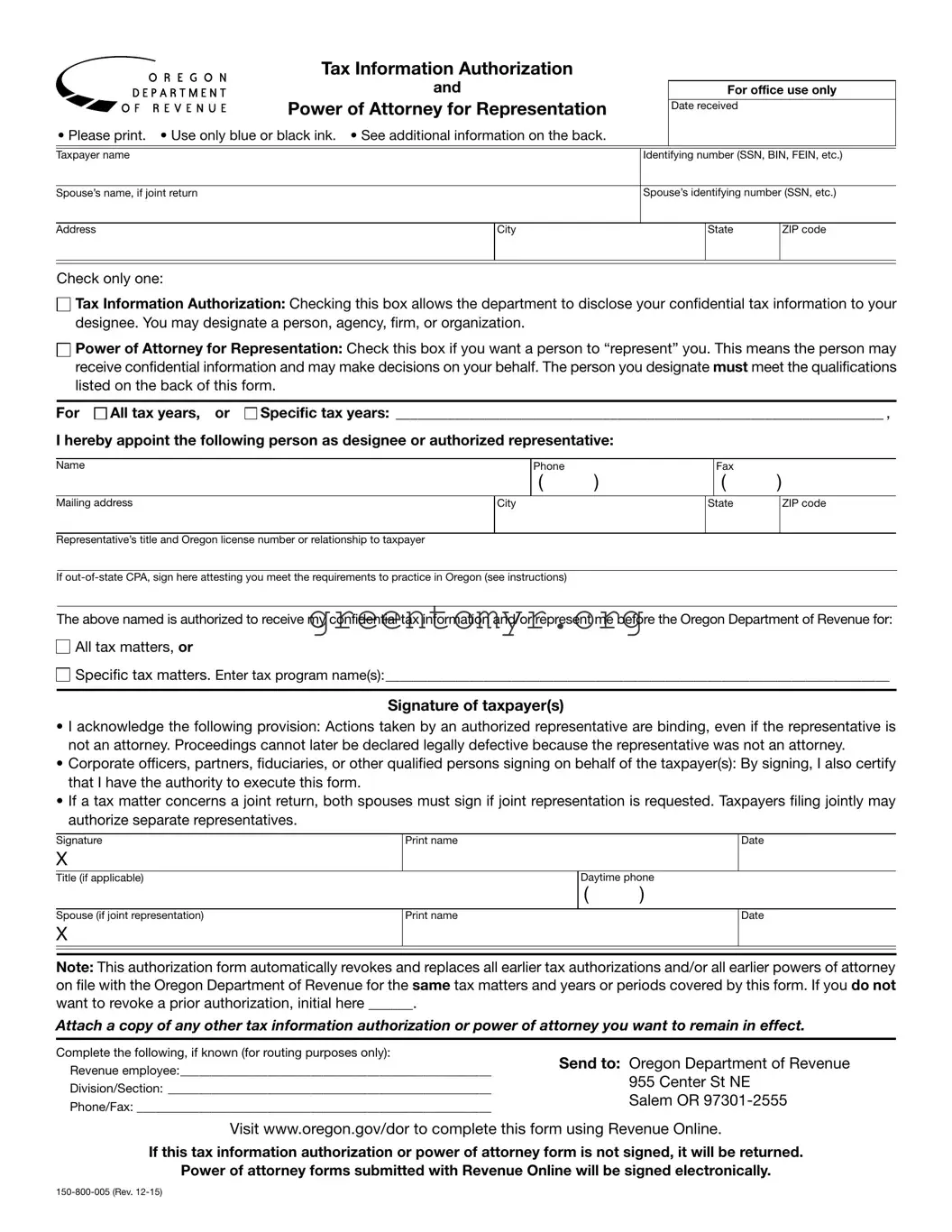

Additional information

This form is used for two purposes:

•Tax information disclosure authorization. You authorize the department to disclose your confidential tax infor- mation to another person. This person will not receive original notices we send to you.

