STATE OF HAWAII - DEPARTMENT OF TAXATION

POWER OF ATTORNEY

(NOTE: References to “married” and “spouse” are also references to “in a civil union” and “civil union partner,” respectively.)

This Power of Attorney will EXPIRE six (6) years from the latest date a Taxpayer signs this document

PART I POWER OF ATTORNEY (Please type or print.)

|

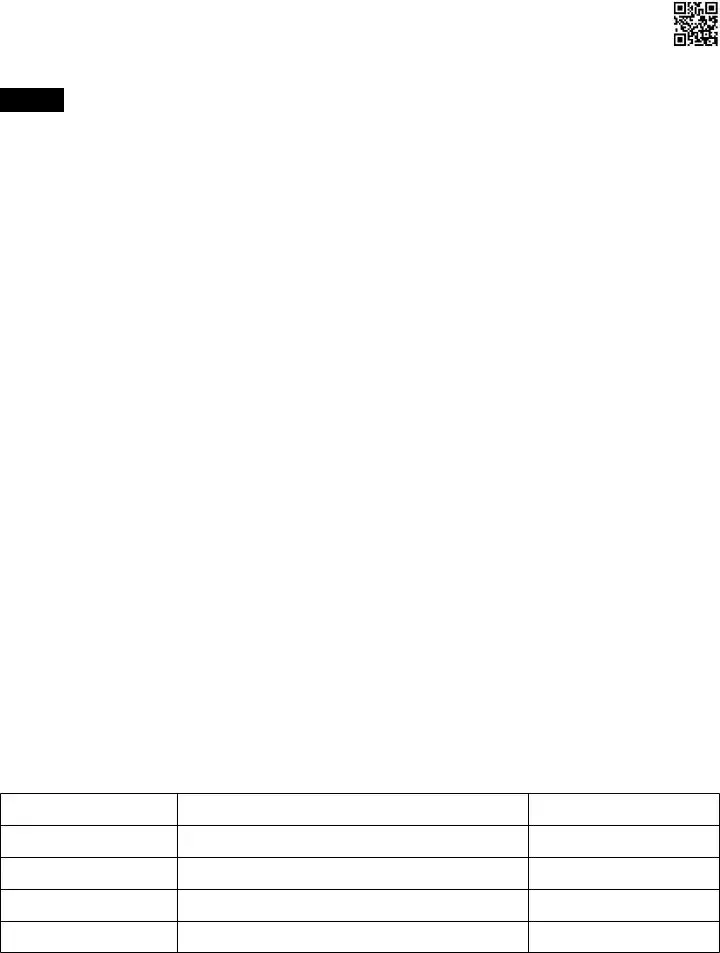

1 Taxpayer Information. Taxpayer(s) must sign and date this form on page 2, line 5. |

Social security number(s) |

Federal employer |

|

Taxpayer name(s) and address |

|

-~------------- |

|

|

|

|

|

|

|

|

identification number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Daytime telephone number |

Fax number |

|

|

|

( ) |

( ) |

|

|

|

|

|

|

|

|

|

|

|

|

E-mail address |

|

|

|

|

|

|

|

|

|

|

|

|

hereby appoint(s) the following representative(s) as attorney(s)-in-fact: |

|

|

|

|

|

|

2Representative(s) must be an individual and must sign and date this form on page 2, Part II.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Individual name and address |

VPID or TMRID |

|

|

|

|

|

|

|

|

|

|

Social Security No. |

|

|

|

|

|

|

|

|

|

|

Telephone No. ( ) |

|

|

|

|

|

|

|

|

|

Fax No. ( ) |

|

|

|

|

|

|

|

|

|

|

E-mail address |

|

|

|

|

|

|

|

|

|

|

Check if new: Address |

|

Telephone |

|

Fax |

|

E-mail |

Individual name and address |

VPID or TMRID |

|

|

|

|

|

|

|

|

|

|

Social Security No. |

|

|

|

|

|

|

|

|

|

|

Telephone No. ( ) |

|

|

|

|

|

|

|

|

|

Fax No. ( ) |

|

|

|

|

|

|

|

|

|

|

E-mail address |

|

|

|

|

|

|

|

|

|

|

Check if new: Address |

|

Telephone |

|

Fax |

|

E-mail |

Individual name and address |

VPID or TMRID |

|

|

|

|

|

|

|

|

|

|

Social Security No. |

|

|

|

|

|

|

|

|

|

|

Telephone No. ( ) |

|

|

|

|

|

|

|

|

|

Fax No. ( ) |

|

|

|

|

|

|

|

|

|

|

E-mail address |

|

|

|

|

|

|

|

|

|

|

Check if new: Address |

|

Telephone |

|

Fax |

|

E-mail |

Individual name and address |

VPID or TMRID |

|

|

|

|

|

|

|

|

|

|

Social Security No. |

|

|

|

|

|

|

|

|

|

|

Telephone No. ( ) |

|

|

|

|

|

|

|

|

|

Fax No. ( ) |

|

|

|

|

|

|

|

|

|

|

E-mail address |

|

|

|

|

|

|

|

|

|

|

Check if new: Address |

|

Telephone |

|

Fax |

|

E-mail |

to represent the taxpayer(s) before the Department of Taxation, State of Hawaii, for the following acts:

