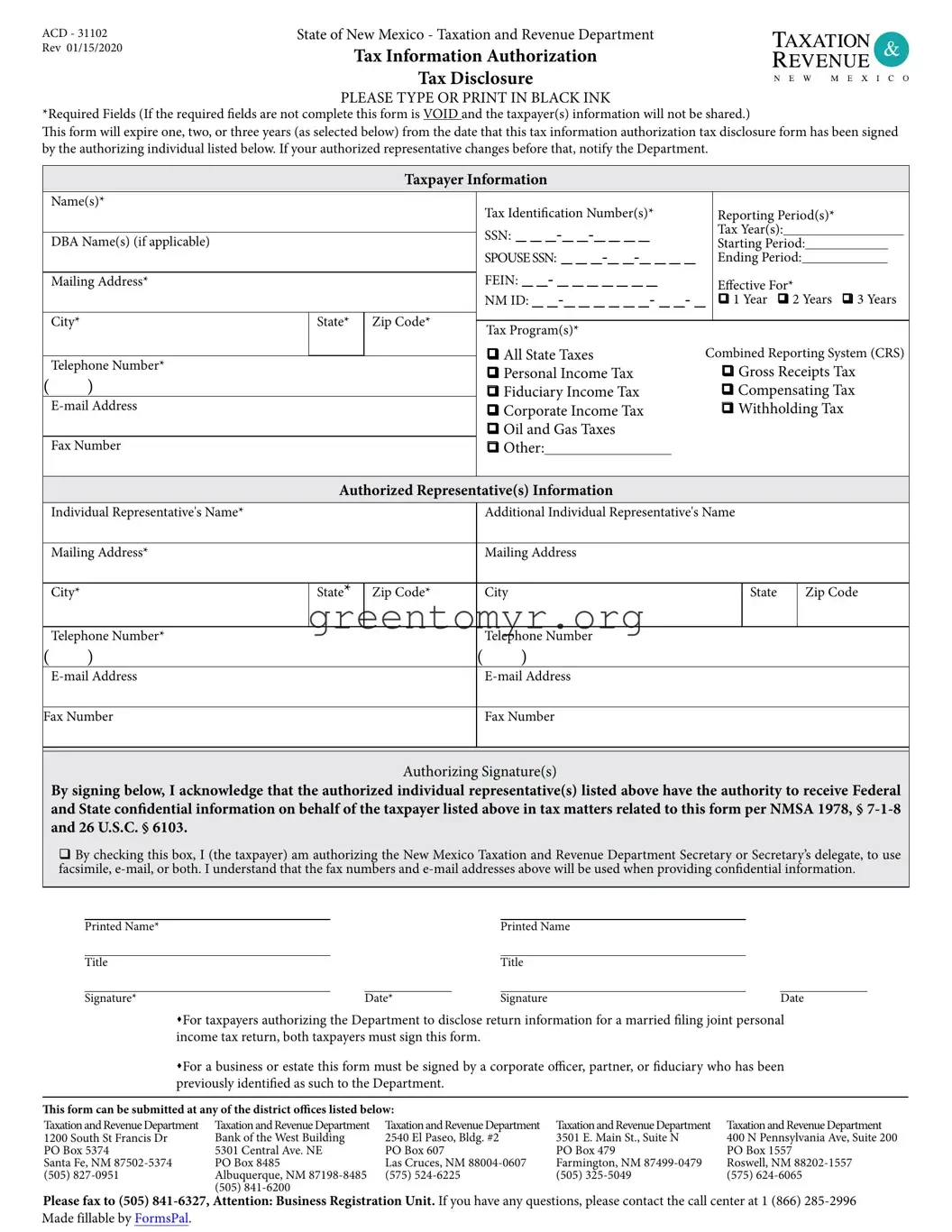

ACD - 31102 |

State of New Mexico - Taxation and Revenue Department |

TAXATION . |

Rev 01/15/2020 |

Tax Information Authorization |

|

REVENUE ~ |

|

Tax Disclosure |

NE W MEXICO |

PLEASE TYPE OR PRINT IN BLACK INK

*Required Fields (If the required felds are not complete this form is VOID and the taxpayer(s) information will not be shared.)