•Power of attorney for representation. You authorize another person to represent you and act on your behalf. The person must meet the qualifications below. Unless you specify differently, this person will have full power to do all things you might do, with as much binding effect, including, but not limited to: providing information; pre- paring, signing, executing, filing, and inspecting returns and reports; and executing statute of limitation extensions and closing agreements.

This form is effective on the date signed. Authorization termi- nates when the department receives written revocation notice or a new form is executed (unless the space provided on the front is initialed indicating that prior forms are still valid).

Unless the appointed representative has a fiduciary relation- ship to the taxpayer (such as personal representative, trustee, guardian, conservator), original Notices of Deficiency or Assessment will be mailed to the taxpayer as required by law. A copy will be provided to the appointed representative when requested.

For corporations, “taxpayer” as used on this form, must be the corporation that is subject to Oregon tax. List fiscal years by year end date.

Qualifications to represent taxpayer(s) before Department of Revenue

Under Oregon Revised Statute (ORS) 305.230 and Oregon Administrative Rule (OAR) 150-305.230, a person must meet one of the following qualifications in order to represent you before the Department of Revenue.

1.For all tax programs:

a.An adult immediate family member (spouse, parent, child, or sibling).

b.An attorney qualified to practice law in Oregon.

c.A certified public accountant (CPA) or public accoun- tant (PA) qualified to practice public accountancy in Oregon, and their employees.

d.An IRS enrolled agent (EA) qualified to prepare tax returns in Oregon.

e.A designated employee of the taxpayer.

f.An officer or full-time employee of a corporation (includ- ing a parent, subsidiary, or other affiliated corporation), association, or organized group for that entity.

g.A full-time employee of a trust, receivership, guardian- ship, or estate for that entity.

h.An individual outside the United States if representa- tion takes place outside the United States.

2.For income tax issues:

a.All those listed in (1); plus

b.A licensed tax consultant (LTC) or licensed tax pre- parer (LTP) licensed by the Oregon State Board of Tax Practitioners.

3.For ad valorem property tax issues:

a.All those listed in (1); plus

b.An Oregon licensed real estate broker or a principal real estate broker; or

c.An Oregon certified, licensed, or registered appraiser; or

d.An authorized agent for designated utilities and com- panies assessed by the department under ORS 308.505 through 308.665 and ORS 308.805 through 308.820.

4.For forestland and timber tax issues:

a.All those listed in (1), (2), and (3)(b) and (c); plus

b.A consulting forester.

An individual who prepares and either signs your tax return or who is not required to sign your tax return (by the instruc- tions or by rule), may represent you during an audit of that return. That individual may not represent you for any other purpose unless they meet one of the qualifications listed above.

Generally, declarations for representation in cases appealed beyond the Department of Revenue must be in writing to the Tax Court Magistrate. A person recognized by a Tax Court Magistrate will be recognized as your representative by the department.

Tax matters partners and S corporation shareholders. See OARs 150-305.242(2) and (5) and 150-305.230 for additional information. Include the partnership or S corporation name in the taxpayer name area.

Out-of-state attorneys and CPAs

Attorneys may contact the Oregon State Bar for information on practicing in Oregon. If your out-of-state representative receives authorization to practice in Oregon, attach proof to this form.

CPAs may practice in Oregon if they meet the following substantial equivalency requirements of ORS 673.010:

1.Licensed in another state;

2.Have an accredited baccalaureate degree with at least 150 semester hours of college education;

3.Passed the Uniform CPA exam; and

4.Have a minimum of one year experience.

Have questions? Need help?

General tax information |

www.oregon.gov/dor |

Salem |

(503) |

378-4988 |

Toll-free from an Oregon prefix |

1 (800) |

356-4222 |

Asistencia en español: |

|

|

En Salem o fuera de Oregon |

(503) |

378-4988 |

Gratis de prefijo de Oregon |

1 (800) |

356-4222 |

TTY (hearing or speech impaired; machine only): |

|

Salem area or outside Oregon |

(503) |

945-8617 |

Toll-free from an Oregon prefix |

1 (800) |

886-7204 |

Americans with Disabilities Act (ADA): Call one of the help numbers above for information in alternative formats.

All tax matters,

All tax matters,