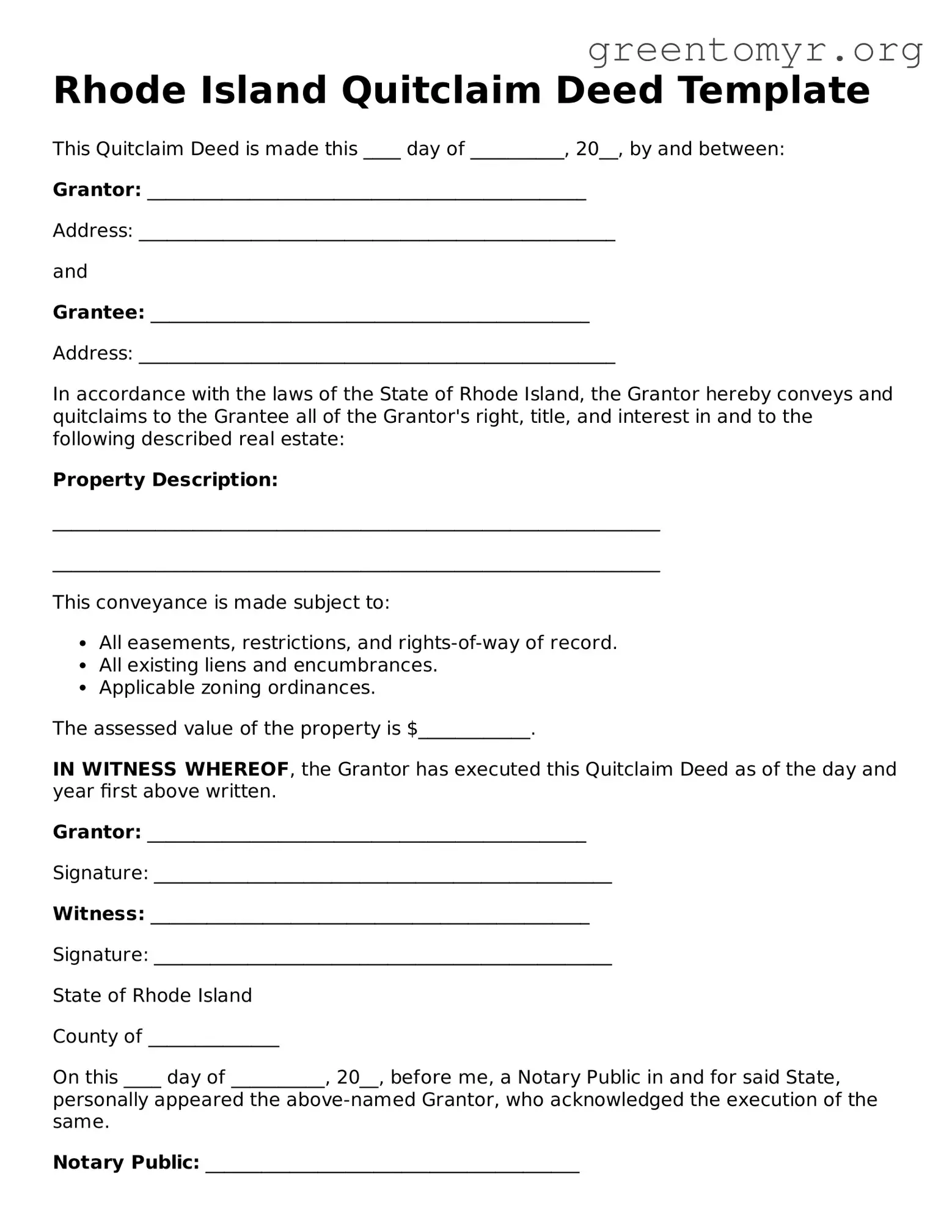

Rhode Island Quitclaim Deed Template

This Quitclaim Deed is made this ____ day of __________, 20__, by and between:

Grantor: _______________________________________________

Address: ___________________________________________________

and

Grantee: _______________________________________________

Address: ___________________________________________________

In accordance with the laws of the State of Rhode Island, the Grantor hereby conveys and quitclaims to the Grantee all of the Grantor's right, title, and interest in and to the following described real estate:

Property Description:

_________________________________________________________________

_________________________________________________________________

This conveyance is made subject to:

- All easements, restrictions, and rights-of-way of record.

- All existing liens and encumbrances.

- Applicable zoning ordinances.

The assessed value of the property is $____________.

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed as of the day and year first above written.

Grantor: _______________________________________________

Signature: _________________________________________________

Witness: _______________________________________________

Signature: _________________________________________________

State of Rhode Island

County of ______________

On this ____ day of __________, 20__, before me, a Notary Public in and for said State, personally appeared the above-named Grantor, who acknowledged the execution of the same.

Notary Public: ________________________________________

My commission expires: ________________________________