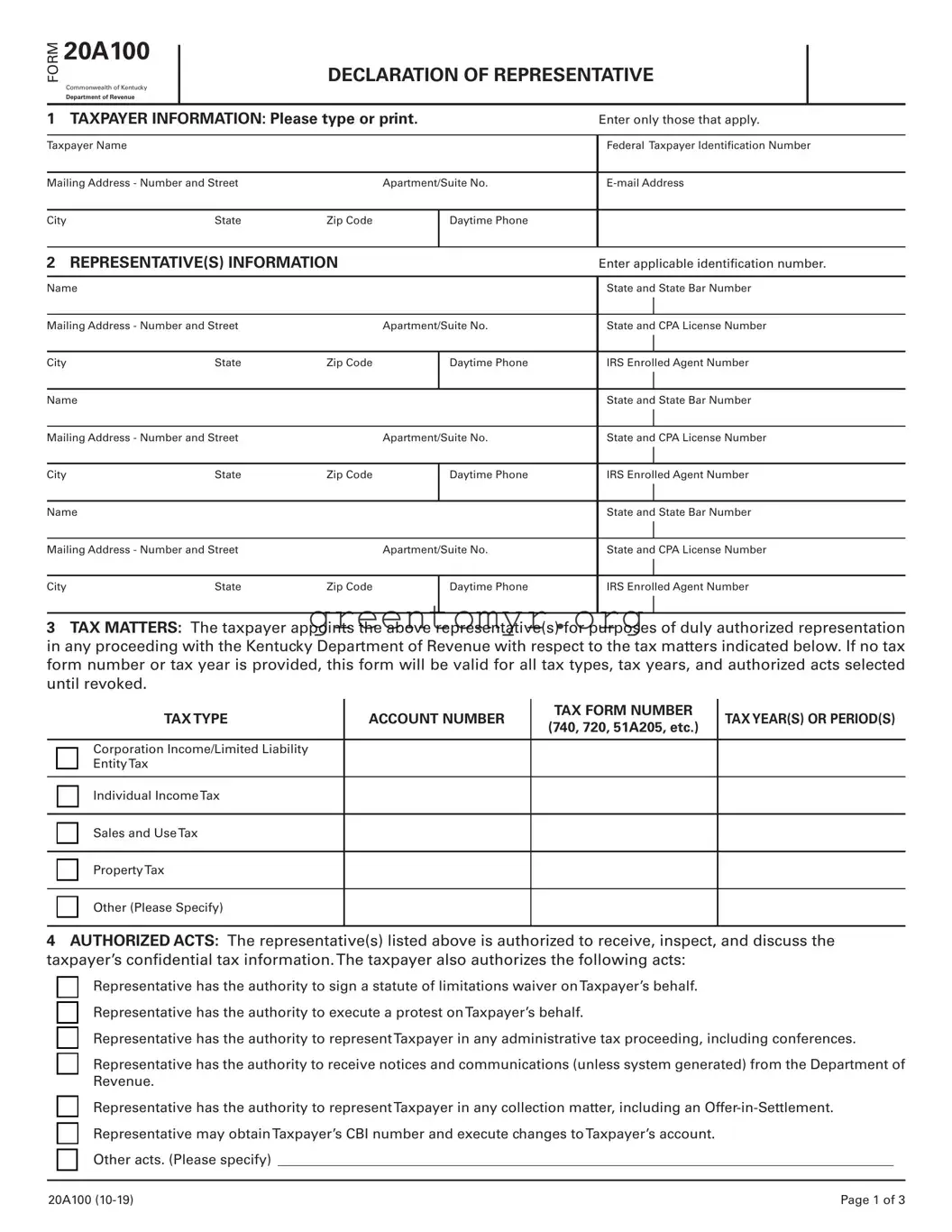

20A100

DECLARATION OF REPRESENTATIVE

Commonwealth of Kentucky

Department of Revenue

1 TAXPAYER INFORMATION: Please type or print. |

|

Enter only those that apply. |

|

|

|

|

|

|

Taxpayer Name |

|

|

|

Federal Taxpayer Identifcation Number |

|

|

|

|

|

Mailing Address - Number and Street |

|

Apartment/Suite No. |

E-mail Address |

|

|

|

|

|

|

City |

State |

Zip Code |

IDaytime Phone |

|

|

2 |

REPRESENTATIVE(S) INFORMATION |

|

|

Enter applicable identifcation number. |

|

|

|

|

|

|

Name |

|

|

|

State and State Bar Number |

|

|

|

|

|

|

I |

Mailing Address - Number and Street |

|

Apartment/Suite No. |

State and CPA License Number |

|

|

|

|

|

|

I |

City |

State |

Zip Code |

I |

Daytime Phone |

I |

|

IRS Enrolled Agent Number |

|

|

|

|

|

|

|

Name |

|

|

|

State and State Bar Number |

|

|

|

|

|

|

I |

Mailing Address - Number and Street |

|

Apartment/Suite No. |

State and CPA License Number |

|

|

|

|

|

|

I |

City |

State |

Zip Code |

I |

Daytime Phone |

I |

|

IRS Enrolled Agent Number |

|

|

|

|

|

|

|

Name |

|

|

|

State and State Bar Number |

|

|

|

|

|

|

I |

Mailing Address - Number and Street |

|

Apartment/Suite No. |

State and CPA License Number |

|

|

|

|

|

|

I |

City |

State |

Zip Code |

I |

Daytime Phone |

I |

|

IRS Enrolled Agent Number |

|

|

|

|

|

|

|

