|

|

|

|

POA - 1 |

|

|

|

|

Indiana Department of Revenue |

|

|

|

|

|

|

|

|

|

State Form 49357 |

|

|

|

|

POWER OF ATTORNEY |

|

|

|

|

|

|

|

|

|

(R7 / 6-20) |

|

|

|

|

|

|

|

|

|

|

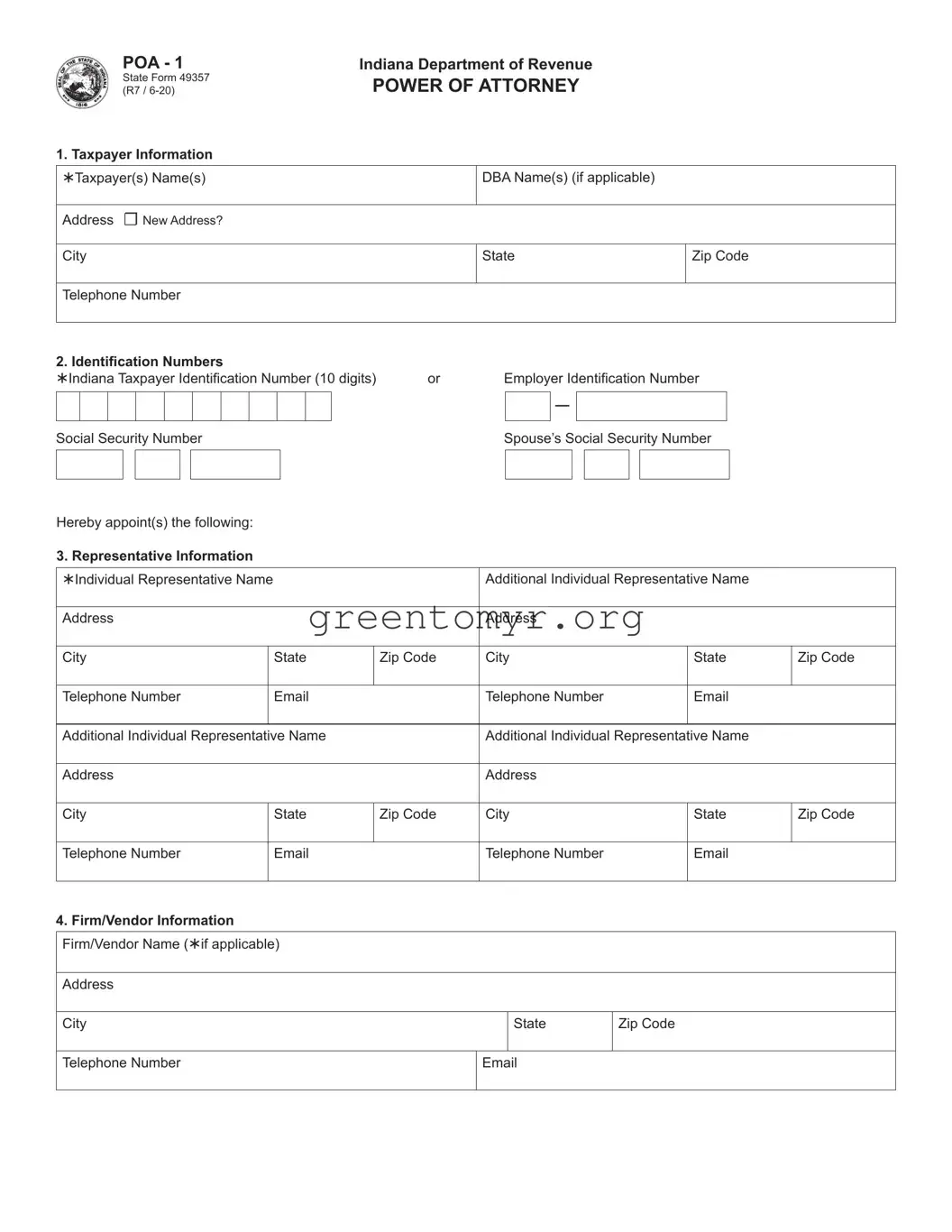

1. Taxpayer Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer(s) Name(s) |

|

|

|

|

|

|

|

|

DBA Name(s) (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

☐ New Address? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

I |

|

|

Telephone Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Identification Numbers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indiana Taxpayer Identification Number (10 digits) |

or |

Employer Identification Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

I |

I |

I |

|

|

I |

I |

I |

I |

I |

|

I |

I |

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security Number |

|

|

|

|

|

Spouse’s Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

~l |

|

□ |

~I~ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hereby appoint(s) the following: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Representative Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Individual Representative Name |

|

|

|

|

|

|

|

|

Additional Individual Representative Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

State |

|

Zip Code |

City |

|

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I |

|

Telephone Number |

|

Email |

|

|

Telephone Number |

|

Email |

|

|

|

|

|

|

|

|

|

|

|

Additional Individual Representative Name |

|

|

Additional Individual Representative Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

State |

|

Zip Code |

City |

|

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I |

|

Telephone Number |

|

Email |

|

|

Telephone Number |

|

Email |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.Firm/Vendor Information Firm/Vendor Name (if applicable)

Address

City |

|

State |

Zip Code |

|

|

I |

I |

Telephone Number |

Email |

|

|

I |

|

If firm or vendor, list representative(s) name, telephone number and email.

