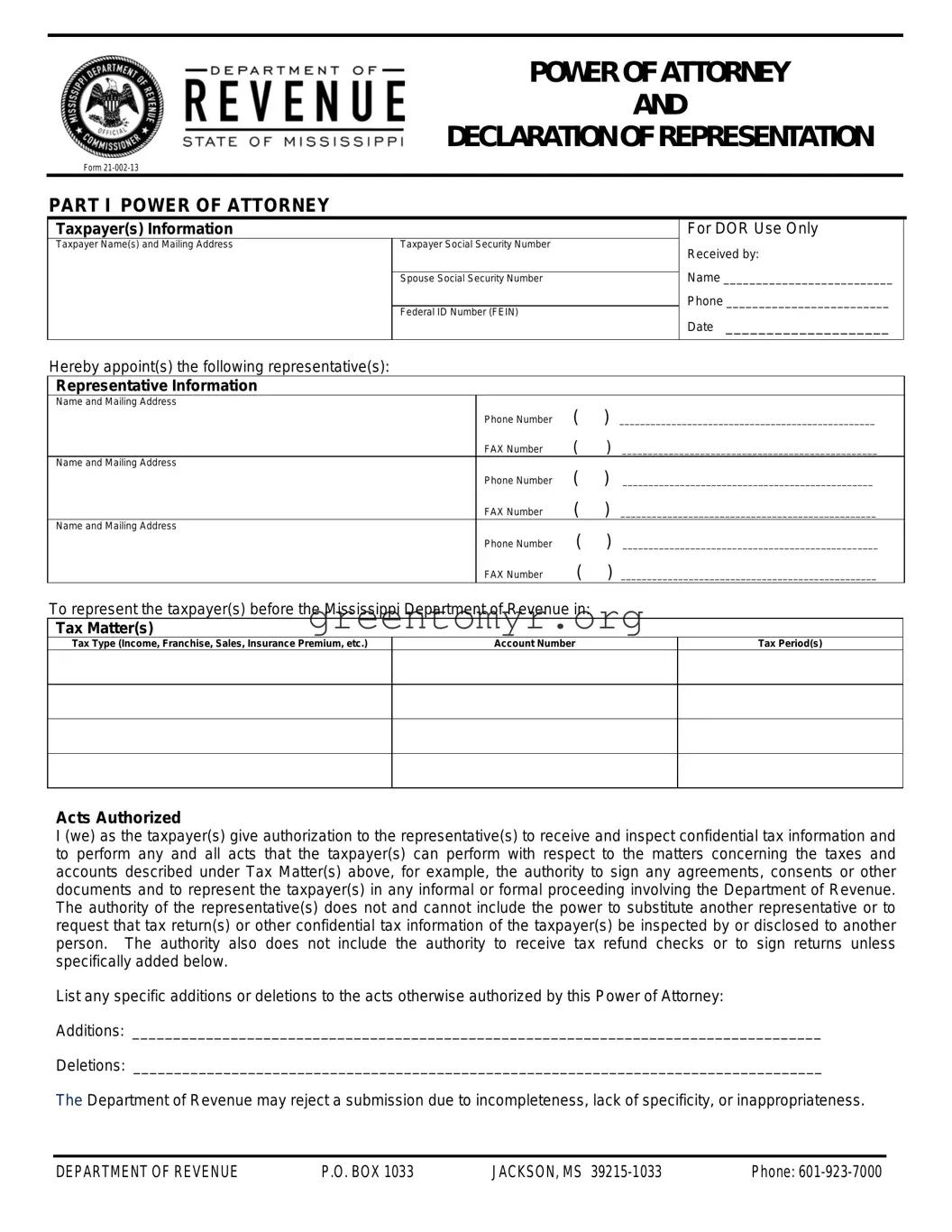

DOR Power of Attorney, Form 21-002

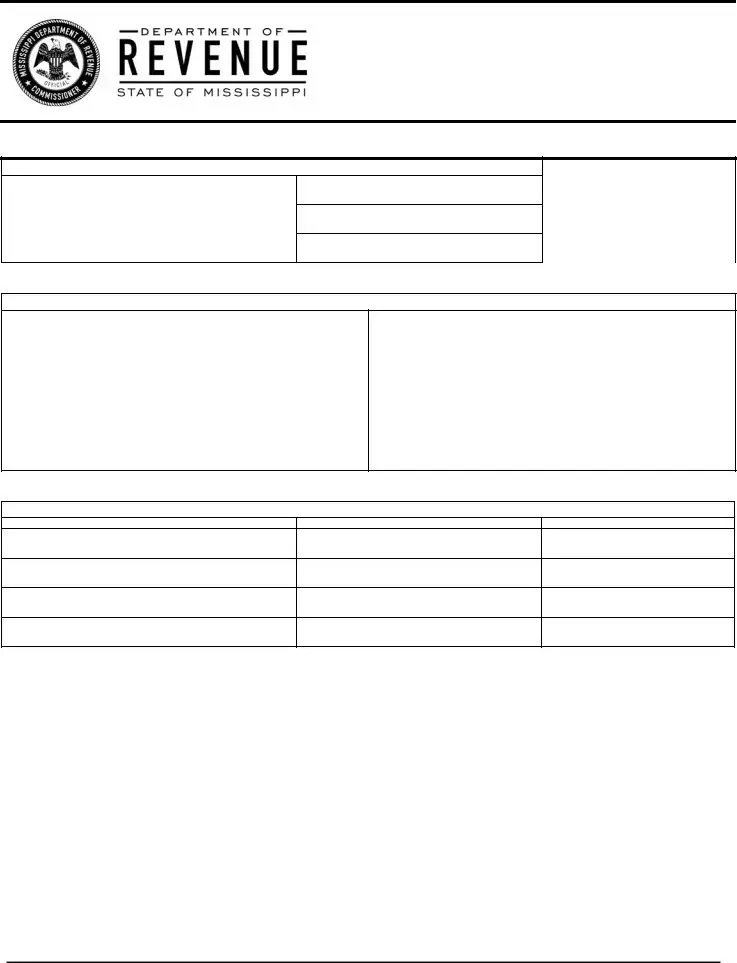

Retention/Revocation of Prior Power(s) of Attorney

The filing of this Power of Attorney automatically revokes all earlier Power(s) of Attorney on file with the Department of Revenue for the same tax matter(s) covered by this document. If you do not want to revoke a prior Power or Attorney,

check here D

and ATTACH A COPY OF THE POWER(S) OF ATTORNEY YOU WANT TO REMAIN IN EFFECT.

and ATTACH A COPY OF THE POWER(S) OF ATTORNEY YOU WANT TO REMAIN IN EFFECT.

Who Must Sign and What Documentation of Authority Must Be Attached

If a tax matter concerns a joint return, both husband and wife must sign if joint representation is requested. A corporation or subsidiary MUST contain the signatures of a principal officer and the secretary or other officer. A guardian, executor, receiver, administrator, conservator or trustee MUST attach the appropriate documentation granting the authority from the court or taxpayer.

Signing is Certification Under Oath Subject to Penalty of Perjury

The person(s) signing this Power of Attorney and Declaration of Representations certifies under oath that all the information contained in this document is true and correct and that he, she or they have the authority to sign this document as the taxpayer(s) or on behalf of the taxpayer(s) and acknowledge that this Power of Attorney and Declaration of Representation is being signed under the penalty of perjury pursuant to Miss. Code Ann. § 27-3-83(5).

