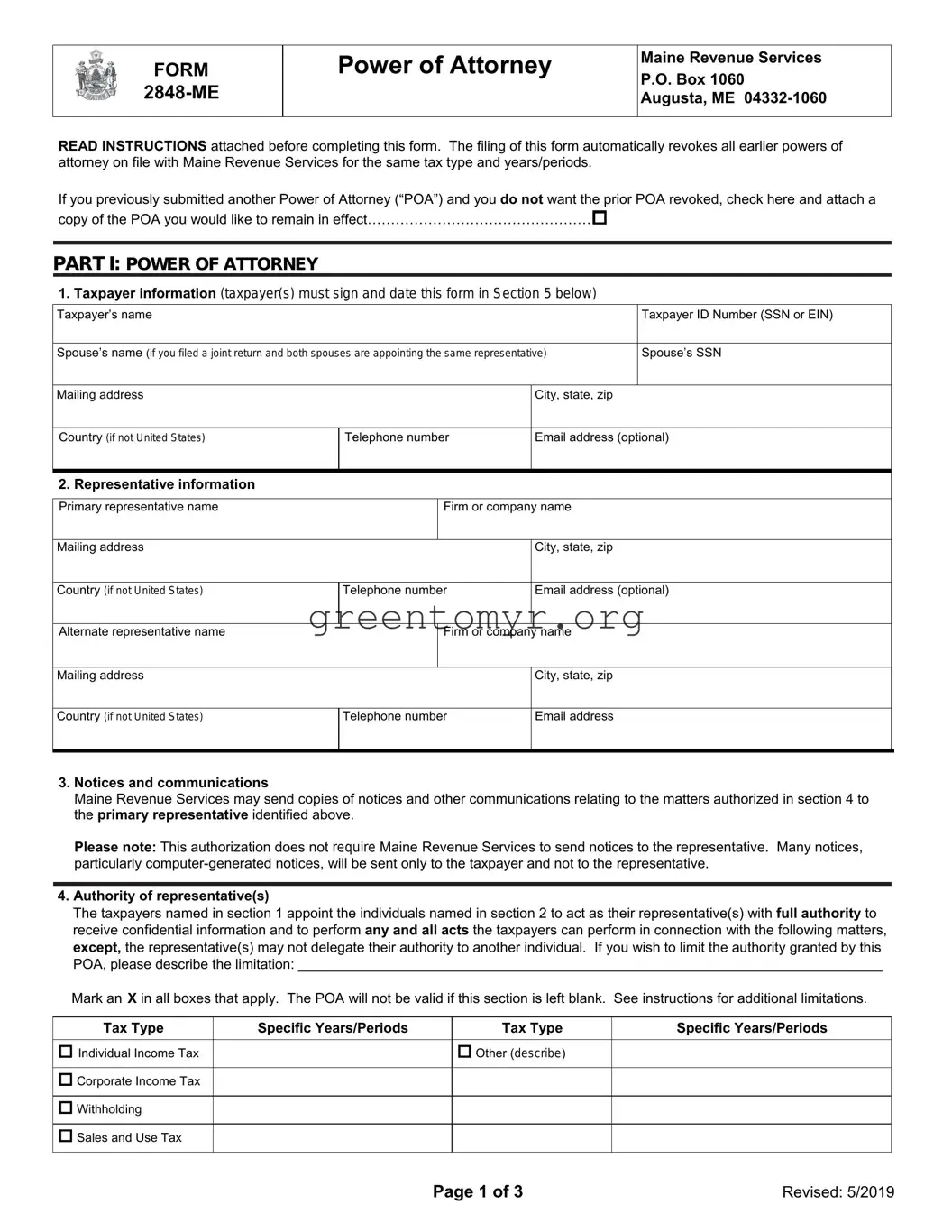

General Information

Use Form 2848-ME to authorize an individual to represent you before Maine Revenue Services (“MRS”). Signing this Power of Attorney (“POA”) form authorizes MRS to communicate with and provide your confidential information to the individual you name as your representative.

Unless you limit the authority (see section 4), your representative will be authorized to perform any and all acts you can perform, including, but not limited to: receiving your confidential information; agreeing to tax adjustments; signing settlement agreements; and making otherwise binding decisions on your behalf with regard to the tax matters covered by the POA.

Limited Power of Attorney Form 2848-L

If you want your representative to communicate with and receive confidential information from MRS, but you do not want that person to act on your behalf, please fill out Form 2848-ME-L (“Limited Power of Attorney”) instead.

Revocation

Filing Form 2848-ME will automatically revoke any earlier POA’s on file with MRS that cover the same tax types and same years/periods.

Example 1:

On 5/1/2017, you authorize Jane Doe to represent you for individual income tax for 2015. On 10/1/2017, you authorize Jim Jones to represent you for individual income tax for 2016. Both POA’s are valid.

Example 2:

On 5/1/2017, you authorize Jane Doe to represent you for individual income tax for 2015. On 10/1/2017, you authorize Jim Jones to represent you for sales and use tax for 2015. Both POA’s will be valid.

Example 3:

On 5/1/2017, you authorize Jane Doe to represent you for individual income tax for 2015. On 10/1/2017, you authorize Jim Jones to represent you for individual income tax for years 2015-2018. Filing the POA for Jim Jones will automatically revoke the POA for Jane Doe.

If you do not want a prior POA automatically revoked, you must check the box at the top of the form and attach a copy of the prior POA you would like to remain in effect.

Other requests to revoke a POA must be in writing and must be signed by the taxpayer.

Section 2 – Representative information

Form 2848-ME allows you to authorize one or more representatives. Representatives must be individuals, i.e., you cannot name a firm as your representative but you can name a person or persons at the firm. Note: By providing an email address, you authorize MRS to communicate your confidential information via email to the address provided.

Section 3 – Notices and communications

MRS may send copies of notices and other communications relating to the tax matters authorized in section 4 only to the primary representative. Many notices, particularly computer-generated notices, will be sent only to the taxpayer and not to the representative.

Section 4 – Authority of representatives

This section allows you to specify which tax matters are covered by the POA and what authority you are granting your representative. By default, your representative will have full authority to receive your confidential information and to perform any and all acts you can perform in connection with the matters described in section 4. However, your authorized representative may not delegate their authority to another individual. If you wish to limit your representative’s authority, please specifically describe the limitation.

For this form to be valid, you must select both the tax type and years/periods covered by the POA. If no tax type is selected, the POA will not be accepted.

You may list current, prior, or future years/periods. You must use specific periods. General references such as “All Years” will not be accepted.

Note: MRS will not accept a POA for future years/period which begin more than three years from the date the POA is received by MRS.

Section 5 – Taxpayer signature

You must sign, print your name, and date the POA for it to be valid. If you filed a joint return and both spouses are appointing the same representative, both spouses must sign. POA forms must be hand- signed.

If you are signing on behalf of the taxpayer, please include your title—e.g., a “CEO” signing on behalf of a corporate taxpayer. You may be asked by MRS to verify your identity and/or provide evidence of authority to sign the POA.