3TAX MATTERS: The taxpayer appoints the above representative(s) for purposes of duly authorized representation in any proceeding with the Kentucky Department of Revenue with respect to the tax matters indicated below. If no tax form number or tax year is provided, this form will be valid for all tax types, tax years, and authorized acts selected until revoked.

|

TAX TYPE |

ACCOUNT NUMBER |

TAX FORM NUMBER |

TAX YEAR(S) OR PERIOD(S) |

|

(740, 720, 51A205, etc.) |

|

|

|

|

Corporation Income/Limited Liability

¨EntityTax

¨Individual IncomeTax

¨Sales and UseTax

¨PropertyTax

¨Other (Please Specify)

4AUTHORIZED ACTS: The representative(s) listed above is authorized to receive, inspect, and discuss the taxpayer’s confdential tax information.The taxpayer also authorizes the following acts:

¨Representative has the authority to sign a statute of limitations waiver onTaxpayer’s behalf.

¨Representative has the authority to execute a protest onTaxpayer’s behalf.

¨Representative has the authority to representTaxpayer in any administrative tax proceeding, including conferences.

¨Representative has the authority to receive notices and communications (unless system generated) from the Department of Revenue.

¨Representative has the authority to representTaxpayer in any collection matter, including an Offer-in-Settlement.

¨Representative may obtainTaxpayer’s CBI number and execute changes toTaxpayer’s account.

¨Other acts. (Please specify) ________________________________________________________________________________________

