mil OFDEPARTMENTREVENUE

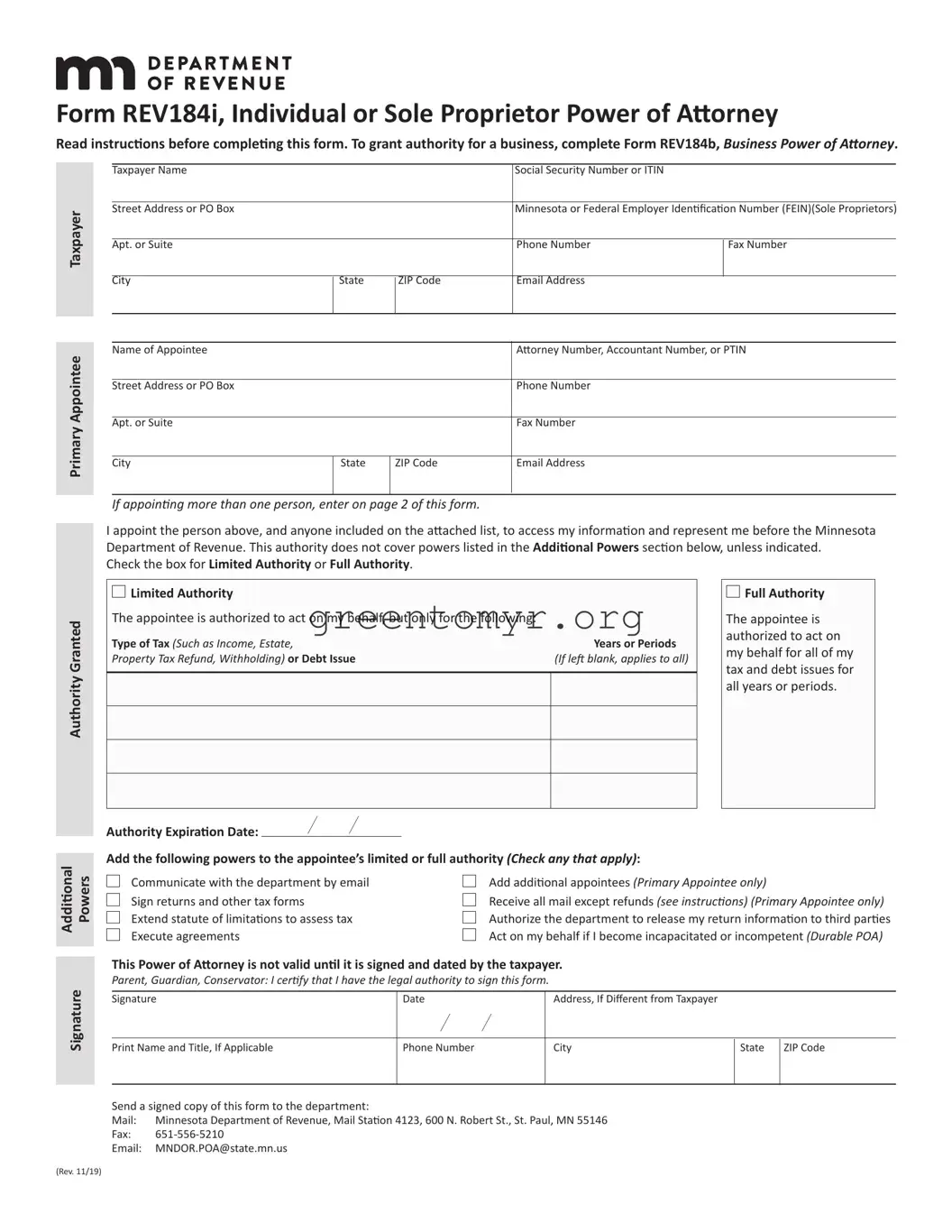

Form REV184b, Business Power of Attorney

Read instructions before completing this form.

To grant authority for an individual or sole proprietor, complete Form REV184i, Individual or Sole Proprietor Power of Attorney.

