|

|

|

|

|

|

|

|

|

|

|

|

|

|

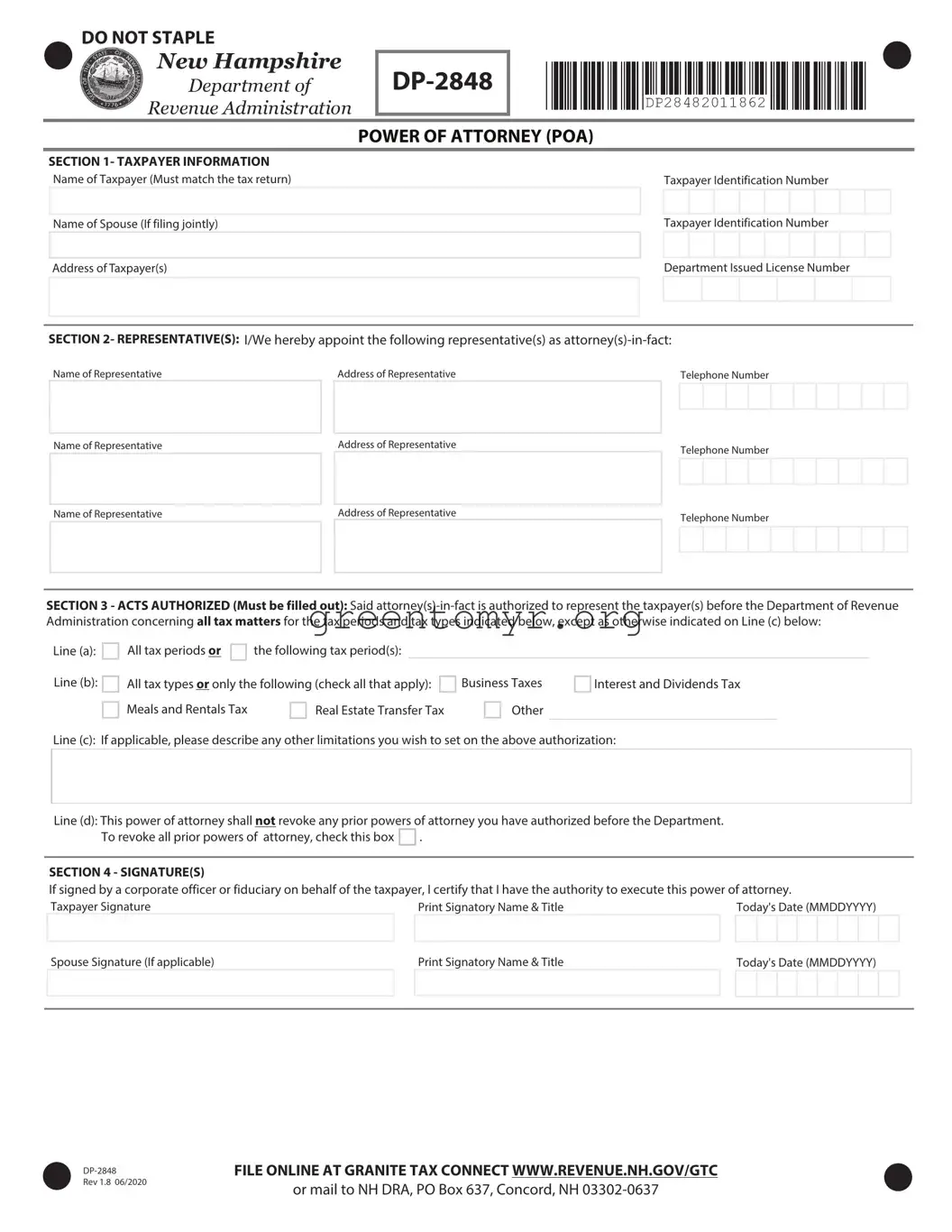

DP-2848 |

|

POWER OF ATTORNEY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INSTRUCTIONS |

(POA) |

|

|

|

|

|

|

|

|

|

WHEN TO FILE

A Power Of Attorney (POA) is required prior to the Department of Revenue Administration communicating with anyone other than the taxpayer regarding any issue relating to the taxpayer.

WHERE TO FILE

File online at Granite Tax Connect www.revenue.nh.gov/gtc or mail to NH DRA, Taxpayer Services Division, PO Box 637, Concord NH 03302-0637

E-mail scanned document to:

[email protected]

PLEASE NOTE

All applicable items must be filled in to properly complete Form DP-2848 New Hampshire Power of Attorney (POA). An incomplete form will prohibit direct communication between the Department and the representative.

SECTION 1 - TAXPAYER INFORMATION

Enter the taxpayer's name (must match the tax return), current mailing address including zip code, and taxpayer identification number (and Department issued license number if applicable). If joint returns are involved and you and your spouse are designating the same representative(s), also enter your spouse's name and taxpayer identification number (and Department issued license number if applicable). If you need to list additional taxpayers, an additional page may be attached with each taxpayer's name and taxpayer identification number.

SECTION 2 - REPRESENTATIVE(S)

Enter the name of the representative(s). This can be an individual(s) or the name of a firm. What you enter in the Name of Representative box determines who the Department will have authority to correspond with as your authorized representative. If you list only an individual(s) name from a firm, then only the individual(s) will have authority to represent you. If you put the firm name in the Name of Representative box then ANYONE with the firm will have the authority to represent you.

Enter the current mailing address including zip code of the representative in the Address of Representative box beside the Name of Representative box. Only the person(s) or firm named in the Name of Representative box has authorization to represent you with the Department. A firm name that is part of an individual's address does not mean that the employees of the firm can represent the taxpayer.

Provide the representative's phone number in the space provided. If more than one name is listed, provide the phone number of the first person listed.

This section allows for three representatives. If you have more than three, please attach an additional sheet and note "see attached" in one of the Name of Representative boxes.

SECTION 3 - ACTS AUTHORIZED (MUST BE FILLED OUT)

On Line (a), either check the "all" box to indicate that the representative applies to all tax periods, or limit the representation to a particular tax period(s) and provide the date range or period(s). If you enter only a year(s) (e.g. 2018) the representation will include any period (including any Meals and Rooms or Tobacco Tax periods, if authorized on Line (b)) that fall within that year. If you limit the representation to a date range, please be aware that your representative will not be permitted to discuss any other date range with the Department. Note: If you check both the "all" box and provide a date range, the representation will not be limited to the date range, but will apply to all dates and tax periods.

On Line (b), check the boxes for the tax types that apply to your representation. If the representation applies to all taxes, check the "all" box. To limit the representation to one or more taxes, check all the appropriate boxes and for any taxes not shown, check the "other" box and identify the taxes on the line (for example MET or UPT). Note: If you check both the "all" box and the boxes for specific taxes, the representation will not be limited to a specific tax, but will apply to all tax types.

On Line (c), describe any other limitations you wish to place on your representation. For example, if you wish to only authorize your representative to receive information, note this limitation on Line (c). Otherwise, your representative will not only be authorized to receive your confidential information but also full power to perform all acts necessary related to the subject matter of the indicated tax types and periods.

If the box on Line (d) is not checked, the filing of this form will not revoke or otherwise invalidate any prior powers on file with the Department. If you check the box provided on Line (d), you will revoke all prior powers of attorney, unless the representatives are identified again in Section 2 of this form.

If you are a representative that wishes to withdraw representation of a taxpayer, please forward a signed and dated letter with a copy of the POA you are withdrawing to the Department.