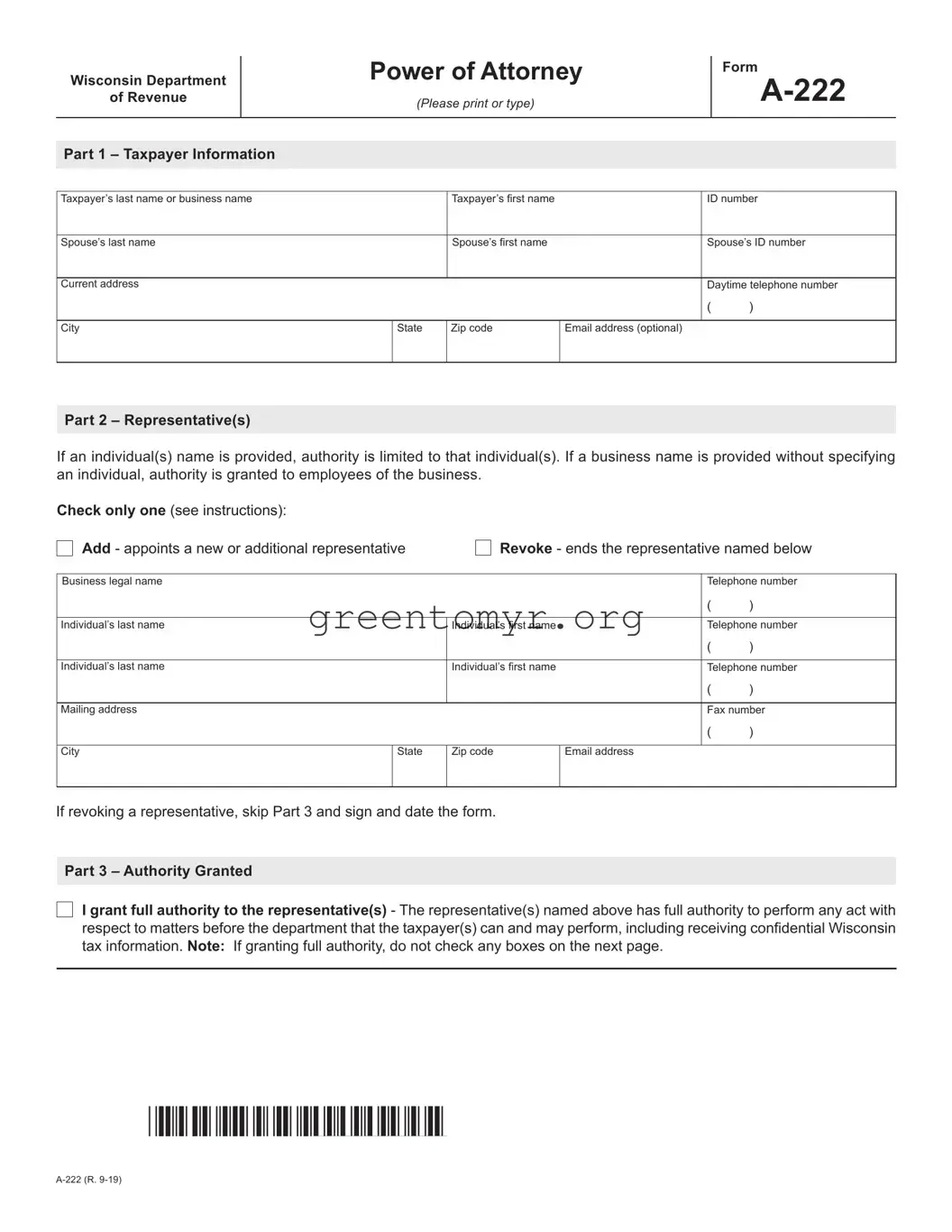

The Tax POA Form A-222 is a Power of Attorney form that allows taxpayers to authorize someone else to represent them before the IRS regarding their tax matters. This form is crucial for individuals who want to appoint someone to handle their tax-related issues, ensuring that their representative can communicate with the IRS on their behalf.

Any individual, including a tax professional such as a CPA or an attorney, can be appointed as a representative by using the Form A-222. However, it's important to select someone you trust to manage your tax affairs since they will have the authority to receive information and act on your behalf.

Form A-222 covers various tax matters, including but not limited to:

-

Filing tax returns

-

Responding to IRS notices

-

Negotiating payment plans

-

Representing you during audits

Essentially, any tax-related communication with the IRS can be conducted by your appointed representative once the form is filed.

Filling out the Form A-222 involves several straightforward steps:

-

Provide your personal information, including your name, address, and Social Security Number.

-

Identify the person you are appointing as your representative by including their name, address, and contact information.

-

Specify the scope of authority you are granting them, indicating if they should have full power or limited authority.

-

Sign and date the form.

Ensure that the details are accurate to avoid any issues with the submission.

