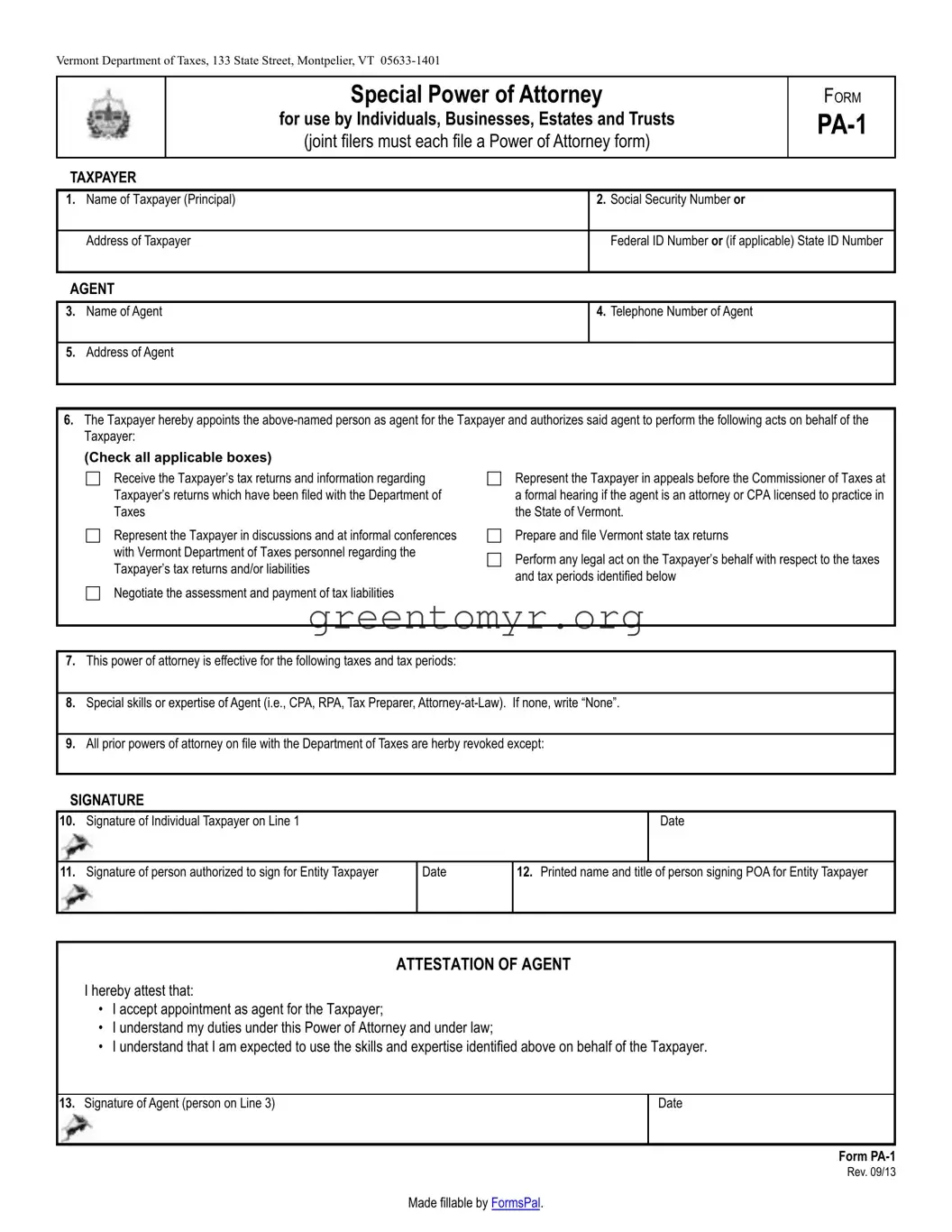

Filling out the Tax Power of Attorney (POA) form, known as PA-1, is a crucial step for anyone looking to authorize someone else to handle their tax matters. Unfortunately, many people make mistakes during this process, which can lead to significant issues down the line. Here are ten common errors to avoid when completing the PA-1 form.

First and foremost, neglecting to provide accurate personal information can cause delays. Individuals must ensure that their names, addresses, and Social Security numbers are correct and match their official documents. A small typo can lead to complications.

Another mistake often seen is failing to specify the powers granted to the representative. The form allows for a range of designations, from limited to general powers. Clarity on what the representative is authorized to do helps avoid any confusion in the future.

Some individuals mistakenly leave the signature blank or forget to sign at all. Without a valid signature, the form may be rendered invalid, which defeats its purpose. Always double-check that the required signatures are provided.

A frequent oversight involves using outdated forms. Tax forms and regulations can change, so it’s essential to ensure you are using the most current version of the PA-1 form to avoid any unexpected rejections.

Moreover, individuals often neglect to include their representative's information completely. It’s vital to provide detailed information about the person authorized to act on your behalf, including their name, address, and taxpayer identification number. Without this information, the IRS may not recognize them as your representative.

Many people also make the error of not indicating the duration of the POA. Whether it’s a specific timeframe or until revoked, stating this clearly helps the representative know how long their authority lasts.

Another common issue is overlooking the “Revocation” section. If someone decides to cancel their POA, it’s essential to follow the right procedures to revoke it formally. Skipping this step can lead to unauthorized actions being taken after the desired revocation.

In some cases, individuals forget to keep a copy of the completed form. Having a copy for personal records is important for reference and ensures you have proof of who is authorized to manage your tax affairs.

Finally, failing to follow up on the status of the POA can be a mistake. Once the form is submitted, it’s advisable to verify that the IRS has processed the request. Checking confirms that everything is in order and can help address any issues that arise quickly.

Being mindful of these common mistakes can help ensure a smoother experience when completing the PA-1 form. Taking the time to carefully fill out the information can make a significant difference in managing tax matters effectively.