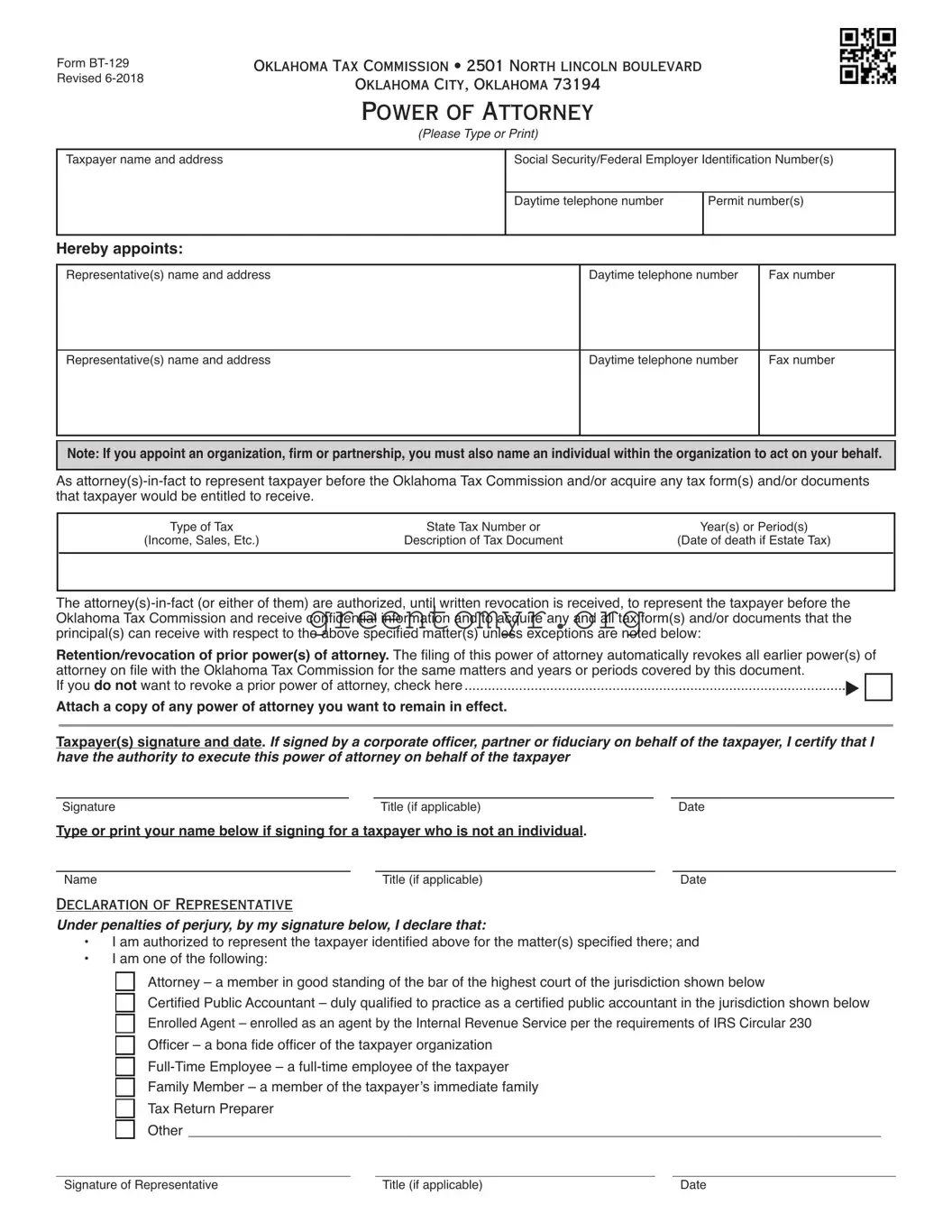

The Tax Power of Attorney (POA) Form BT-129 is a legal document that allows one individual, referred to as the "principal," to designate another person, known as the "agent," to represent them in tax matters before the state tax authority. This form is essential for individuals who may not have the time, expertise, or ability to handle their tax affairs personally.

The agent can be anyone trustworthy and qualified, including family members, friends, or tax professionals such as accountants and lawyers. However, it’s best to choose someone familiar with tax issues to ensure effective representation.

The agent has the power to perform various actions on behalf of the principal, including:

-

Filing tax returns and claims for refunds.

-

Negotiating with the tax authority regarding taxes owed.

-

Receiving confidential tax information.

-

Making payment arrangements or requesting payment plans.

This flexibility allows the agent to manage complex tax situations effectively.

Filling out the BT-129 form involves a few steps. First, download the form from the relevant tax authority’s website. Then complete the following sections:

-

Provide your personal information as the principal.

-

Enter the agent's details.

-

Specify the type of tax matters for which the agent is being authorized.

-

Sign and date the form to validate it.

Make sure to check the form for clarity and accuracy before submission.

No, a notary is not required to validate the BT-129 form. However, it’s important to ensure that all signatures are completed correctly to avoid any delays in processing.

You should submit the completed form to the appropriate tax authority. The specific submission process may vary based on your location. Typically, it can be mailed or sometimes submitted electronically through a secure portal provided by the tax authority.

The authority granted by the BT-129 form remains in effect until you revoke it. It’s advisable to review your needs periodically. If you no longer require the agent's services or if your circumstances change, you can revoke the POA by submitting a revocation form to the tax authority.

Yes, you can revoke the authority at any time. To do this, you should submit a formal revocation of power of attorney to the tax authority. It’s important to communicate this change to your agent as well, so they are aware that their authority has ended.

If the agent is not performing their duties appropriately, the principal can revoke the POA. It is essential to monitor the activities of the agent, especially if your tax situation is complex or time-sensitive. Open communication with your agent can often help address issues before they escalate.

The BT-129 form can be used to authorize an agent for specific tax years, but it only covers the periods indicated on the form. If you need representation for different years, you should specify this in your authorization or submit separate forms as needed.