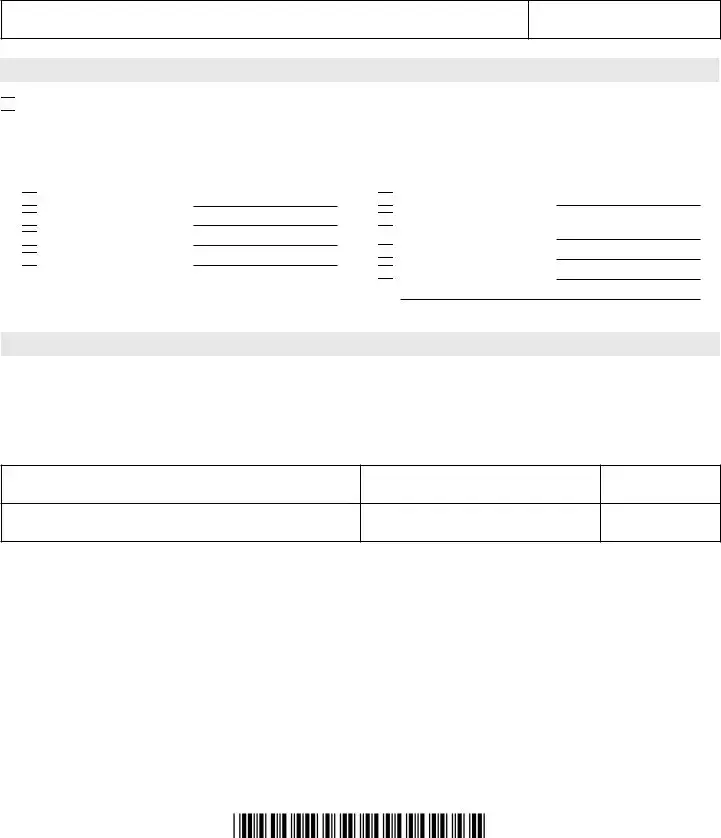

After completing the Form A-222, you need to submit it to the appropriate IRS office. The specific address may depend on your location and the nature of your tax situation. Check the IRS website for guidance on where to send your form, or consult your representative for clarity.

No, there is no fee to file the Form A-222. However, if you choose to hire a professional to assist you with the form, they may charge for their services. Always clarify fees in advance when working with a tax professional.

Once submitted, the IRS processes the form, typically taking several weeks. After processing, your representative will be able to access your tax information and communicate with the IRS on your behalf. You should receive a confirmation from the IRS when the form is accepted.

Yes, you can revoke your Power of Attorney at any time. To do this, complete a new Form A-222 and select the option to cancel the previous authorization. Additionally, inform your representative of your decision to revoke the authority. This will help avoid any confusion moving forward.

The validity of Form A-222 can extend until you revoke it or until the matter is resolved. If you have a specific duration in mind or particular actions that you want your representative to handle, be sure to specify those in the form when you submit it.

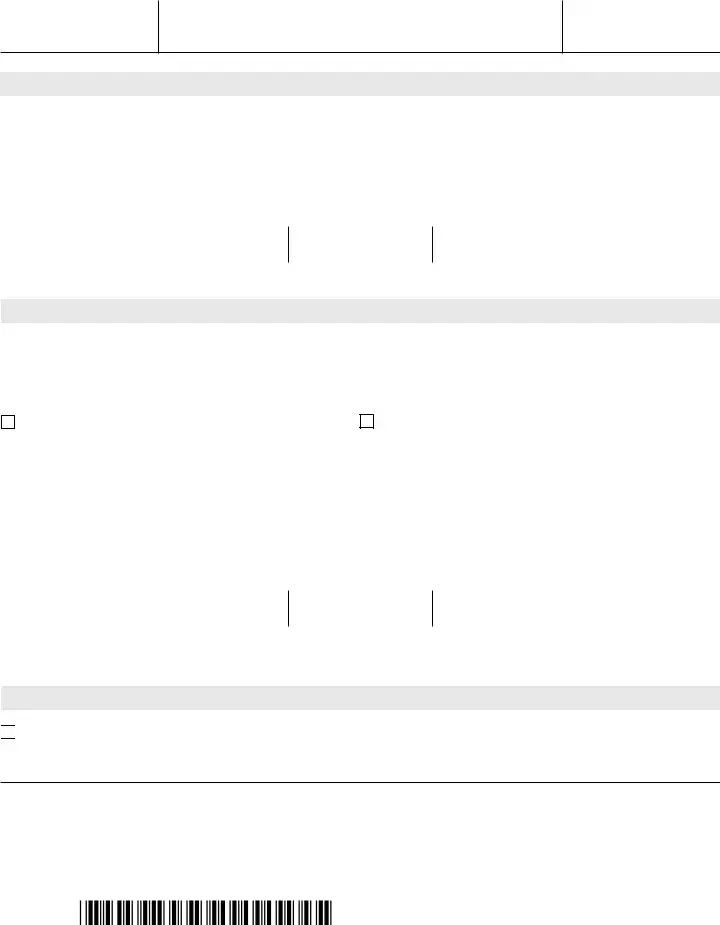

Income or Franchise Taxes

Income or Franchise Taxes

Sales and Use Taxes

Sales and Use Taxes

Excise Taxes

Excise Taxes

Property Taxes

Property Taxes

Employer Withholding Taxes

Employer Withholding Taxes

Nontax Debt

Nontax Debt