5. General Authorization

☐I authorize the listed representative(s), in addition to anything otherwise authorized on this form, to represent me regarding any matters with the Indiana Department of Revenue regardless of tax years or income periods. I understand that this authority will expire 5 years from the date this POA is signed or a written and signed notice is filed revoking this authorization.

6.Tax Type(s) (Not applicable if box is checked in question 5 above)

Type of Tax |

Year(s)/Period(s) |

(Income, Withholding, Sales, etc.) |

☐ Current Year ☐ Specify |

_______________________________________ |

___________________________________ |

_______________________________________ |

___________________________________ |

_______________________________________ |

___________________________________ |

I acknowledge that the designated representative has the authority to receive confidential information and full power to perform on behalf of the taxpayer in tax matters related to this Power of Attorney. This authority does not include the power to receive refund checks.

I acknowledge that actions taken by the designated representative are binding, even if the representative is not an attorney. Proceedings cannot later be declared legally defective because the representative was not an attorney.

If I am a corporate officer, partner, or fiduciary acting on behalf of the taxpayer, I certify that I have authority to execute this Power of Attorney on behalf of the taxpayer.

7. Authorizing Signature |

|

Signature _______________________________________________ |

Date _______________________________ |

Printed Name ____________________________________________ |

Title _______________________________ |

Telephone Number ________________________________________ |

Email ______________________________ |

Required fields - if not complete, this form will be returned to sender.

Instructions for Indiana Form POA-1

Casual conversations with a taxpayer’s representative who does not have a Power of Attorney on file are permitted. However, the Indi- ana Department of Revenue will not disclose tax return information or taxpayer-specific information to the representative unless a prop- erly executed Power of Attorney has been filed with the department. In lieu of a Power of Attorney, you can authorize the department to discuss your tax return information with someone else by filling out the Personal Representative Portion on your individual tax return.

Pursuant to 45 IAC 15-3-4, a properly executed Power of Attorney must contain the following information:

1.The taxpayer’s name, DBA name (if applicable), address (Please check the box if this is a new address), and telephone number.

2.The Indiana taxpayer’s identification (10-digit TID) number. The department assigns TID numbers, and each entity has its own TID number. The Internal Revenue Service provides the employer identification number (EIN). Individual taxpayers should use their Social Security numbers unless they have been issued a TID number.

3.The name, address, and telephone number of your individual representative(s). Only individuals can be named as representatives. If you want to add one individual representative, enter one in the spaces provided. If you want to add more representatives, enter them in the spaces provided.

4.If your representative works for a consulting firm or vendor, enter the company’s name, address, telephone number, and email address. Enter the individual representative name(s) employed by the firm or vendor you have designated. If you want to add more than four individual representatives for a firm or vendor, you can provide the names of those representatives in a separate list, to be attached to this Power of Attorney form.

If you wish for your firm to be represented generally by a company such as a payroll processor, enter the company’s name,

address, telephone number, and email address. If the company is not listed, you must provide the names of one or more individual |

representatives. |

--- |

|

5.Check this box if you want to authorize your representative to represent you regarding all tax matters, regardless of the tax year or income period involved.

6.The Power of Attorney form can contain the specific type of tax, or the option ALL. By choosing the option ALL, you will be allowed access to ALL tax types appropriate to the taxpayer. The tax years must be specific.

7.The taxpayer’s signature or the signature of an individual authorized to execute the Power of Attorney on the taxpayer’s behalf.

NOTE: Include as an enclosure any restrictions or limitations the taxpayer has placed on the representative while acting as the tax- payer’s representative.

After the taxpayer executes a Power of Attorney, the department will communicate primarily with the taxpayer’s representative.

The department accepts faxed copies of original Power of Attorney forms. If a copy is provided, the person forwarding the copy certifies, under penalties for perjury, that the copy is a true, accurate, and complete copy of the original document.

Do not send POA-1 via email. This is not a secure means of transmittal.

The department will not accept a Power of Attorney form that has been altered unless it has the initials of the taxpayer (or an individual authorized to execute the Power of Attorney on the taxpayer’s behalf) beside the alteration(s).

This Power of Attorney is effective for 5 years from the date the form is signed. After the expiration of 5 years, a new Power of Attorney form must be completed if the taxpayer wishes to permit the department to communicate with the taxpayer’s representative.

This Power of Attorney can be revoked prior to expiration only by written and signed notice. A subsequent Power of Attorney alone will NOT revoke a prior Power of Attorney.

Required fields – if not complete, this form will be returned to sender.

Submit the form using these methods:

•Fax: (317) 615-2605

•Mail: Indiana Department of Revenue PO Box 7230

Indianapolis, IN 46207-7230