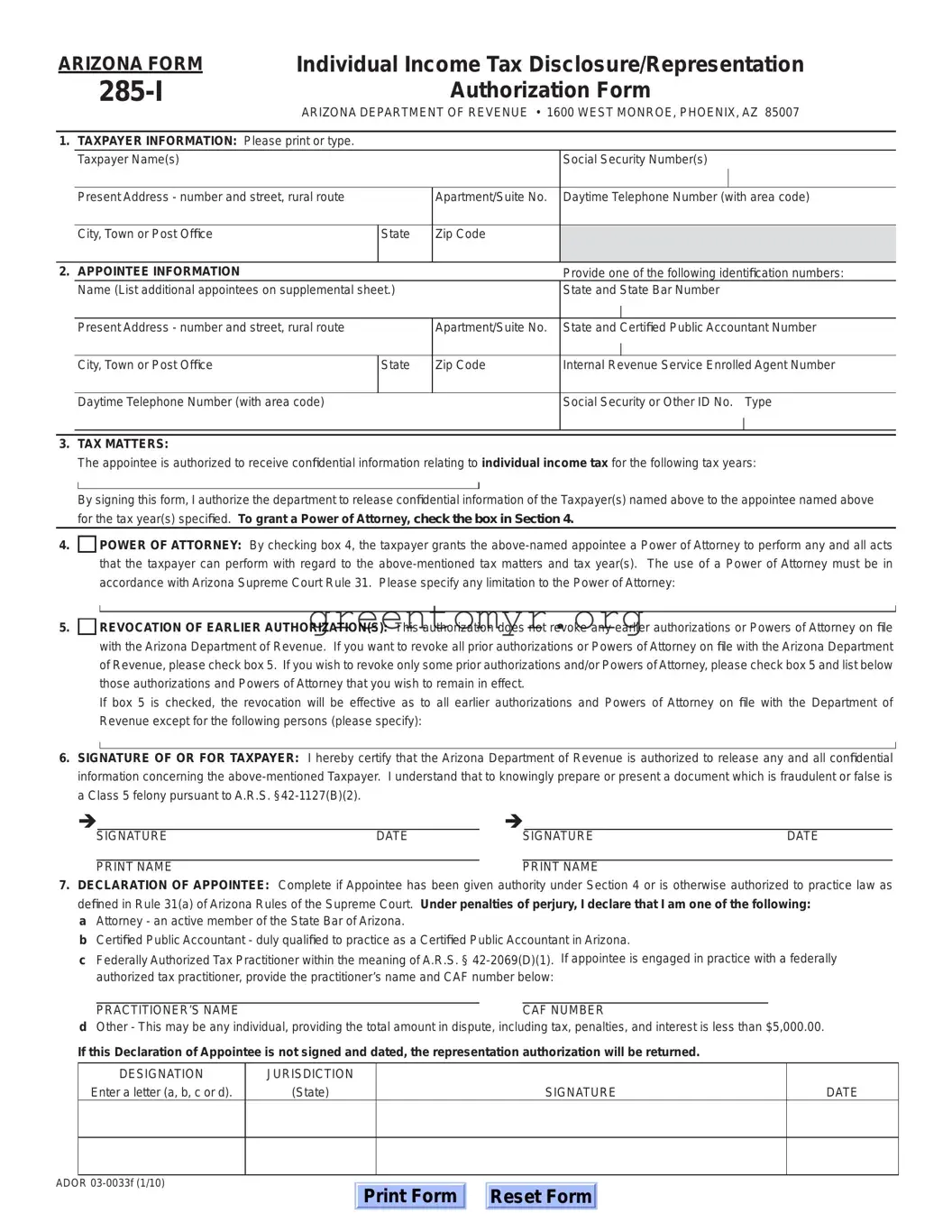

The Tax POA 285-I form is a Power of Attorney form that allows individuals to designate someone else to represent them concerning tax matters before the IRS. This form authorizes the appointed individual to handle specific tax-related tasks on behalf of the taxpayer.

You can designate any individual as your representative. This can include tax professionals such as CPAs, attorneys, or enrolled agents. It is important to choose someone you trust who is knowledgeable about tax matters.

Do I need to specify the tax matters for which the representative is authorized?

Yes, the POA 285-I form requires you to specify the tax matters your representative is authorized to handle. This could include income tax, employment tax, or other specific issues. Clearly outlining these matters helps ensure that your representative understands their authority.

No, there is no fee for filing the Tax POA 285-I form with the IRS. However, if you choose a paid representative, they may charge you for their services.

You may submit the POA 285-I form by mailing it to the appropriate IRS office, or you can submit it electronically if your representative has authorization. Check the IRS website or contact the agency for details on submission methods.

Yes, you can revoke the Power of Attorney at any time. To do so, you must submit a written statement to the IRS informing them of the revocation. It is also a good practice to notify your representative if you decide to revoke their authority.

What should I do if my representative does not act in my best interest?

If you feel that your representative is not acting in your best interest, you have the right to revoke their Power of Attorney using the proper procedures. You can also contact the IRS to report any misconduct.

How long is the Power of Attorney valid?

The POA 285-I form remains valid until you revoke it or until your representative can no longer act on your behalf (e.g., due to disability or death). It is advisable to review and update your Power of Attorney regularly.

Yes, you can authorize multiple representatives by completing the form for each individual. However, ensure that each representative has a designated role to avoid confusion regarding authority.

You can find the Tax POA 285-I form on the IRS official website. It is available for download in PDF format, and you can print it out for completion.