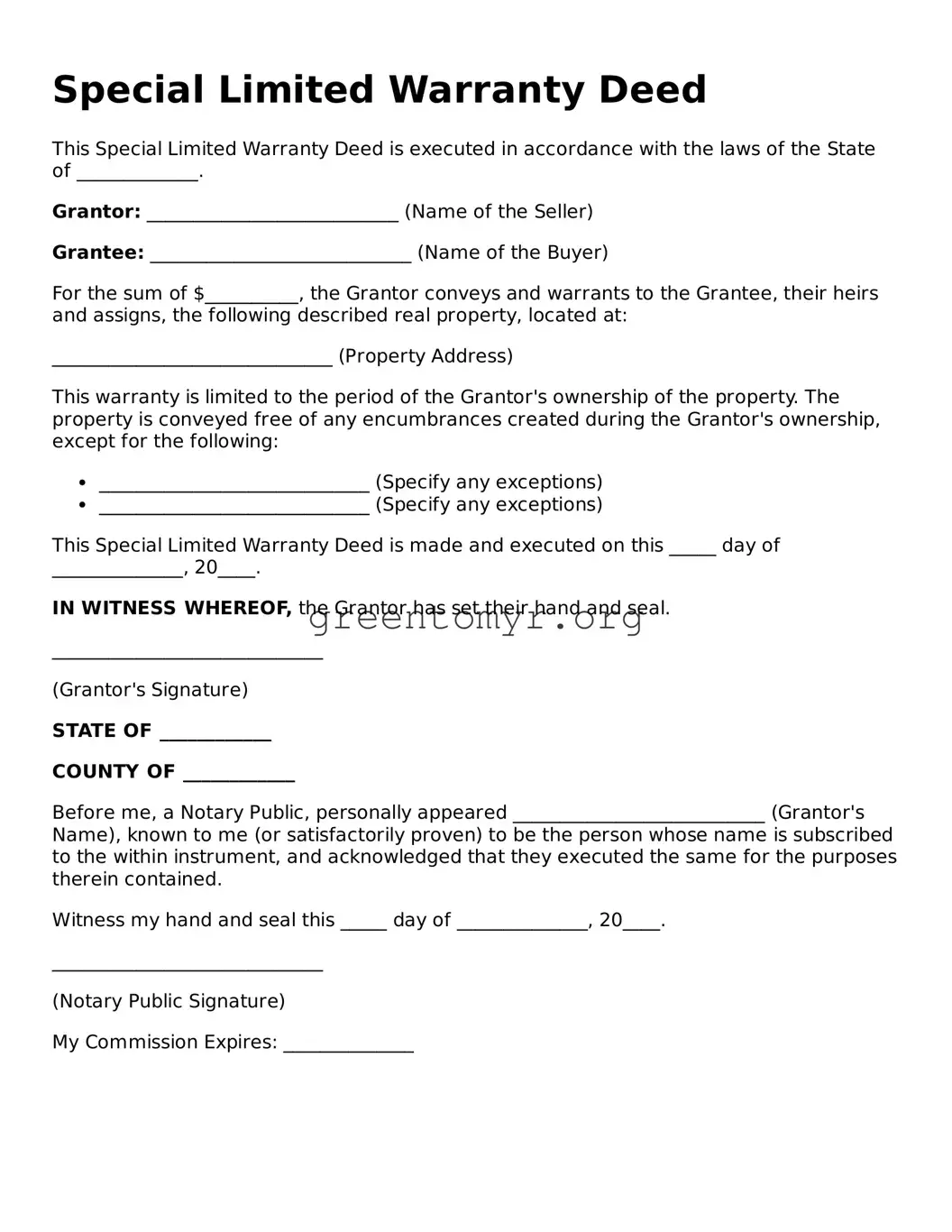

Special Limited Warranty Deed

This Special Limited Warranty Deed is executed in accordance with the laws of the State of _____________.

Grantor: ___________________________ (Name of the Seller)

Grantee: ____________________________ (Name of the Buyer)

For the sum of $__________, the Grantor conveys and warrants to the Grantee, their heirs and assigns, the following described real property, located at:

______________________________ (Property Address)

This warranty is limited to the period of the Grantor's ownership of the property. The property is conveyed free of any encumbrances created during the Grantor's ownership, except for the following:

- _____________________________ (Specify any exceptions)

- _____________________________ (Specify any exceptions)

This Special Limited Warranty Deed is made and executed on this _____ day of ______________, 20____.

IN WITNESS WHEREOF, the Grantor has set their hand and seal.

_____________________________

(Grantor's Signature)

STATE OF ____________

COUNTY OF ____________

Before me, a Notary Public, personally appeared ___________________________ (Grantor's Name), known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

Witness my hand and seal this _____ day of ______________, 20____.

_____________________________

(Notary Public Signature)

My Commission Expires: ______________