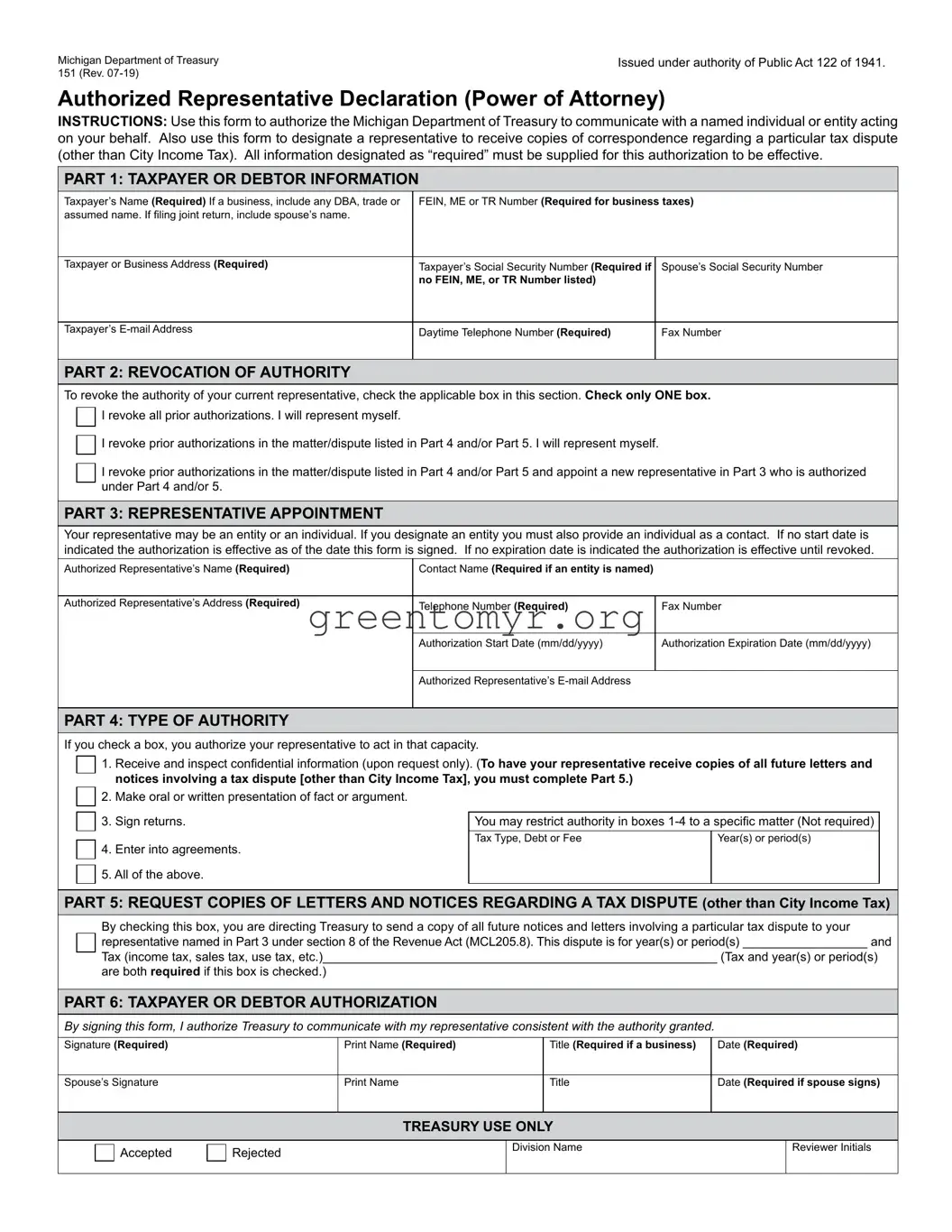

Michigan Department of Treasury |

Issued under authority of Public Act 122 of 1941. |

151 (Rev. 07-19) |

|

Authorized Representative Declaration (Power of Attorney)

INSTRUCTIONS: Use this form to authorize the Michigan Department of Treasury to communicate with a named individual or entity acting on your behalf. Also use this form to designate a representative to receive copies of correspondence regarding a particular tax dispute (other than City Income Tax). All information designated as “required” must be supplied for this authorization to be effective.

