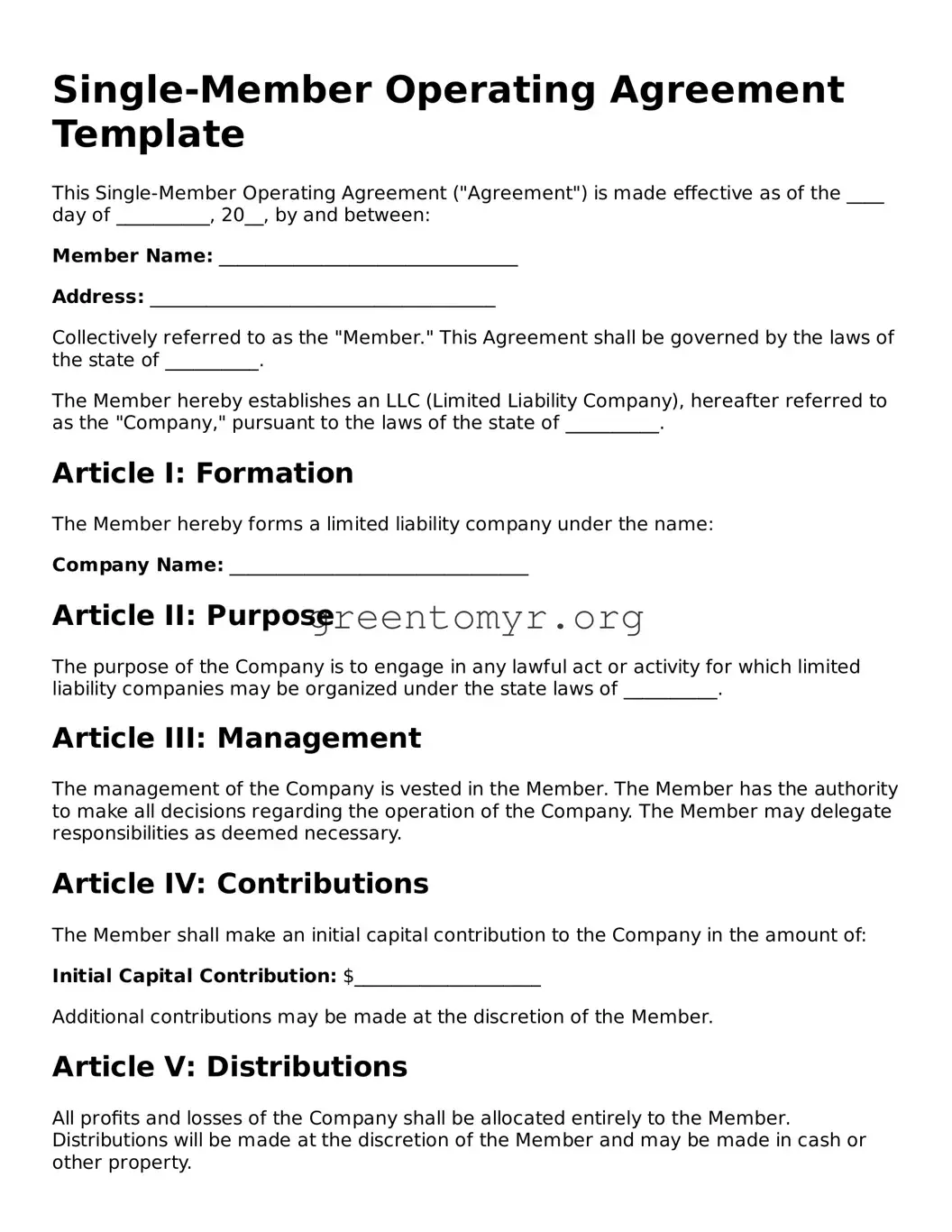

Single-Member Operating Agreement Template

This Single-Member Operating Agreement ("Agreement") is made effective as of the ____ day of __________, 20__, by and between:

Member Name: ________________________________

Address: _____________________________________

Collectively referred to as the "Member." This Agreement shall be governed by the laws of the state of __________.

The Member hereby establishes an LLC (Limited Liability Company), hereafter referred to as the "Company," pursuant to the laws of the state of __________.

Article I: Formation

The Member hereby forms a limited liability company under the name:

Company Name: ________________________________

Article II: Purpose

The purpose of the Company is to engage in any lawful act or activity for which limited liability companies may be organized under the state laws of __________.

Article III: Management

The management of the Company is vested in the Member. The Member has the authority to make all decisions regarding the operation of the Company. The Member may delegate responsibilities as deemed necessary.

Article IV: Contributions

The Member shall make an initial capital contribution to the Company in the amount of:

Initial Capital Contribution: $____________________

Additional contributions may be made at the discretion of the Member.

Article V: Distributions

All profits and losses of the Company shall be allocated entirely to the Member. Distributions will be made at the discretion of the Member and may be made in cash or other property.

Article VI: Records

The Member shall maintain complete and accurate records of the Company's activities, finances, and operations. These records will be kept at the principal office of the Company.

Article VII: Indemnification

The Company shall indemnify the Member against any and all expenses and liabilities incurred in connection with the Company, to the fullest extent permitted by law.

Article VIII: Amendments

This Agreement may only be amended or modified by a written agreement signed by the Member.

Article IX: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the state of __________.

IN WITNESS WHEREOF, the undersigned Member has executed this Single-Member Operating Agreement as of the date first above written.

Member Signature: ________________________________

Date: _____________________________________