20A100 (10-19) |

Page 1 of 3 |

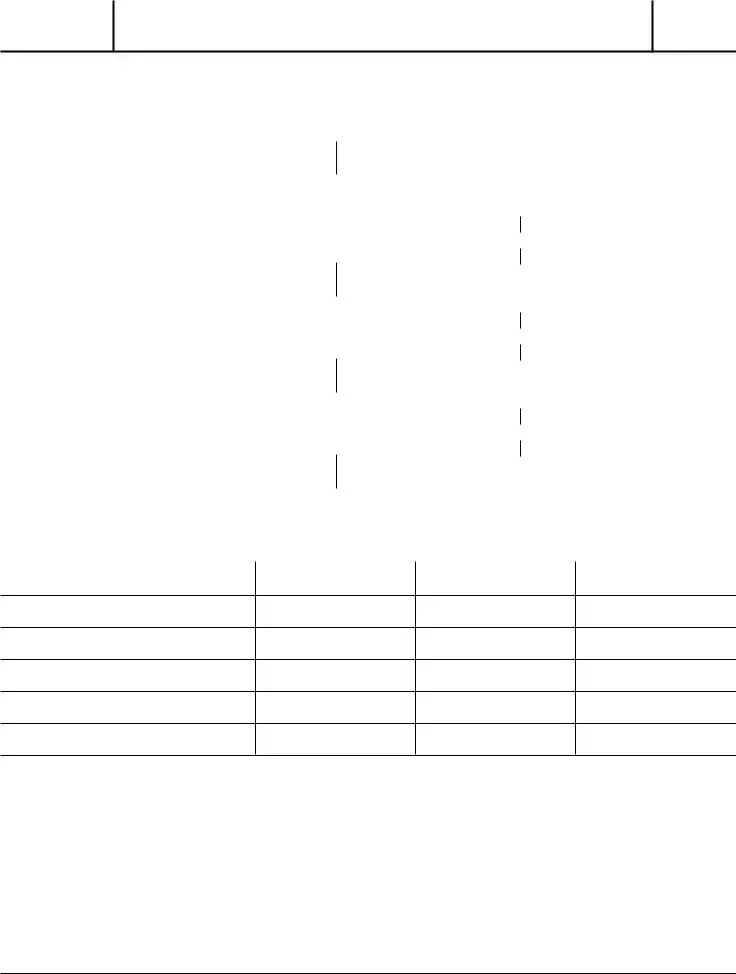

DECLARATION OF REPRESENTATIVE

5CONSOLIDATED OR UNITARY COMBINED RETURN FILERS: If the taxpayer fles a consolidated or unitary combined tax return per KRS 141.200(11) and/or KRS 141.201(3)(a), the authorized acts will be extended to the subsidiaries included in the return. If any subsidiaries are to be excluded from the authorized acts, list below.

FEDERAL IDENTIFICATION

NUMBER

6 RETENTION/REVOCATION OF PRIOR POWER(S) OF ATTORNEY OR REPRESENTATIVE AUTHORIZATION(S)

The fling of this authorization form automatically revokes any prior power(s) of attorney or representative authorization(s) on fle with the Department of Revenue for the same matter(s) and year(s) or period(s) covered by this document. If you do not want to revoke any prior power(s) of attorney or representative authorization(s), you must attach a copy of any power(s) of attorney or

representative authorization(s) you wish to remain in effect for the same matter(s) and year(s) or period(s) covered.

7SIGNATURE OFTAXPAYER. If a tax matter concerns a year in which a joint return was fled, each spouse must fle a separate representative authorization even if they are appointing the same representative(s). If signed by a corporate offcer, partner, guardian, tax matters partner, executor, receiver, administrator, or trustee on behalf of the taxpayer, I certify that I have the legal authority to execute this form on behalf of the taxpayer.

NOT VALID UNLESS COMPLETED, SIGNED, AND DATED BY THE TAXPAYER.

Signature |

Date Signed |

|

|

|

Print Name |

Title (if applicable) |

8 SIGNATURE OF REPRESENTATIVE(S)

Under penalties of perjury, by my signature below I declare that:

•I am not currently suspended or disbarred from practice, or ineligible for practice;

•I am subject to regulations contained in Circular 230 (31 CFR, Subtitle A, Part 10) as amended, governing practice before the Internal Revenue Service;

•I am authorized to represent the taxpayer for the matter(s) specifed; and

NOT VALID UNLESS COMPLETED, SIGNED, AND DATED BY THE REPRESENTATIVE(S).

Signature |

Date Signed |

|

|

|

Printed Name |

PTIN (if applicable) |

|

|

|

Signature |

Date Signed |

|

|

|

Printed Name |

PTIN (if applicable) |

|

|

|

Signature |

Date Signed |

Printed Name |

PTIN (if applicable) |