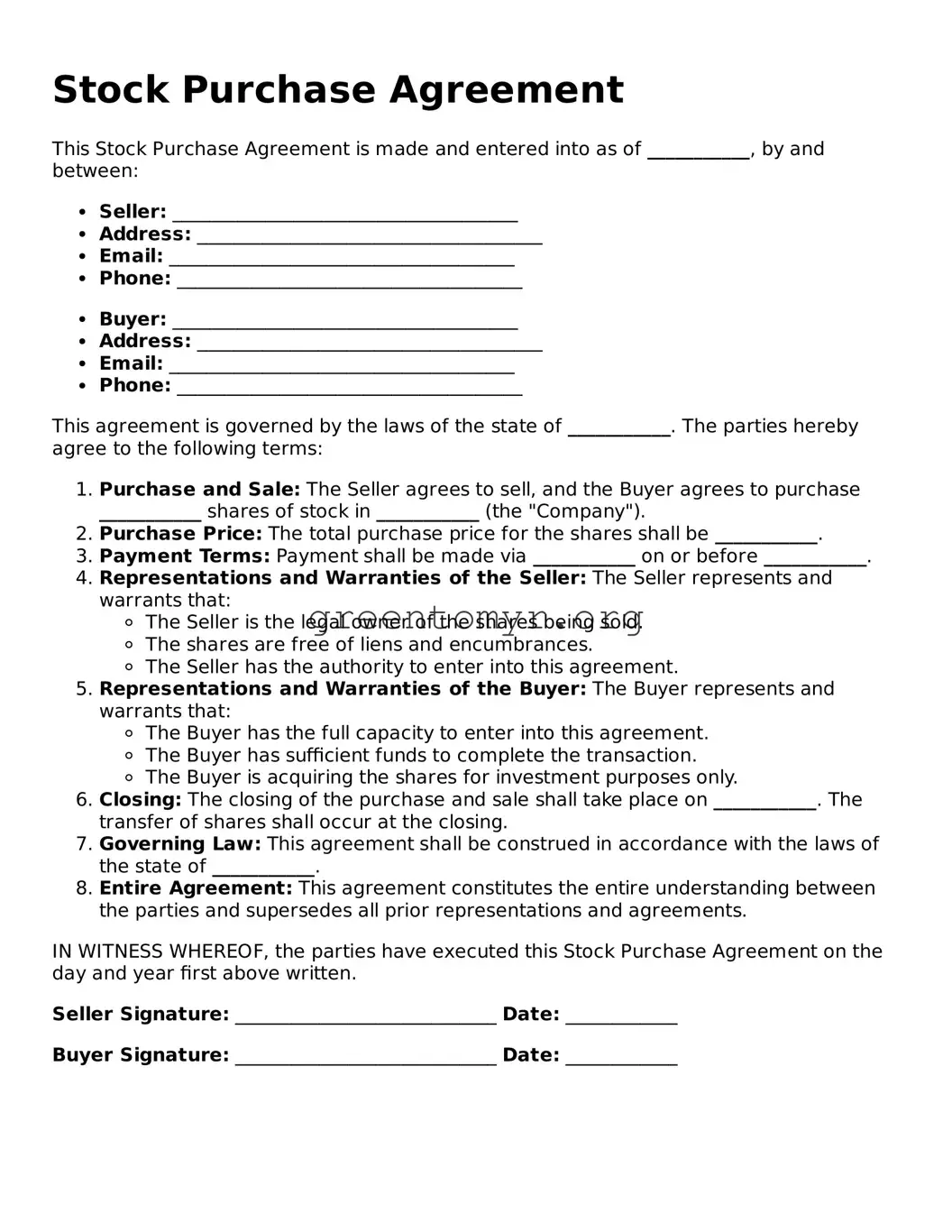

Filling out a Stock Purchase Agreement requires attention to detail. One common mistake is failing to accurately specify the names of the parties involved. It is essential to use the legal names of both the buyer and seller. Discrepancies in names can lead to disputes and complications in transaction enforcement.

Another frequent error is neglecting to include important definitions. Terms used in the agreement should be clearly defined to prevent any ambiguity. Without these definitions, different interpretations may arise, which can create potential legal issues down the line.

People often overlook the importance of specifying the exact number of shares being sold. It may seem straightforward, but mistakes in this section can lead to misunderstandings regarding ownership and valuation. Listing the correct number ensures all parties are in alignment regarding the transaction's details.

Many individuals forget to outline the payment terms adequately. This includes the total amount due, whether payments will occur in one lump sum or over time, and acceptable payment methods. Lack of clarity can result in payment disputes and frustration for all parties involved.

In some cases, buyers fail to conduct due diligence before signing the agreement. This means not investigating a company's financial health or share valuation. Skipping this step can lead to unexpected losses and complications after the purchase.

Overlooking closing conditions is another critical mistake. Parties need to specify conditions that must be met before the transaction is finalized. These could include approvals or documentation requirements that protect both the buyer and seller.

People also frequently neglect to specify what happens in the event of default. Defining consequences clear-up front provides a road map for actions to take if one party fails to meet their obligations. This omission can lead to chaos should a default occur.

Another common oversight is incorrectly handling representations and warranties. These assurances should be accurately represented to prevent misrepresentation claims later. Clarity and honesty in this section are pivotal to maintaining trust between the parties.

Moreover, failing to include a dispute resolution clause can hinder effective problem-solving should conflicts arise. Specifying how disputes will be addressed leads to quicker resolutions and can save both time and money.

Lastly, many signers overlook the importance of obtaining legal advice before finalizing the agreement. Consulting with professionals can help identify potential pitfalls and ensure the agreement complies with legal standards. Ignoring this step can have long-lasting effects on the enforceability of the contract.