■ |

|

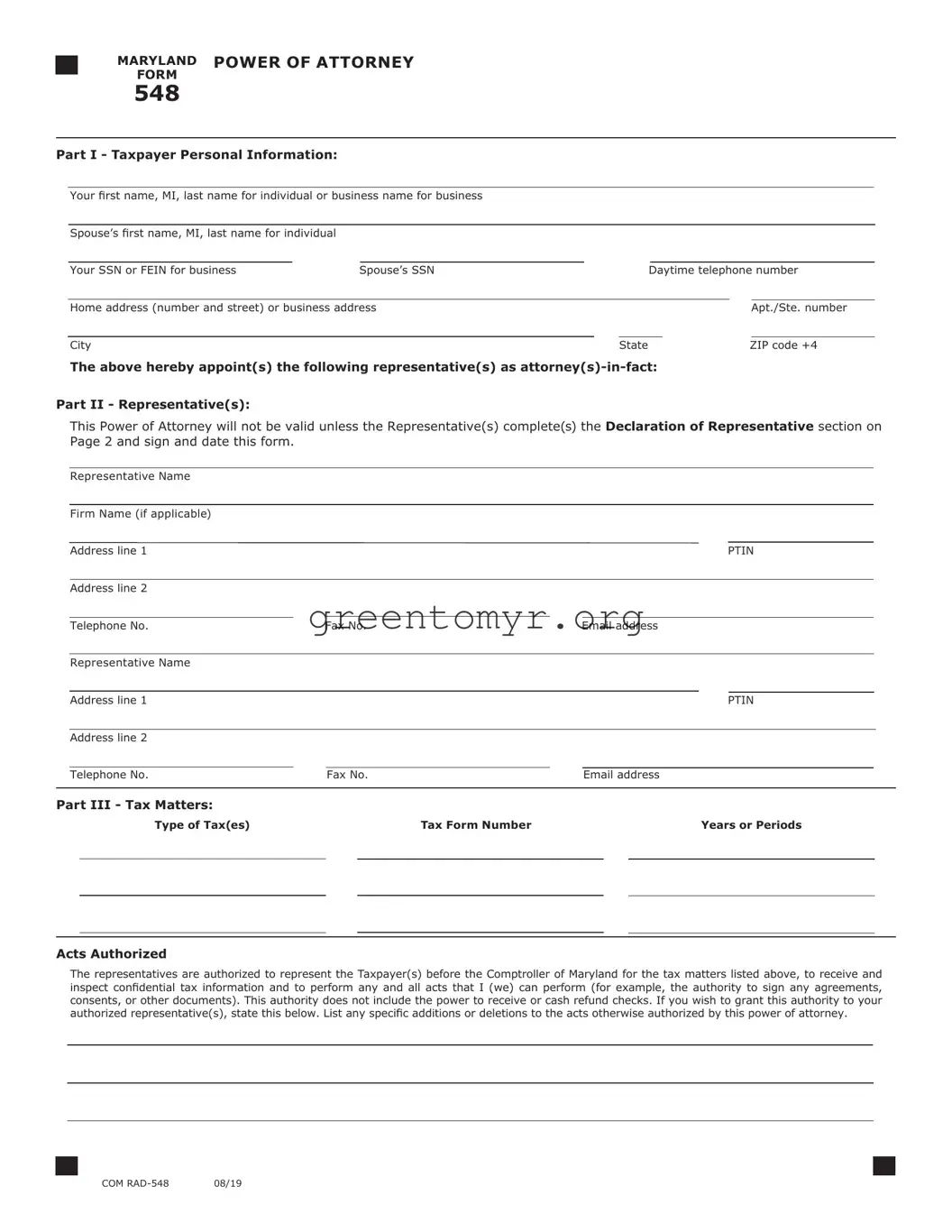

MARYLAND |

POWER OF ATTORNEY |

|

|

|

|

|

|

|

FORM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

548 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part I - Taxpayer Personal Information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your first name, MI, last name for individual or business name for business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s first name, MI, last name for individual |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your SSN or FEIN for business |

Spouse’s SSN |

|

Daytime telephone number |

|

|

|

|

|

|

|

|

|

|

|

|

|

Home address (number and street) or business address |

|

|

|

|

Apt./Ste. number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

State |

|

|

ZIP code +4 |

|

The above hereby appoint(s) the following representative(s) as attorney(s)-in-fact:

Part II - Representative(s):

This Power of Attorney will not be valid unless the Representative(s) complete(s) the Declaration of Representative section on Page 2 and sign and date this form.

Representative Name

|

Firm Name (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address line 1 |

|

|

|

|

|

|

|

|

PTIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address line 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone No. |

Fax No. |

Email address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Representative Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address line 1 |

|

|

|

|

|

|

|

|

PTIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address line 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone No. |

|

Fax No. |

|

Email address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part III - Tax Matters: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Type of Tax(es) |

|

|

Tax Form Number |

|

|

|

|

Years or Periods |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acts Authorized

The representatives are authorized to represent the Taxpayer(s) before the Comptroller of Maryland for the tax matters listed above, to receive and inspect confidential tax information and to perform any and all acts that I (we) can perform (for example, the authority to sign any agreements, consents, or other documents). This authority does not include the power to receive or cash refund checks. If you wish to grant this authority to your authorized representative(s), state this below. List any specific additions or deletions to the acts otherwise authorized by this power of attorney.

