General Instructions

Form 500 may be used by a taxpayer to do one of the following:

Authorize the North Dakota Office of State Tax Commissioner to disclose the taxpayer’s confidential tax information to another individual or firm not otherwise entitled to the information.

Designate another individual or firm to represent or act on behalf of the taxpayer before the Office of State Tax Commissioner, and to authorize the North Dakota Office of State Tax Commissioner to disclose the taxpayer’s confidential tax information to the designated representative or firm.

Form 500 does not apply to the routine mailing of tax forms, refund checks, original notices (e.g., a Notice of Determination), or other original written communications, which are always mailed to the taxpayer.

Unless Box C on Form 500 is checked to authorize the sending of confidential tax information by facsimile (fax) transmission or email, the Office of State Tax Commissioner will send confidential tax information authorized by Form 500 to the designated individual or firm only by letter or telephone.

Changing a previously filed Form 500. To change a Form 500 previously filed with respect to a particular designated individual or firm, complete and file

a new Form 500 for that designated individual or firm. The new Form 500 automatically revokes and replaces the previously filed Form(s) 500.

Revoking a previously filed Form 500. To revoke a previously filed Form 500, see instructions to Box D under “Authorization or Revocation.”

When Form 500 takes effect. Form 500 takes effect upon receipt by the Office of State Tax Commissioner and remains in effect until revoked by the taxpayer.

