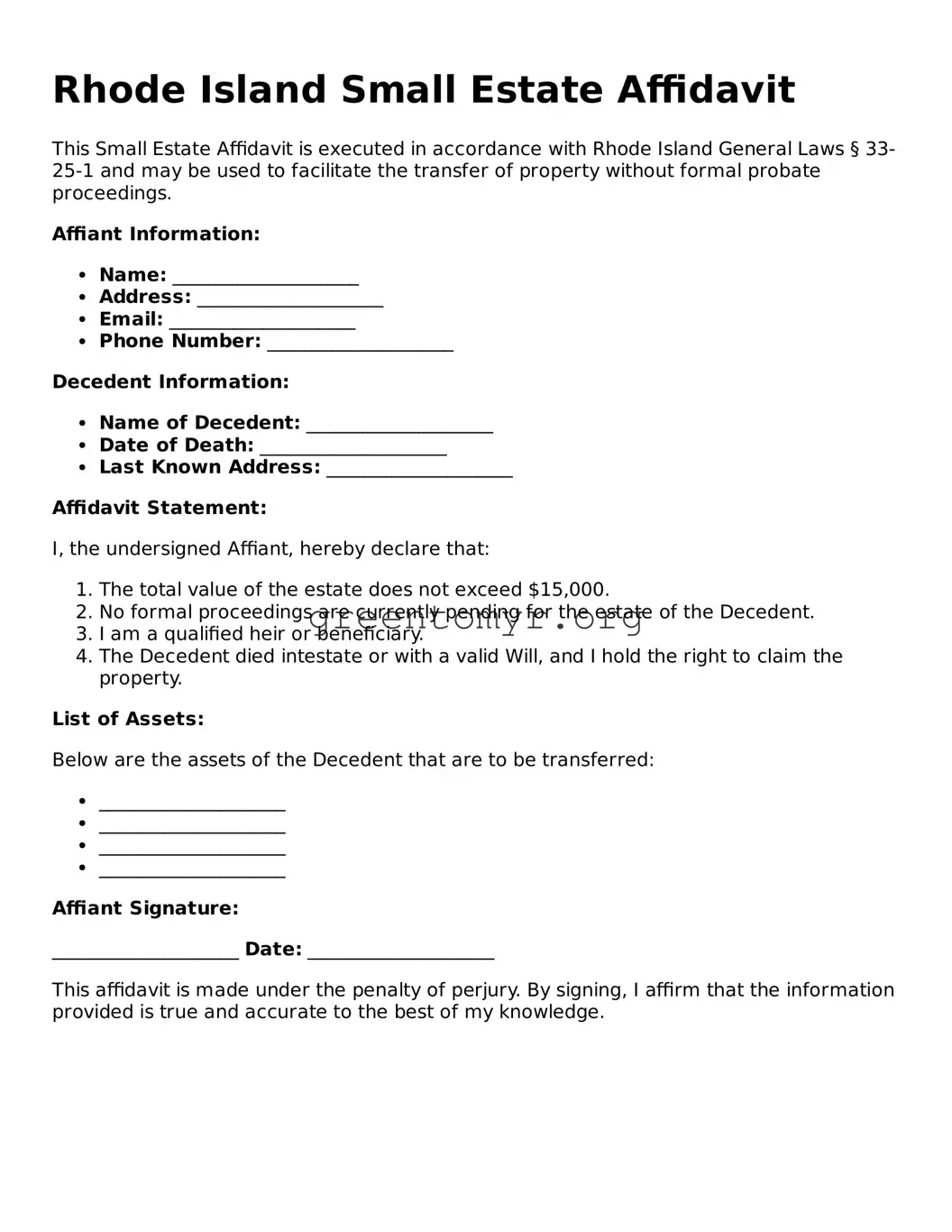

The Rhode Island Small Estate Affidavit form is a legal document used by individuals to claim property from an estate when the total value of the estate is below a certain threshold. The form allows heirs or beneficiaries to avoid the lengthy probate process in situations involving smaller estates.

Who is eligible to use the Small Estate Affidavit?

Anyone who is a beneficiary or heir of the deceased individual can use the Small Estate Affidavit, provided that the estate's total value does not exceed the statutory limit set by Rhode Island law. Current regulations specify that the limit is $15,000, excluding certain types of property such as real estate.

To complete the Small Estate Affidavit, an individual must provide the following information:

-

The name and address of the deceased.

-

The date of death.

-

The names and addresses of all heirs and beneficiaries.

-

A description of the property being claimed.

-

The value of the estate.

How does one file the Small Estate Affidavit?

The Small Estate Affidavit can be filed with the local probate court in the county where the deceased individual resided. It is important to ensure that all required information is complete and accurate before filing. Additionally, notarization of the affidavit may be required.

Is there a fee associated with filing the Small Estate Affidavit?

Yes, there typically is a filing fee when submitting the Small Estate Affidavit. This fee can vary based on the court and jurisdiction. It is advisable to contact the local probate court for the specific fee schedule and payment methods accepted.

What happens after the Small Estate Affidavit is filed?

Once the Small Estate Affidavit is filed, the court will review the document. If everything is in order, the court may approve the affidavit, allowing the heirs to collect the property specified within the document. Heirs can then present the approved affidavit to financial institutions or other entities holding the deceased's assets.

Can the Small Estate Affidavit be contested?

Yes, it is possible for the Small Estate Affidavit to be contested. If another party believes they have a rightful claim to the estate or if there are disputes regarding the distribution of assets, they may challenge the affidavit in court. It is recommended to consult with legal counsel in such instances.

Can a Small Estate Affidavit be used for real estate?

A Small Estate Affidavit cannot be used to transfer real estate in Rhode Island directly. Real property typically requires a different legal process, such as probate. However, some circumstances may allow for a transfer outside of probate court, and it is advisable to seek legal guidance for specific situations.

How long is the Small Estate Affidavit valid?

The Small Estate Affidavit does not have an expiration date. However, it is important to initiate the claims process within a reasonable timeframe after the individual's death. Beneficiaries should complete the claim as soon as possible to prevent complications or disputes.