The Tax POA DO-10 form, or the Power of Attorney for tax matters, is an essential document used in the United States to allow someone else to handle your tax affairs. Filling it out may seem straightforward, but individuals often make common mistakes that can lead to confusion and delays. Recognizing these mistakes can help ensure that your form is completed correctly, allowing your authorized representative to assist you effectively.

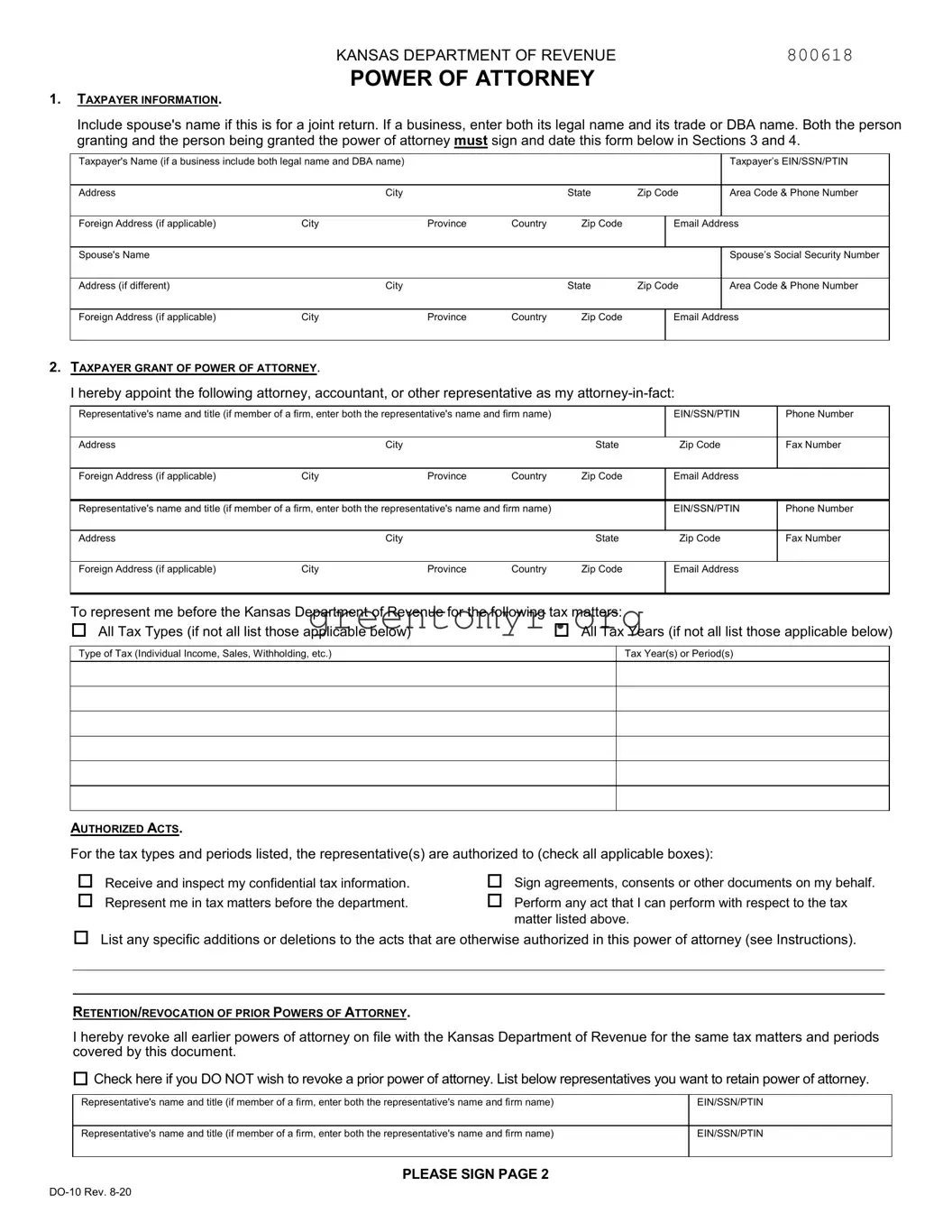

One frequent error is failing to provide the correct personal information. When completing the form, it is vital to double-check that your name, address, and Social Security number (or Employer Identification Number) are accurate. An oversight in these details can result in the form being rejected or, worse, unauthorized representation.

Another mistake occurs when individuals neglect to specify the tax matters that the Power of Attorney covers. The form provides sections where you can define what types of taxes you're authorizing someone to manage. If this part is left blank, the IRS may interpret it as a lack of authority, preventing your representative from acting on your behalf.

Alongside this, people often overlook signing and dating the form. Omitting your signature means the document is invalid, rendering all the information inputted ineffective. Remember, after filling it out, you must also date it. The date is crucial as it shows when you granted the power.

People sometimes forget to include the representative's exact information. While it might be tempting to fill in a name and contact number, providing incomplete information can lead to complications. Ensuring that the appointed representative’s details, including their address and phone number, are accurate is essential for seamless communication with the IRS.

In addition, some individuals mistakenly assume that simply having a Power of Attorney means the person can automatically deal with tax issues. Depending on the specifics outlined in the form, such as which taxes are covered, there may be limitations. It's essential to be clear about the scope of authority you are granting.

Another common pitfall occurs when the form is not filed with the correct tax authority. Many people believe submitting the form wherever it may seem convenient would suffice. However, direct submission to the IRS or relevant state tax office is required. It’s wise to double-check the guidelines for where to send your completed form.

Additionally, individuals may fail to retain a copy of the signed form for their records. This might not seem crucial, but having a copy can be invaluable if questions arise about your designated representative’s authority in the future. Keep this document safe and accessible.

Some people also neglect to check if their representative is indeed authorized to act in specific tax matters. Not every tax professional is equipped to handle all tax situations; some may lack the credentials for representation in particular contexts. Confirming their qualifications is prudent before granting them power.

Finally, one of the biggest mistakes is not reviewing the form thoroughly before submission. Errors in the information can often go unnoticed, causing delays or complications down the line. Taking a moment to review everything carefully ensures the accuracy of the filing and avoids unnecessary backtracking later.

By understanding these pitfalls, individuals can take proactive steps to ensure that their Tax POA DO-10 form is correctly filled out, enabling their chosen representative to assist with their tax matters confidently.