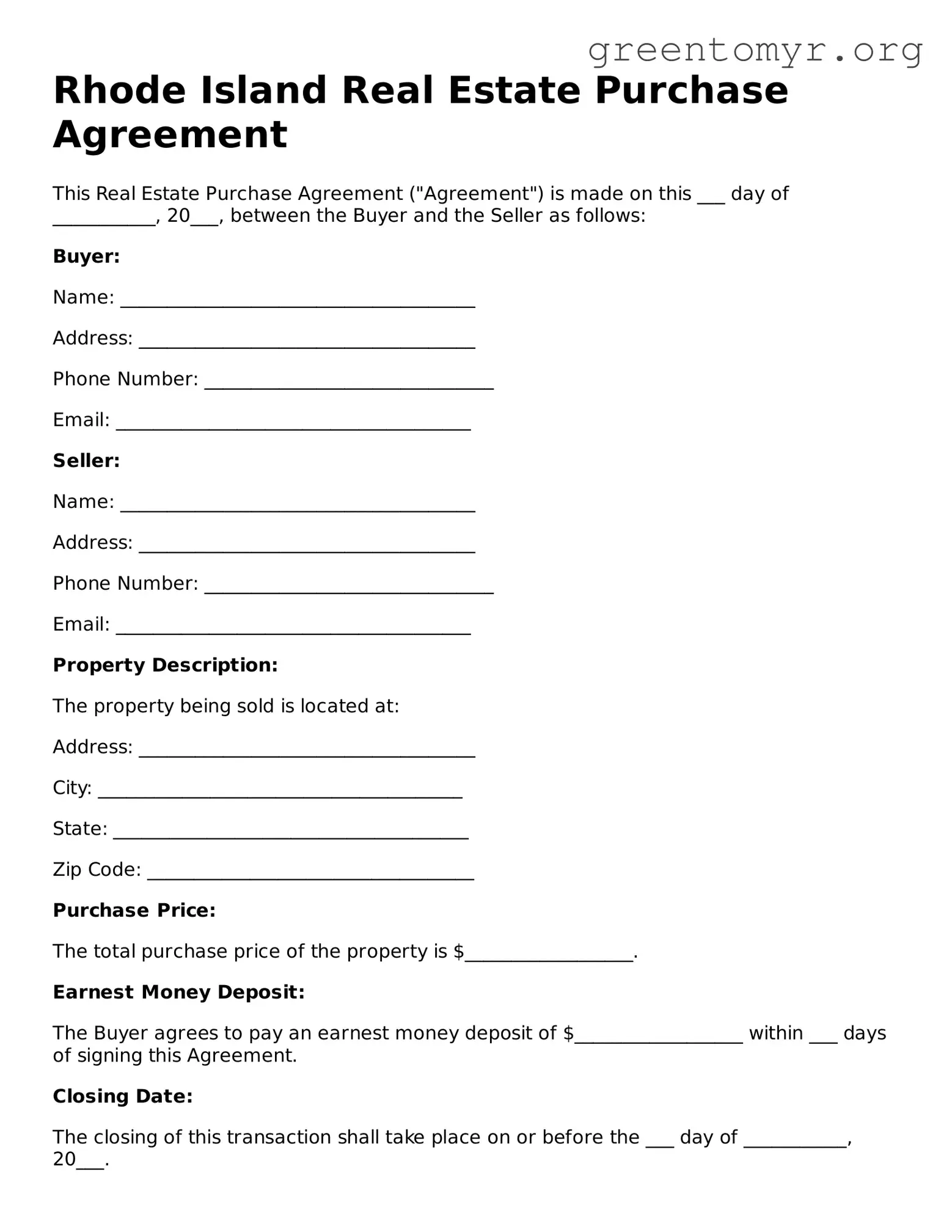

Rhode Island Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made on this ___ day of ___________, 20___, between the Buyer and the Seller as follows:

Buyer:

Name: ______________________________________

Address: ____________________________________

Phone Number: _______________________________

Email: ______________________________________

Seller:

Name: ______________________________________

Address: ____________________________________

Phone Number: _______________________________

Email: ______________________________________

Property Description:

The property being sold is located at:

Address: ____________________________________

City: _______________________________________

State: ______________________________________

Zip Code: ___________________________________

Purchase Price:

The total purchase price of the property is $__________________.

Earnest Money Deposit:

The Buyer agrees to pay an earnest money deposit of $__________________ within ___ days of signing this Agreement.

Closing Date:

The closing of this transaction shall take place on or before the ___ day of ___________, 20___.

Contingencies:

This Agreement is contingent upon the following:

- Financing Approval

- Inspection of Property

- Appraisal

- Any other conditions agreed upon

Property Condition:

The property is being sold in "as-is" condition, unless otherwise specified herein.

Disclosure:

The Seller must comply with all state-specific laws regarding property disclosures.

Signatures:

In witness whereof, the parties have executed this Agreement as of the date first above written.

Buyer Signature: __________________________________ Date: _______________

Seller Signature: __________________________________ Date: _______________