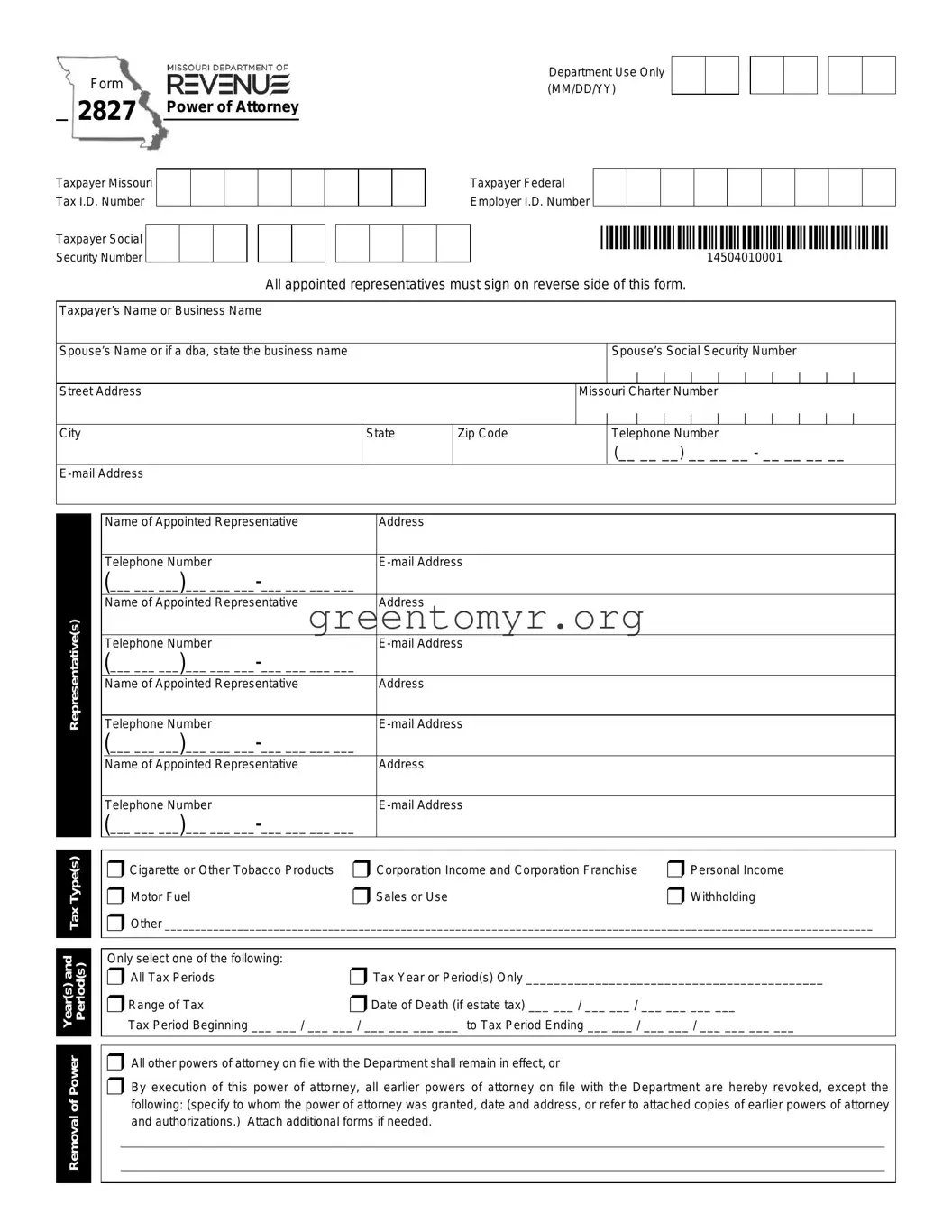

Filling out the Tax Power of Attorney (POA) form 2848 can feel overwhelming, but avoiding common mistakes can make the process much smoother. One of the most frequent errors people make is not providing all the necessary information. When you leave out critical details, such as the taxpayer’s Social Security Number or Taxpayer Identification Number, it can cause delays. Always double-check to ensure that all required fields are filled correctly and thoroughly.

Another common mistake involves improperly designating the representative. It’s important to ensure that the person you are granting power of attorney to is qualified and listed correctly. Some individuals try to name multiple representatives without clearly indicating who is the primary contact. Keeping it clear and concise is crucial to avoid confusion.

Many people also overlook the importance of signing the form. A missing signature can lead to rejection by the IRS. Make sure that the person granting the power of attorney—and not just the representative—signs the form. Remember, both parties must sign for the document to be valid.

Inadequate explanations regarding the powers granted can result in misunderstandings. The form includes sections where you can specify what authority you are granting. Be precise. If you leave it too vague, the representative may not be able to act on your behalf in the way you intended. Clarity is essential.

Not keeping a copy of the completed form is another typical oversight. After filing, it’s wise to retain a copy for your own records. This can be a useful reference in case of any future disputes or questions regarding the powers you’ve designated. Simple oversight can create unnecessary complications down the road.

Many individuals also underestimate the timelines involved in processing the form. Submitting it close to a deadline can lead to stress and potentially missed opportunities for tax relief or negotiation. Plan ahead and file the form well in advance to avoid last-minute issues.

Another mistake people often make is neglecting to inform the representative about the extent of their authority. Ensure that the person you designate understands their responsibilities and the limits of their power. This way, there’s no room for misunderstandings about what actions they can take on your behalf.

Finally, consider the communication with the IRS. Failing to inform the IRS about changes or the revocation of a POA can create confusion. If a situation arises where you need to terminate the power of attorney, be sure to communicate this effectively to avoid any complications. Always follow up to ensure that the IRS has processed the revocation if necessary.