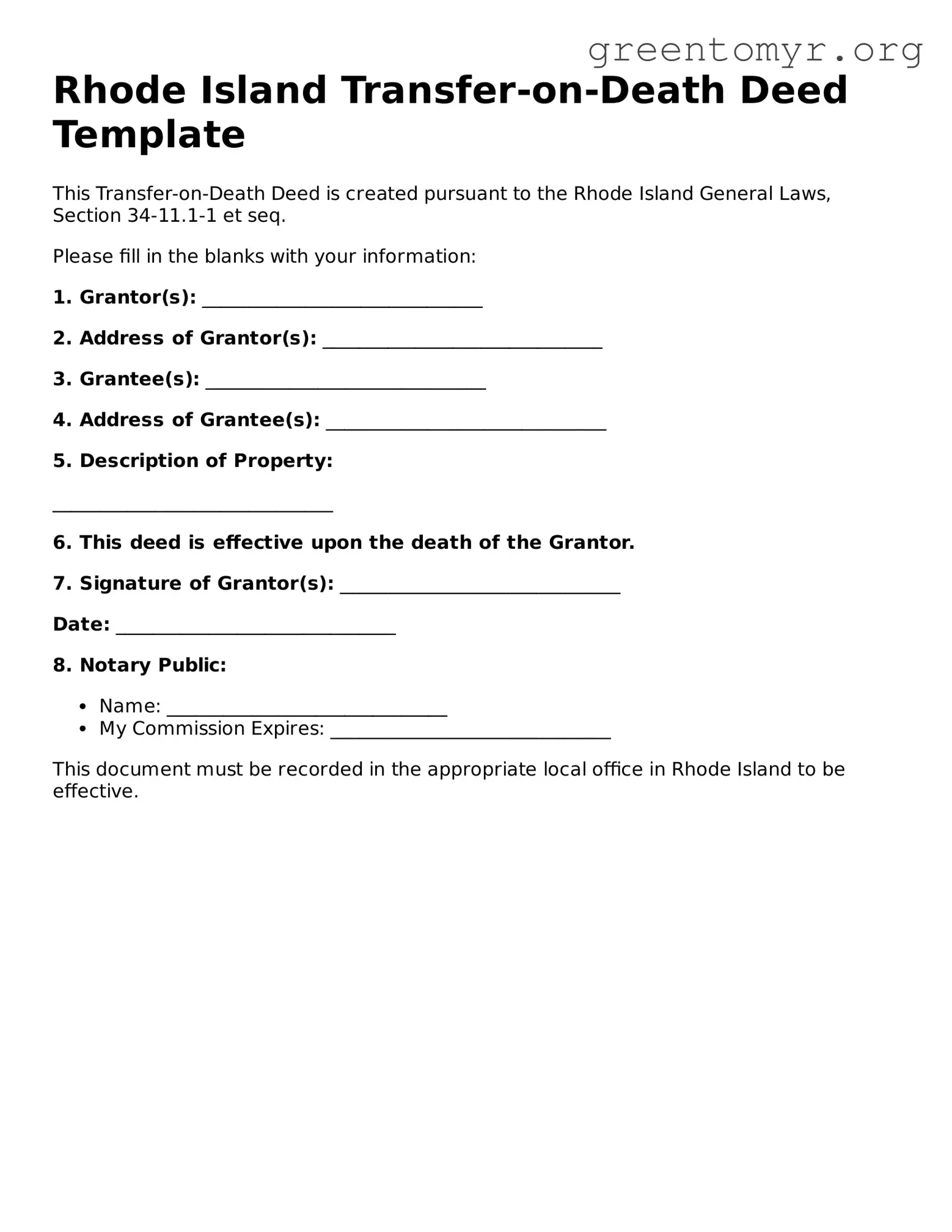

Transfer-on-Death Deed Form for the State of Rhode Island

The Rhode Island Transfer-on-Death Deed form is a legal document that allows property owners to designate beneficiaries to receive their property upon their death, without the need for probate. This form streamlines the transfer process, providing both convenience and peace of mind for property owners. If you are ready to take this important step in your estate planning, consider filling out the form by clicking the button below.