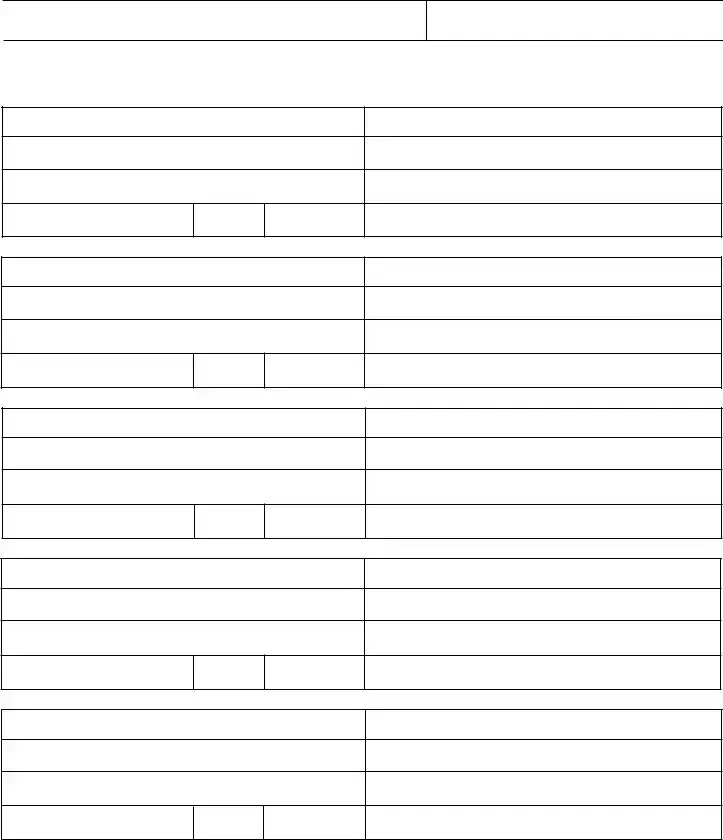

Business Taxpayer

Primary Appointee

Business Taxpayer Name |

|

|

Minnesota or Federal Employer Identification Number (FEIN) |

Street Address or PO Box |

|

|

Phone Number |

Fax Number |

Apt. or Suite |

|

|

|

I |

|

|

Combined Business Returns: Filing entity name (if different) |

City |

State |

ZIP Code |

Filing Entity FEIN or Taxpayer Identification Number |

I |

|

I |

|

|

Name of Appointee |

|

|

Attorney Number, Accountant Number, or PTIN |

Street Address or PO Box |

|

|

Phone Number |

|

Apt. or Suite |

|

|

Fax Number |

|

City |

State |

ZIP Code |

Email Address |

|

I |

|

I |

|

|

If appointing more than one person, enter on page 2 of this form. |

|

|

The person named above, and anyone included on the attached list, is appointed to access the taxpayer’s information and represent it be- fore the Minnesota Department of Revenue. Check the box for Limited Authority or Full Authority. (This authority does not cover powers listed in the Additional Powers section below, unless indicated.)

□

Limited Authority

Limited Authority

The appointee is authorized to act on behalf of the taxpayer, but only for the following:

Type of Tax (Such as Business Income, |

Tax Form Name or Number |

Years or Periods |

Sales, Withholding) or Debt Issue |

(If applicable) |

(If left blank, applies to all) |

□

Full Authority

Full Authority

The appointee is authorized to act on behalf of the taxpayer for all tax and debt issues for all years or periods.

Authority Expiration Date: |

I |

I |

|

|

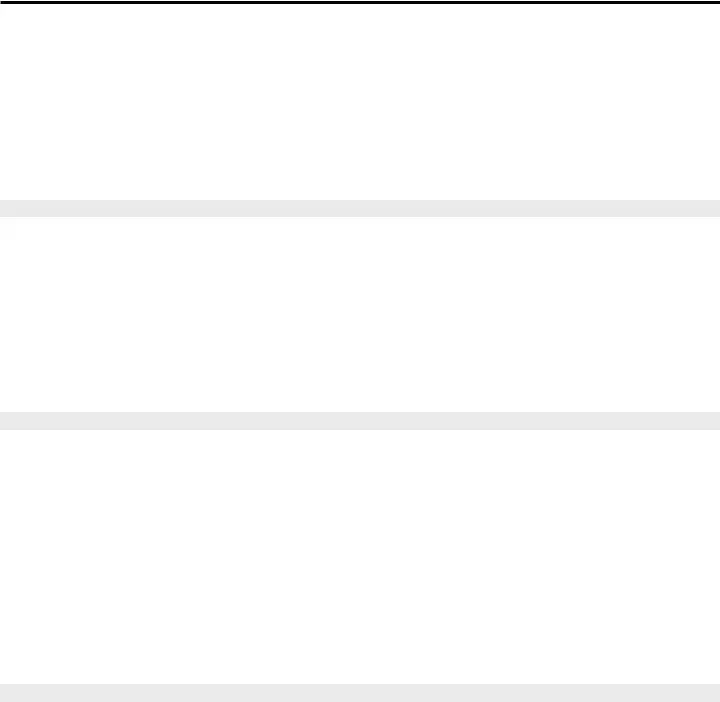

Signature Powers

Additional

(Rev. 11/19)