■ |

MARYLAND |

POWER OF ATTORNEY |

Page 2 |

FORM |

|

|

|

548 |

|

|

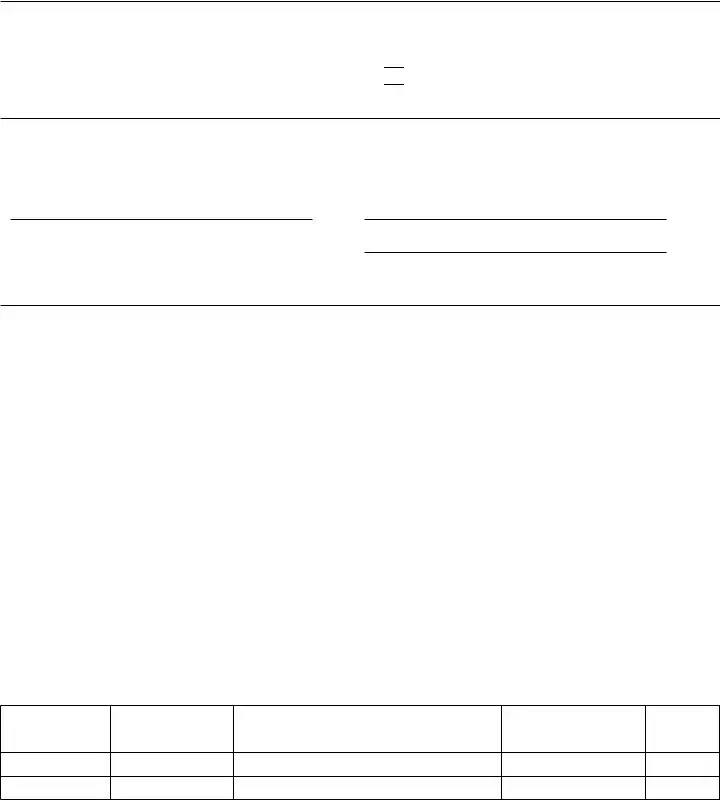

Taxpayer’s SSN or FEIN |

|

Taxpayer’s Name |

Retention/Revocation of Prior Power(s) of Attorney

By filing this power of attorney form, you automatically revoke all earlier power(s) of attorney on file with the Comptroller of Maryland for the same tax matters and years or periods covered by this document.

If you do not want to revoke a prior power of attorney, check here □

You must attach a copy of any Power of Attorney you want to remain in effect.

Signature of Taxpayer(s)

If a tax matter concerns a joint return, both spouses must sign if joint representation is requested. If signed by a corporate officer, partner, guardian, tax matters partner, executor, receiver, administrator, or trustee on behalf of the Taxpayer, I certify that I have the authority to execute this form on behalf of the Taxpayer. If other than the Taxpayer, print the name here and sign below.

Your signature |

Date |

|

|

Spouse’s signature if filing jointly |

Date |

Title, if business taxpayer or if other than individual taxpayer

Telephone number if other than the Taxpayer

If not signed and dated, this power of attorney will not be processed.

Declaration of Representative Representative(s) must complete this section and sign below.

Under penalties of perjury, I declare that

•I am not currently under suspension or disbarment from practice within the State of Maryland or in any jurisdiction;

•I have verified the identity of the taxpayer described under Taxpayer Personal Information and that the person signing as the authorized taxpayer is the same person described under Taxpayer Personal Information;

•I am aware of regulations governing the practice of attorneys, certified public accountants, public accountants, enrolled agents and others; and the penalties for false or fraudulent statements provided;

•I am authorized to represent in Maryland, the Taxpayer(s) identified for the tax matter(s) specified herein; and I am one of the following:

1.A member in good standing of the bar of the highest court of the jurisdiction shown below.

2.A Certified Public Accountant duly qualified to practice in the jurisdiction shown below.

3.An Enrolled Agent.

Attach government-issued photo identification for individual or business taxpayer if representative designation is item 4-10. Representative identification is not required.

4.A Maryland Registered Individual Tax Preparer.

5.A bona fide officer of the Taxpayer.

6.A full-time employee of the Taxpayer.

7.A member of the Taxpayer’s immediate family (spouse, parent, child, grandparent, grandchild, step-parent, step- child, brother, or sister).

8.A general partner of the Taxpayer (partnership).

9.A fiduciary for the Taxpayer (Estate or trust).

10.Other (attach statement).

Designation-insert appropriate number from above list

Identification Number

(Bar, CPA, EA, Certification or Federal Employer Identification Number)

An incomplete Form 548 will not be processed.