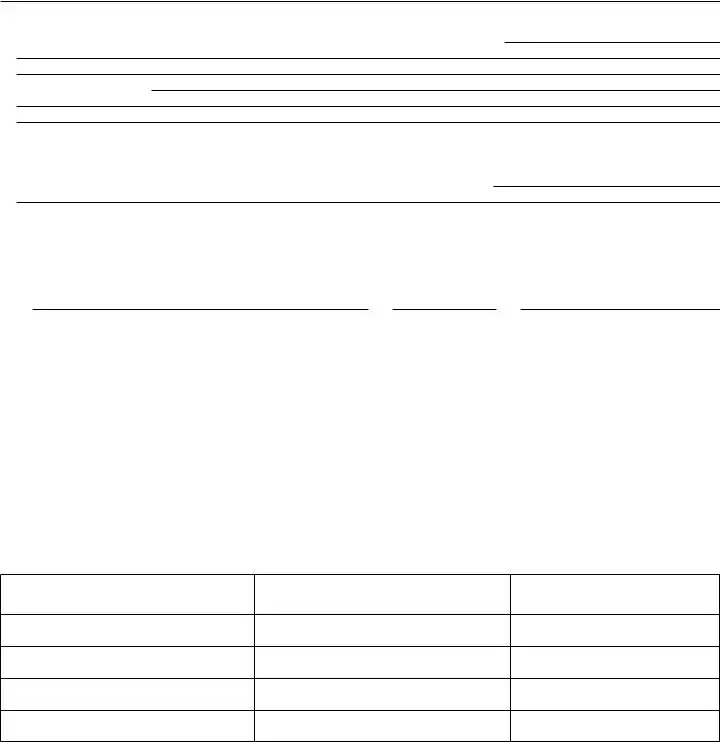

3Acts authorized (you are required to complete this line 3). (Stating “All Taxes” or “All Periods” on line 3 is NOT acceptable.) With the exception of the acts described in line 4b, I (we) authorize my (our) representative(s) to receive and inspect my (our) confidential tax information and to perform acts that I (we) can perform with respect to the tax matters described below. For example, my (our) representative(s) shall have the authority to sign any agreements, consents, tax clearance applications, or similar documents (but see instructions for authorizing a representative to sign a return). Please note that the tax year(s) or period(s) on line 3 can extend only 3 years after the current year. For example, if Form N-848 is submitted at any time in 2018, the tax year or period on line 3 cannot be extended beyond December 31, 2021. Also, please note that all correspondence from the Department of Taxation will be sent to the taxpayer. See page 2 of the instructions on how to revoke an existing power of attorney.

Complete a separate line for each specific tax type. All three (3) columns of the line must be completed for the tax type.

Hawaii Tax I.D. Number

(e.g., GE-001-002-1234-01)

Type of Tax

(Income, General Excise, etc.)

N848_I 2018A 01 VID01

ID NO 01

FORM N-848 |

|

(REV. 2018) |

PAGE 2 |

4a Additional acts authorized. In addition to the acts listed on line 3 above, I (we) authorize my (our) representative(s) to perform the following acts (see instructions): Authorize disclosure to third parties; Substitute or add representatives; Sign a return;

Other acts authorized:

4b Specific acts not authorized. My (our) representative(s) is (are) not authorized to endorse or otherwise negotiate any check (including directing or accepting payment by any means, electronic or otherwise, into an account owned or controlled by the representative(s) or any firm or other entity with whom the representative(s) is (are) associated) issued by the government in respect of a Hawaii tax liability.

List any specific deletions to the acts otherwise authorized in this power of attorney (see instructions):

5Signature of Taxpayer(s). If a tax matter concerns a year in which a joint return was filed, both spouses must sign if joint representation is requested. If signed by a corporate officer, partner, guardian, tax matters partner/person, executor, receiver, administrator, or trustee on behalf of the taxpayer, I certify that I have the authority to execute this form on behalf of the taxpayer.

IF NOT SIGNED AND DATED, THIS POWER OF ATTORNEY WILL BE RETURNED TO THE TAXPAYER.

|

|

|

|

Signature |

|

Date |

|

Title (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Print Name |

|

Print name of taxpayer from line 1 if other than individual |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature |

|

Date |

|

Title (if applicable) |

-IF |

|

|

|

NOT~------------- |

|

|

|

|

Print Name |

|

|

|

|

|

|

PART II |

SIGNATURE OF REPRESENTATIVE(S) |

|

|

|

|

|

|

|

|

COMPLETED, SIGNED AND DATED, THIS POWER OF ATTORNEY WILL BE RETURNED TO THE TAXPAYER. REPRESENTATIVES |

|

|

MUST SIGN IN THE ORDER LISTED IN PART I, LINE 2. |

|

|

|

|

|

Filing the Power of Attorney

File the original, photocopy, or facsimile transmission (fax) with each letter, request, form, or other document for which the power of attorney is required. For example, if you wish to designate an individual to represent you in obtaining tax clearance certificates, a copy of Form N-848 must be filed each time you submit Tax Clearance Applications. Unless you are provided with contact instructions by a representative from the Department of Taxation, mail the completed Form N-848 to:

Hawaii Department of Taxation

P.O. Box 259

Honolulu, HI 96809-0259

or send it by FAX to (808) 587-1488

QUESTIONS? Call 808-587-4242, 1-800-222-3229 (Toll-Free) or Telephone for the Hearing Impaired: 808-587-1418 or 1-800-887-8974 (Toll-Free)