Add the following powers to the appointee’s limited or full authority (check any that apply):

□ |

Communicate with the department by email |

□ |

Add additional appointees (Primary Appointee only) |

□ |

Sign returns and other tax forms |

□ |

Receive all mail except refunds (see instructions) (Primary Appointee only) |

□ |

Extend statute of limitations to assess tax |

□ |

Authorize the department to release return information to third parties |

□ |

Execute agreements |

|

|

This Power of Attorney is not valid until it is signed and dated by someone with legal authority to sign agreements on behalf of the business taxpayer.

I certify that I have the legal authority to sign this form.

Signature |

Date |

Address, If Different from Taxpayer |

|

I |

I |

|

|

Print Name and Title |

Phone Number |

City |

State |

ZIP Code |

|

|

|

|

|

Send a signed copy of this form to the department:

Mail: |

Minnesota Department of Revenue, Mail Station 4123, 600 N. Robert St., St. Paul, MN 55146 |

Fax: |

651-556-5210 |

Email: |

[email protected] |

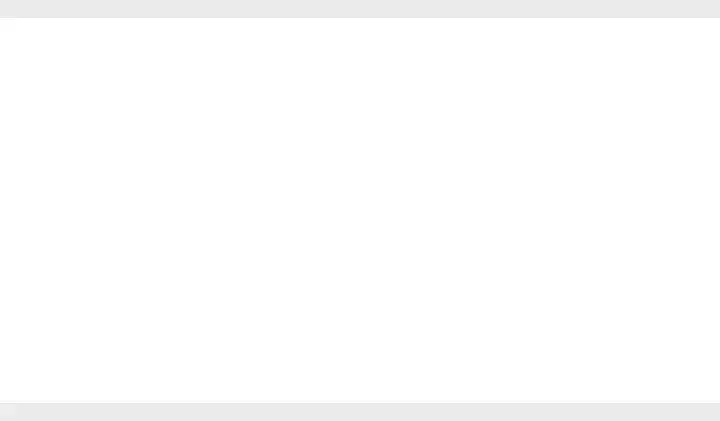

Form REV184b, Page 2 — Additional Appointees

Name of Business Taxpayer

Include any additional appointees below. Additional appointees only have authority over matters chosen in the Authority Granted and Additional Powers sections on page 1.

Name of Appointee |

|

|

Attorney Number, Accountant Number, or PTIN |

Street Address or PO Box |

|

|

Phone Number |

Apt. or Suite |

|

|

Fax Number |

City |

State |

ZIP Code |

Email Address |

I |

|

I |

|

Name of Appointee |

|

|

Attorney Number, Accountant Number, or PTIN |

Street Address or PO Box |

|

|

Phone Number |

Apt. or Suite |

|

|

Fax Number |

City |

State |

ZIP Code |

Email Address |

I |

|

I |

|

Name of Appointee |

|

|

Attorney Number, Accountant Number, or PTIN |

Street Address or PO Box |

|

|

Phone Number |

Apt. or Suite |

|

|

Fax Number |

City |

State |

ZIP Code |

Email Address |

I |

|

I |

|

Name of Appointee |

|

|

Attorney Number, Accountant Number, or PTIN |

Street Address or PO Box |

|

|

Phone Number |

Apt. or Suite |

|

|

Fax Number |

City |

State |

ZIP Code |

Email Address |

I |

|

I |

|

Name of Appointee |

|

|

Attorney Number, Accountant Number, or PTIN |

Street Address or PO Box |

|

|

Phone Number |

Apt. or Suite |

|

|

Fax Number |

City |

State |

ZIP Code |

Email Address |

I |

|

I |

|

Attach additional copies of this page, as needed.

Form REV184b Instructions

What is a Power of Attorney (POA)?

A power of attorney (POA) is a legal document that grants an attorney, accountant, agent, tax return preparer, or other person authority to access the business taxpayer’s account information and represent the taxpayer before the Minnesota Department of Revenue.

