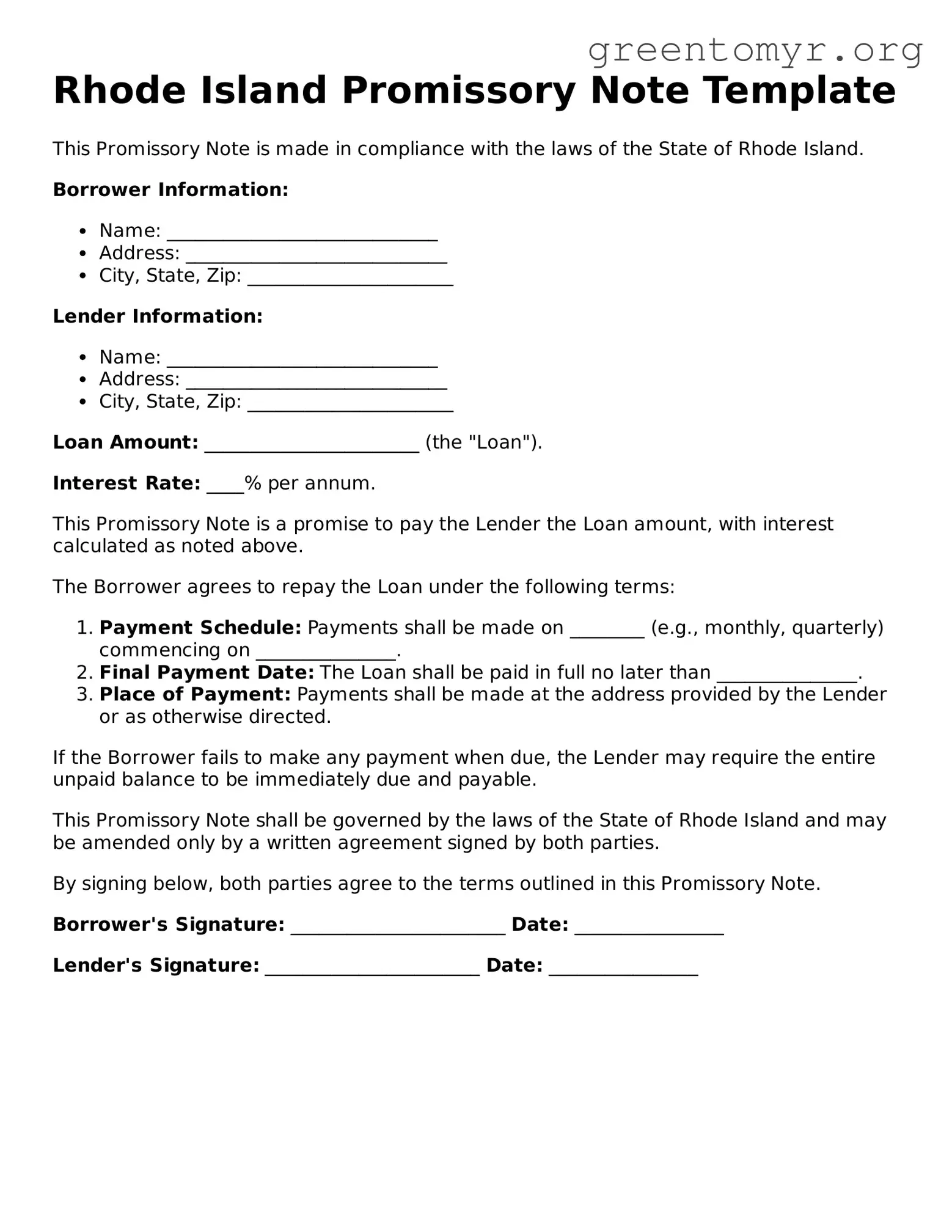

Rhode Island Promissory Note Template

This Promissory Note is made in compliance with the laws of the State of Rhode Island.

Borrower Information:

- Name: _____________________________

- Address: ____________________________

- City, State, Zip: ______________________

Lender Information:

- Name: _____________________________

- Address: ____________________________

- City, State, Zip: ______________________

Loan Amount: _______________________ (the "Loan").

Interest Rate: ____% per annum.

This Promissory Note is a promise to pay the Lender the Loan amount, with interest calculated as noted above.

The Borrower agrees to repay the Loan under the following terms:

- Payment Schedule: Payments shall be made on ________ (e.g., monthly, quarterly) commencing on _______________.

- Final Payment Date: The Loan shall be paid in full no later than _______________.

- Place of Payment: Payments shall be made at the address provided by the Lender or as otherwise directed.

If the Borrower fails to make any payment when due, the Lender may require the entire unpaid balance to be immediately due and payable.

This Promissory Note shall be governed by the laws of the State of Rhode Island and may be amended only by a written agreement signed by both parties.

By signing below, both parties agree to the terms outlined in this Promissory Note.

Borrower's Signature: _______________________ Date: ________________

Lender's Signature: _______________________ Date: ________________