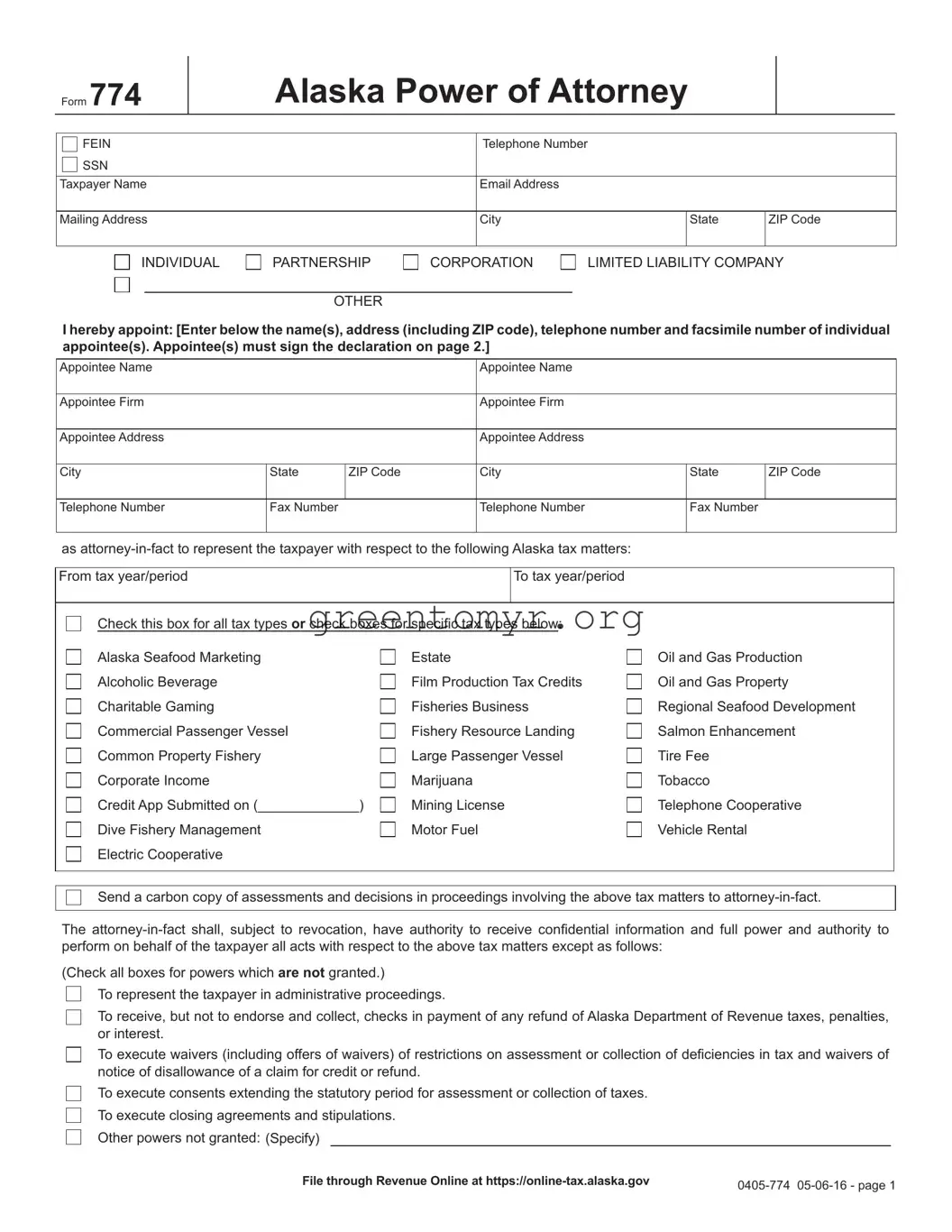

The Tax POA 774 form, formally known as the Power of Attorney for Tax Representation, allows individuals to designate someone else to represent them before the tax authorities, such as the IRS or state tax agencies. This form grants authority to the designated representative to receive information, make inquiries, and represent the taxpayer's interests in various tax matters.

Taxpayers can appoint a wide range of individuals as their representatives. Common choices include tax professionals such as accountants, CPAs, or attorneys. Friends or family members may also serve in this role, but it is essential that the designated person is trustworthy and knowledgeable about tax matters.

To complete the form, an individual must provide personal information, including their name, address, and taxpayer identification number. The form also requires details about the designated representative, such as their name and contact information. Clarity is crucial; ensure that the authority granted is specified clearly, allowing for the representative to act in specific areas related to taxation.

No, the Tax POA 774 form does not require notarization. However, both the taxpayer and the representative must sign the document. Their signatures signify an understanding and agreement to the terms outlined in the form.

The completed Tax POA 774 form can typically be submitted through various methods, depending on the tax agency involved. Common submission methods include mailing the form to the appropriate tax office or, in the case of some states and the IRS, submitting it electronically via their online systems. Check the relevant agency’s guidelines for specific instructions.

Yes, taxpayers have the right to revoke the Tax POA 774 form at any time. To do so, a written revocation should be drafted and sent to the appropriate tax authority. It is also courteous to inform the designated representative of the decision to revoke the power of attorney, so that they are aware of the change in representation.

What happens if my representative acts outside the scope of authority granted?

Should a representative act outside the authority specified in the Tax POA 774 form, the taxpayer may not be liable for any actions taken by the representative that do not comply with the granted Powers. This emphasizes the importance of clearly outlining the areas of authority on the form.

Most tax agencies do not charge a fee for submitting the Tax POA 774 form. However, it is important to verify this with the specific agency, as policies may vary and additional fees could apply if further services are needed from a tax professional or advisor.

This power of attorney revokes all prior powers of attorney filed with respect to the same matters and years or periods covered by this instrument, except the following: (Specify and attach copies of the powers of attorney)

This power of attorney revokes all prior powers of attorney filed with respect to the same matters and years or periods covered by this instrument, except the following: (Specify and attach copies of the powers of attorney)