Use of Information

The information you enter on this form may be private or nonpublic under state law. We use it to allow the appointee to access the taxpay- er’s account and take actions on its behalf. We may share it with other government entities for tax administration if allowed by law. You are not required to provide the information requested; however, we are unable to process the appointment unless the form is complete.

How do I complete this form?

Business Taxpayer

Step 1

Enter the business taxpayer’s name and contact information.

Note: This form does not cover personal tax issues or sole proprietorships. Complete Form REV184i, Individual Power of Attorney.

Step 2

Enter the Federal Employer ID number (FEIN), or Minnesota Tax ID number.

Step 3

For businesses filing combined business returns, enter the name and ID number for the entity responsible for filing returns.

Primary Appointee

Eligibility: The appointee must be eligible to represent the business with the department.

The taxpayer may not appoint:

•A person barred or suspended from practice as an attorney or accountant

•A person barred or suspended from practice before the IRS

•An employee of the department

•A former department employee within one year of leaving the department

For details, go to www.revenue.state.mn.us and enter Preparer Enforcement in the Search box.

Step 4

Enter the appointee’s name and contact information. An appointee is a person selected to represent the taxpayer before the department. The taxpayer may have more than one appointee, but only the primary appointee can be selected to receive mailed correspondence from the department.

For additional appointees, complete page 2 of Form REV184b. Include additional pages, if needed. Note: The taxpayer is responsible for keeping the appointees informed of changes to its account.

Authority Granted

Step 5

Choose whether to grant the appointee full authority or to limit authority to specific issues.

Limited Authority allows the appointee to act on specific tax or debt issues.

•By tax type or issue

•By year or filing period is optional. If no year is provided, authority applies to all periods.

Full Authority allows your appointee to act on your behalf for your tax and debt issues.

Choose an expiration date for the POA if applicable. To have the POA end on a specific date, enter the month, day, and year (enter as MM/ DD/YY). If no date is provided, the POA and additional powers will remain in effect until removed.

Form REV184b Instructions, cont.

Additional Powers

Step 6

Choose additional powers to give the appointee.

•Communicate by email

Allows the appointee to communicate with the department by email.

Note: Transmit return information at your own risk. Email is not secure. The department is not liable for damages caused by interception of emails.

•Sign returns and other forms

This does not authorize the appointee to endorse or negotiate any checks or other payments issued by the department.

•Add additional appointees

Allows the primary appointee to authorize additional appointees.

Note: The appointee may only grant authority over tax types or issues authorized in the Authority Granted section.

•Execute agreements

Allows the appointee to enter into contracts and other binding agreements on behalf of the taxpayer.

•Authorize disclosure to third parties

Allows the appointee to authorize the department to share return information with people outside the department. Appointees may discuss the taxpayer’s account with people they employ or supervise, even if this box is not checked.

•Receive all mail except refunds

Authorizes the department to mail letters, legal notices, and tax information directly to the primary appointee only. Any refunds or letters relating to refunds will be sent directly to the business.

Note: The business may still receive copies of some mail from the department in certain circumstances.

This power is effective only for the tax types or issues granted to the primary appointee. If the business is only granting authority for spe- cific years or periods, this option is not available. All mail will go directly to the business.

Mail will go to the most recently designated person, replacing designations from a prior POA.

Signature

Step 7

Owners, officers, or authorized agents:

Sign, date, print your name and title, and enter your contact information. This POA is not valid until it is signed and dated by someone with legal authority to sign it

We reserve the right to request additional information as needed to verify identity and authority to sign.

Step 8

Send the form to the department using only one of the following:

•Mail: Minnesota Department of Revenue, Mail Station 4123, 600 N. Robert St., St. Paul, MN 55146

•Fax: 651-556-5210

•Email: [email protected]

How do I revoke an appointee?

To revoke an appointee, the taxpayer or the appointee must send the department a signed and dated statement terminating the appointee’s authority or a completed Form REV184r, Revocation of Power of Attorney.

E-Services Account

No POA form is necessary to access a taxpayer’s e-Services account, but the appointee must request Third-Party access through e-Services. Go to our website and enter Third Party Access in the Search box.

Questions?

Website: www.revenue.state.mn.us

Email: [email protected]

Phone: 651-556-3003 or 1-800-657-3909

Limited Authority

Limited Authority

Full Authority

Full Authority