Specific Instructions

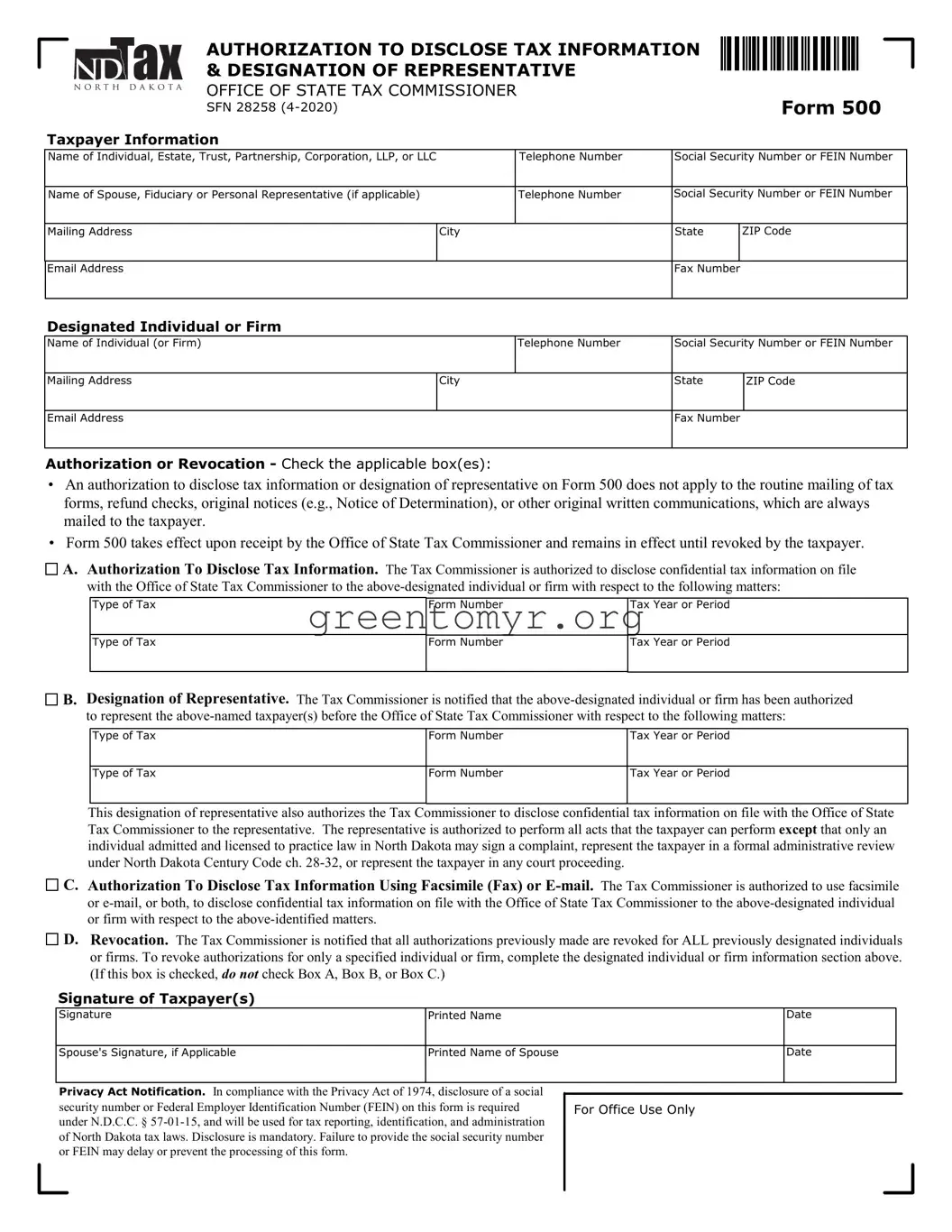

Taxpayer Information

Enter the taxpayer’s name, social security number or federal employer identification number (FEIN), mailing address, and contact information.

For a trust, enter the trust’s name and FEIN, and the name, mailing address, and contact information of the fiduciary.

For an estate, enter the decedent’s name and social security number, and the name, mailing address, and contact information of the decedent’s personal representative or fiduciary.

Designated Individual or Firm

Enter the name, social security number or federal employer identification number (FEIN), mailing address, and contact information for the designated individual or firm. If designating more than one individual or firm, attach a statement listing each one.

Note: Do not complete this section of the form if filing this form to revoke previously filed Forms 500 and the revocation is intended to apply to all previously designated individuals and firms.

Authorization or Revocation

For Box A and Box B, the authorization to disclose or the designation of representative can be limited to a certain tax type (e.g., individual income tax or sales tax), form number, or taxable year or period by entering that information in the spaces provided.

If attaching a statement to identify additional designated individuals or firms, indicate the authority being given to each one by entering “Box A” or “Box B” (and “Box C” if desired) next to each one listed on the statement.

Box A - Check this box to authorize the Office of State Tax Commissioner to disclose confidential tax information to the designated individual or firm.

Box B - Check this box to designate an individual or firm to represent or act on behalf of the taxpayer before the Office of

State Tax Commissioner, and to authorize the Office of State Tax Commissioner to disclose confidential tax information to the designated individual or firm.

Box C - Check this box to authorize the Office of State Tax Commissioner to send confidential tax information to the designated individual or firm by facsimile (fax) transmission or email.

Box D - Check this box to revoke all previously filed Forms 500. To limit the revocation to a specific designated individual or firm, identify that individual or firm by completing the “Designated Individual or Firm” section of the form. Otherwise, leave that section of the form blank to apply the revocation to all previously designated individuals and firms. If checking this box, do not check any of the other boxes (A, B, or C) on the form.

Signature of Taxpayer(s)

Partnership (all types). One of the general partners must sign.

Corporation. An officer having authority to bind the corporation must sign.

Limited liability company. A governor or manager must sign.

Estate, trust, or any other situation where there is a fiduciary relationship. The personal representative, trustee, guardian, conservator, or other fiduciary must sign.

Where to Send Form 500

Form 500 may be submitted to the North Dakota Office of State Tax Commissioner by fax, email, or regular mail.

Fax or email

Income & Withholding Taxes—

Fax701.328.1942

Email [email protected]

Business Registration—

Fax701.328.0332

Email [email protected]

General (other tax or purpose)—

Fax701.328.3700

Email[email protected]

Regular mail

Office of State Tax Commissioner

600 E. Boulevard Ave., Dept. 127

Bismarck, ND 58505-0599

llll

llll

111111111111111

111111111111111

C. Authorization To Disclose Tax Information Using Facsimile (Fax) or

C. Authorization To Disclose Tax Information Using Facsimile (Fax) or