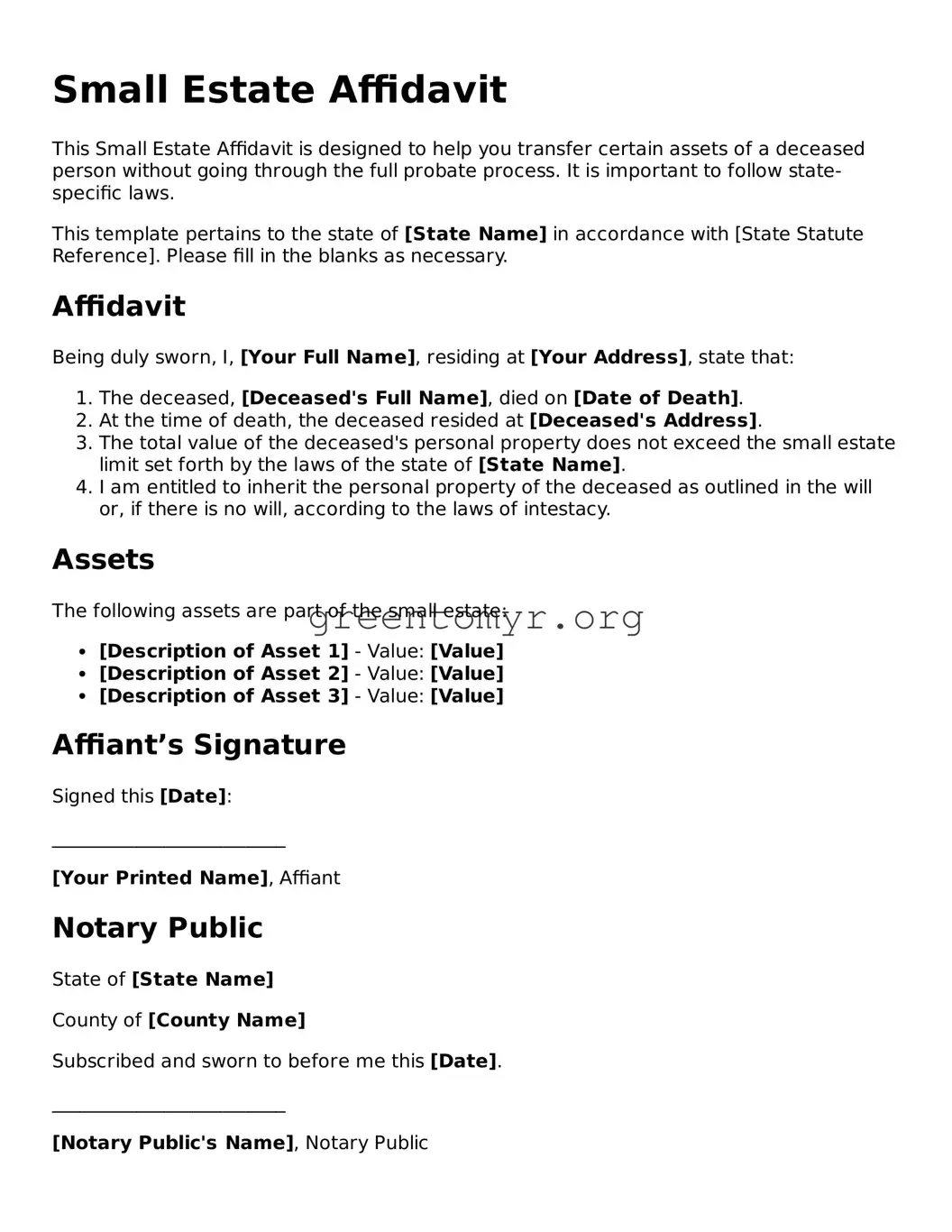

Small Estate Affidavit

This Small Estate Affidavit is designed to help you transfer certain assets of a deceased person without going through the full probate process. It is important to follow state-specific laws.

This template pertains to the state of [State Name] in accordance with [State Statute Reference]. Please fill in the blanks as necessary.

Affidavit

Being duly sworn, I, [Your Full Name], residing at [Your Address], state that:

- The deceased, [Deceased's Full Name], died on [Date of Death].

- At the time of death, the deceased resided at [Deceased's Address].

- The total value of the deceased's personal property does not exceed the small estate limit set forth by the laws of the state of [State Name].

- I am entitled to inherit the personal property of the deceased as outlined in the will or, if there is no will, according to the laws of intestacy.

Assets

The following assets are part of the small estate:

- [Description of Asset 1] - Value: [Value]

- [Description of Asset 2] - Value: [Value]

- [Description of Asset 3] - Value: [Value]

Affiant’s Signature

Signed this [Date]:

_________________________

[Your Printed Name], Affiant

Notary Public

State of [State Name]

County of [County Name]

Subscribed and sworn to before me this [Date].

_________________________

[Notary Public's Name], Notary Public

My commission expires: [Expiration Date]

This affidavit can be submitted to collect the assets as provided under the small estate Laws of the state of [State Name].