Tis form will expire one, two, or three years (as selected below) from the date that this tax information authorization tax disclosure form has been signed by the authorizing individual listed below. If your authorized representative changes before that, notify the Department.

Taxpayer Information

|

|

Name(s)* |

|

|

|

Tax Identifcation Number(s)* |

|

Reporting Period(s)* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN: - - --- --- - - - |

|

Tax Year(s): |

|

|

DBA Name(s) (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Starting Period: |

|

|

|

|

|

|

|

SPOUSE SSN: - - --- --- - - - |

|

Ending Period: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FEIN: - -- - - - - - - - |

|

|

|

|

|

|

|

|

|

Mailing Address* |

|

|

|

|

Efective For* |

|

|

|

|

|

|

|

NM ID: - --- - - - - -- - -- - |

|

q 1 Year |

q 2 Years q 3 Years |

|

|

City* |

|

State* |

Zip Code* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Program(s)* |

|

|

|

|

|

|

|

|

|

|

|

I |

|

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

q All State Taxes |

Combined Reporting System (CRS) |

|

|

Telephone Number* |

|

|

|

|

|

|

|

|

q Personal Income Tax |

|

q Gross Receipts Tax |

( |

) |

|

|

|

|

|

|

|

|

|

q Fiduciary Income Tax |

|

q Compensating Tax |

|

|

E-mail Address |

|

|

|

q Corporate Income Tax |

|

q Withholding Tax |

|

|

|

|

|

|

|

q Oil and Gas Taxes |

|

|

|

|

|

|

|

|

|

|

Fax Number |

|

|

|

q Other: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Authorized Representative(s) Information |

|

|

|

|

|

|

|

|

|

|

Individual Representative's Name* |

|

|

|

Additional Individual Representative's Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address* |

|

|

|

Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City* |

|

State* |

Zip Code* |

|

City |

|

State |

|

|

|

Zip Code |

|

|

|

I |

|

I |

|

|

|

|

|

I |

|

I |

|

|

Telephone Number* |

|

|

|

Telephone Number |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

E-mail Address |

|

|

|

E-mail Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fax Number |

|

|

|

Fax Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Authorizing Signature(s)

By signing below, I acknowledge that the authorized individual representative(s) listed above have the authority to receive Federal and State confdential information on behalf of the taxpayer listed above in tax matters related to this form per NMSA 1978, § 7-1-8 and 26 U.S.C. § 6103.

qBy checking this box, I (the taxpayer) am authorizing the New Mexico Taxation and Revenue Department Secretary or Secretary’s delegate, to use facsimile, e-mail, or both. I understand that the fax numbers and e-mail addresses above will be used when providing confdential information.

Printed Name* |

|

Printed Name |

|

Title |

|

Title |

|

Signature* |

Date* |

Signature |

Date |

sFor taxpayers authorizing the Department to disclose return information for a married fling joint personal income tax return, both taxpayers must sign this form.

sFor a business or estate this form must be signed by a corporate ofcer, partner, or fduciary who has been previously identifed as such to the Department.

Tis form can be submitted at any of the district ofces listed below:

Taxation and Revenue Department |

Taxation and Revenue Department |

Taxation and Revenue Department |

Taxation and Revenue Department |

Taxation and Revenue Department |

1200 South St Francis Dr |

Bank of the West Building |

2540 El Paseo, Bldg. #2 |

3501 E. Main St., Suite N |

400 N Pennsylvania Ave, Suite 200 |

PO Box 5374 |

5301 Central Ave. NE |

PO Box 607 |

PO Box 479 |

PO Box 1557 |

Santa Fe, NM 87502-5374 |

PO Box 8485 |

Las Cruces, NM 88004-0607 |

Farmington, NM 87499-0479 |

Roswell, NM 88202-1557 |

(505) 827-0951 |

Albuquerque, NM 87198-8485 |

(575) 524-6225 |

(505) 325-5049 |

(575) 624-6065 |

|

(505) 841-6200 |

|

|

|

Please fax to (505) 841-6327, Attention: Business Registration Unit. If you have any questions, please contact the call center at 1 (866) 285-2996

Made fillable by FormsPal.