IF NOT SIGNED AND DATED, THIS POWER OF ATTORNEY WILL BE RETURNED.

Signature |

Date |

Title (if applicable) |

Print Name |

Phone Number |

FAX Number |

Signature |

Date |

Title (if applicable) |

Print Name |

Phone Number |

FAX Number |

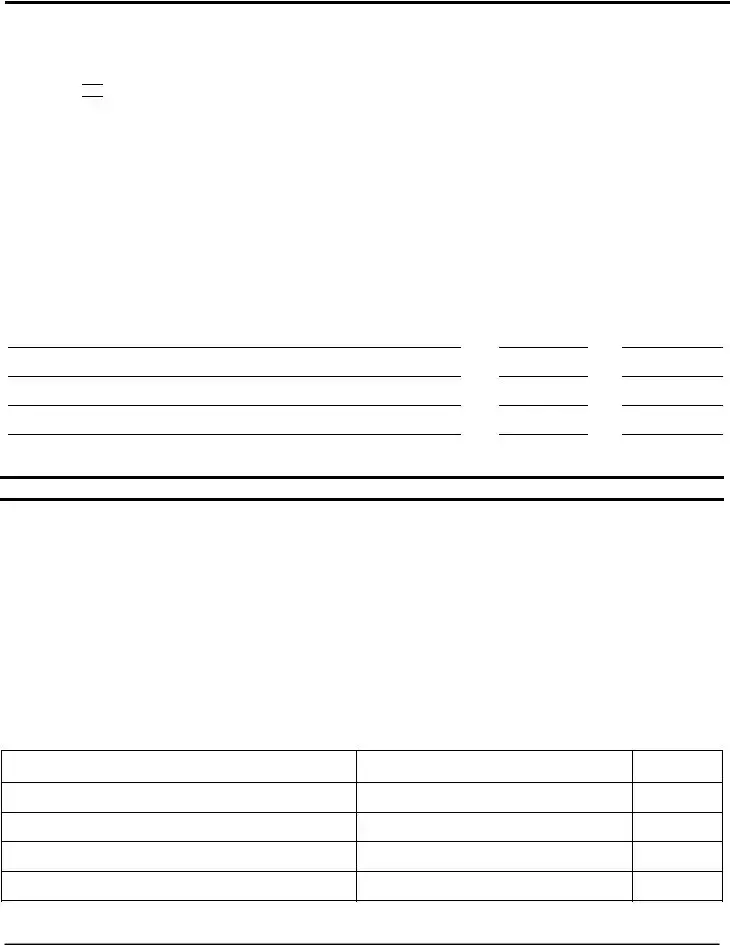

PART II DECLARATION OF REPRESENTATIVE

Under penalties of perjury and Miss. Code Ann. §97-7-10, I declare that:

1)I am authorized to represent the taxpayer(s) identified in Part I for the tax matter(s) specified there: and

2)I am one of the following:

a.Attorney – a member in good standing of the bar of the highest court of the jurisdiction shown below.

b.Certified Public Accountant – duly authorized to practice as a certified public accountant in the jurisdiction shown.

c.Officer – a bona fide officer of the taxpayer’s organization.

d.Full-time employee – a full time employee of the taxpayer.

e.Family Member – a member of the taxpayer’s immediate family (i.e., spouse, parent, child, brother, or sister).

f.Enrolled Agent – enrolled as an agent under the requirements of the IRS.

g.Other – Provide explanation ________________________________________________________________

IF NOT SIGNED AND DATED, THIS POWER OF ATTORNEY WILL BE RETURNED.