Filling out the IRS Power of Attorney (POA) form 01-137 is a critical step for individuals seeking to authorize someone to represent them in tax matters. However, many people make avoidable mistakes that can lead to delays or complications. Understanding these pitfalls can save time and reduce stress.

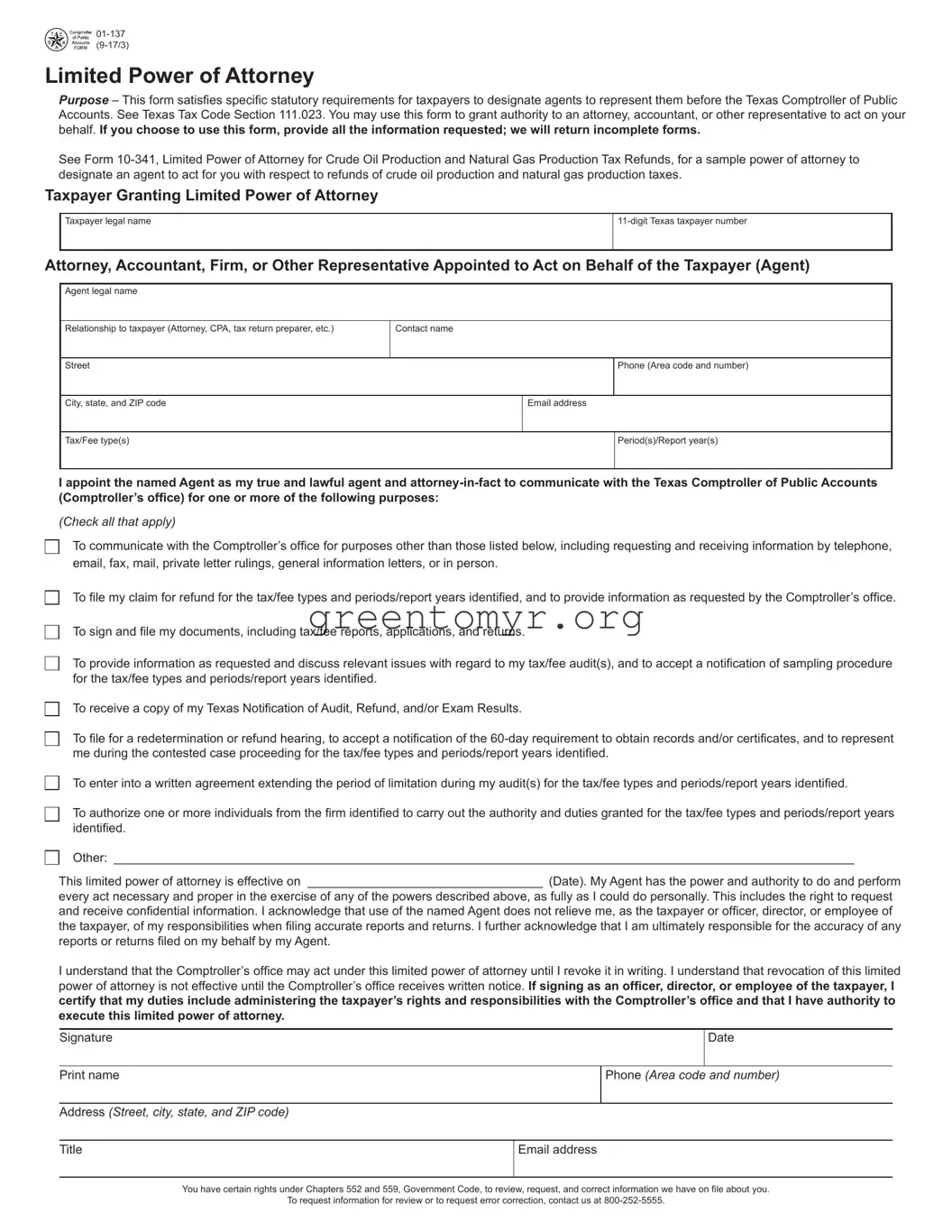

One common error is neglecting to include all required information. Failing to provide complete names, Social Security numbers, or addresses can invalidate the form. It is essential to double-check that every piece of necessary information is accurate and present.

Another mistake occurs when individuals do not sign the form. A signature is a vital component that confirms acceptance of the Power of Attorney. Even if all other sections are correctly filled out, an unsigned form is essentially useless.

People often choose the wrong type of representation. The form allows for specific representations, but selecting an incorrect option can ultimately lead to unauthorized actions. Consider the nature of the services you need, ensuring that those are clearly indicated on the form.

Many individuals forget to provide a valid expiration date. Leaving this section blank can cause confusion regarding the longevity of the authority granted. A clear expiration date helps prevent misunderstandings in the future.

Another common oversight is not including multiple representatives when necessary. If someone wants to authorize more than one person, they must explicitly list each individual on the form. Omitting this step may limit the effectiveness of their representation.

People often make mistakes related to the choice of tax matters. It is essential to specify the tax types correctly. A vague selection can lead to complications and force representatives to act without a clear mandate.

In addition, individuals sometimes fail to keep copies of the form. Submitting the original without retaining a copy means losing important documentation. Always keep a personal record for future reference and to track the status of your designation.

Another critical point is the failure to communicate with the appointed representative. After filling out the form, it is wise to inform the chosen representative of their authority. Many people mistakenly assume that just filling out the form is enough.

Many individuals overlook reviewing the IRS guidelines for the POA. Each guideline provides clarity on the submission process and requirements. Ignoring these can lead to negating the form due to minor but impactful errors.

Finally, people often submit the form to the wrong IRS address. Knowing where to send the completed form is crucial. It's advisable to check the IRS website for the appropriate mailing address, ensuring prompt processing of the request.

Other: ___________________________________________________________________________________________________________

Other: ___________________________________________________________________________________________________________