PART 1: TAXPAYER OR DEBTOR INFORMATION

Taxpayer’s Name (Required) If a business, include any DBA, trade or |

FEIN, ME or TR Number (Required for business taxes) |

assumed name. If filing joint return, include spouse’s name. |

|

|

|

|

|

Taxpayer or Business Address (Required) |

Taxpayer’s Social Security Number (Required if |

Spouse’s Social Security Number |

|

no FEIN, ME, or TR Number listed) |

|

|

|

|

Taxpayer’s E-mail Address |

Daytime Telephone Number (Required) |

Fax Number |

|

|

|

PART 2: REVOCATION OF AUTHORITY

To revoke the authority of your current representative, check the applicable box in this section. Check only ONE box. □

I revoke all prior authorizations. I will represent myself.

I revoke all prior authorizations. I will represent myself.

□

I revoke prior authorizations in the matter/dispute listed in Part 4 and/or Part 5. I will represent myself.

I revoke prior authorizations in the matter/dispute listed in Part 4 and/or Part 5. I will represent myself.

□ I revoke prior authorizations in the matter/dispute listed in Part 4 and/or Part 5 and appoint a new representative in Part 3 who is authorized under Part 4 and/or 5.

PART 3: REPRESENTATIVE APPOINTMENT

Your representative may be an entity or an individual. If you designate an entity you must also provide an individual as a contact. If no start date is indicated the authorization is effective as of the date this form is signed. If no expiration date is indicated the authorization is effective until revoked.

Authorized Representative’s Name (Required) |

Contact Name (Required if an entity is named) |

|

|

|

|

Authorized Representative’s Address (Required) |

Telephone Number (Required) |

Fax Number |

|

|

|

|

Authorization Start Date (mm/dd/yyyy) |

Authorization Expiration Date (mm/dd/yyyy) |

|

|

|

|

Authorized Representative’s E-mail Address |

|

|

|

|

PART 4: TYPE OF AUTHORITY

If you check a box, you authorize your representative to act in that capacity. |

|

|

|

|

|

1. |

Receive and inspect confidential information (upon request only). (To have your representative receive copies of all future letters and |

|

|

□ |

|

|

|

|

|

notices involving a tax dispute [other than City Income Tax], you must complete Part 5.) |

|

|

|

□ |

|

2. |

Make oral or written presentation of fact or argument. |

|

|

|

|

|

|

|

|

|

|

|

□ |

|

3. |

Sign returns. |

You may restrict authority in boxes 1-4 to a specific matter (Not required) |

|

|

|

|

|

Tax Type, Debt or Fee |

Year(s) or period(s) |

|

|

□ |

|

4. |

Enter into agreements. |

|

|

|

|

|

5. All of the above. |

|

|

|

|

□ |

|

I |

I |

I |

|

|

|

|

|

|

|

PART 5: REQUEST COPIES OF LETTERS AND NOTICES REGARDING A TAX DISPUTE (other than City Income Tax)

By checking this box, you are directing Treasury to send a copy of all future notices and letters involving a particular tax dispute to your

□ representative named in Part 3 under section 8 of the Revenue Act (MCL205.8). This dispute is for year(s) or period(s) __________________ and

Tax (income tax, sales tax, use tax, etc.)_________________________________________________________ (Tax and year(s) or period(s)

are both required if this box is checked.)

PART 6: TAXPAYER OR DEBTOR AUTHORIZATION

By signing this form, I authorize Treasury to communicate with my representative consistent with the authority granted.

Signature (Required) |

Print Name (Required) |

Title (Required if a business) |

Date (Required) |

Spouse’s Signature |

Print Name |

Title |

Date (Required if spouse signs) |

TREASURY USE ONLY

□ Accepted |

□ Rejected |

Division Name |

Reviewer Initials |

I |

I |

I revoke all prior authorizations. I will represent myself.

I revoke all prior authorizations. I will represent myself.

I revoke prior authorizations in the matter/dispute listed in Part 4 and/or Part 5. I will represent myself.

I revoke prior authorizations in the matter/dispute listed in Part 4 and/or Part 5. I will represent myself.