■ |

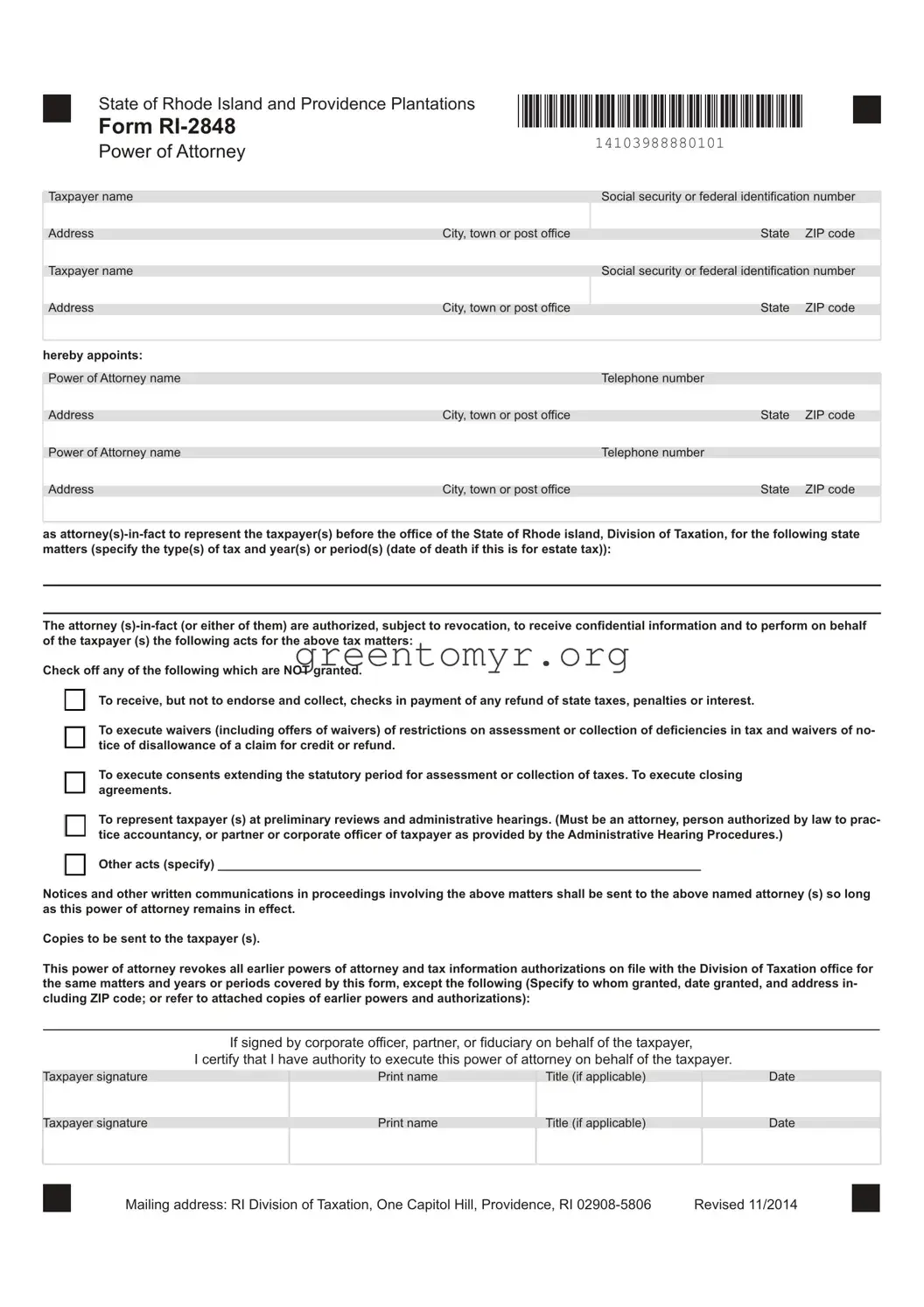

State of Rhode Island and Providence Plantations |

Illllll lllll lllll lllll lllll lllll lllll lllll lllll lllll lllll lllll 111111111111111111 |

■ |

Form RI-2848 |

|

Power of Attorney |

14103988880101 |

|

Taxpayer name |

|

Social security or federal identification number |

|

|

|

|

|

|

Address |

City, town or post office |

State |

ZIP code |

|

|

|

|

|

|

Taxpayer name |

|

Social security or federal identification number |

|

|

|

|

|

|

Address |

City, town or post office |

State |

ZIP code |

|

|

|

|

|

hereby appoints: |

|

|

|

|

|

|

|

|

|

Power of Attorney name |

|

Telephone number |

|

|

|

|

|

|

Address |

City, town or post office |

State |

ZIP code |

|

|

|

|

|

|

Power of Attorney name |

|

Telephone number |

|

|

|

|

|

|

|

Address |

City, town or post office |

State |

ZIP code |

as attorney(s)-in-fact to represent the taxpayer(s) before the office of the State of Rhode island, Division of Taxation, for the following state matters (specify the type(s) of tax and year(s) or period(s) (date of death if this is for estate tax)):

The attorney (s)-in-fact (or either of them) are authorized, subject to revocation, to receive confidential information and to perform on behalf of the taxpayer (s) the following acts for the above tax matters:

Check off any of the following which are NOT granted.

To receive, but not to endorse and collect, checks in payment of any refund of state taxes, penalties or interest.

To execute waivers (including offers of waivers) of restrictions on assessment or collection of deficiencies in tax and waivers of no- tice of disallowance of a claim for credit or refund.

To execute consents extending the statutory period for assessment or collection of taxes. To execute closing agreements.

To represent taxpayer (s) at preliminary reviews and administrative hearings. (Must be an attorney, person authorized by law to prac- tice accountancy, or partner or corporate officer of taxpayer as provided by the Administrative Hearing Procedures.)

Other acts (specify) ______________________________________________________________________

Notices and other written communications in proceedings involving the above matters shall be sent to the above named attorney (s) so long as this power of attorney remains in effect.

Copies to be sent to the taxpayer (s).

This power of attorney revokes all earlier powers of attorney and tax information authorizations on file with the Division of Taxation office for the same matters and years or periods covered by this form, except the following (Specify to whom granted, date granted, and address in- cluding ZIP code; or refer to attached copies of earlier powers and authorizations):

If signed by corporate officer, partner, or fiduciary on behalf of the taxpayer,

I certify that I have authority to execute this power of attorney on behalf of the taxpayer.

|

Taxpayer signature |

Print name |

Title (if applicable) |

Date |

|

|

|

|

|

|

|

Taxpayer signature |

Print name |

Title (if applicable) |

Date |

|

|

|

|

|

■ |

Mailing address: RI Division of Taxation, One Capitol Hill, Providence, RI 02908-5806 |

Revised 11/2014 |

■ |

■ |

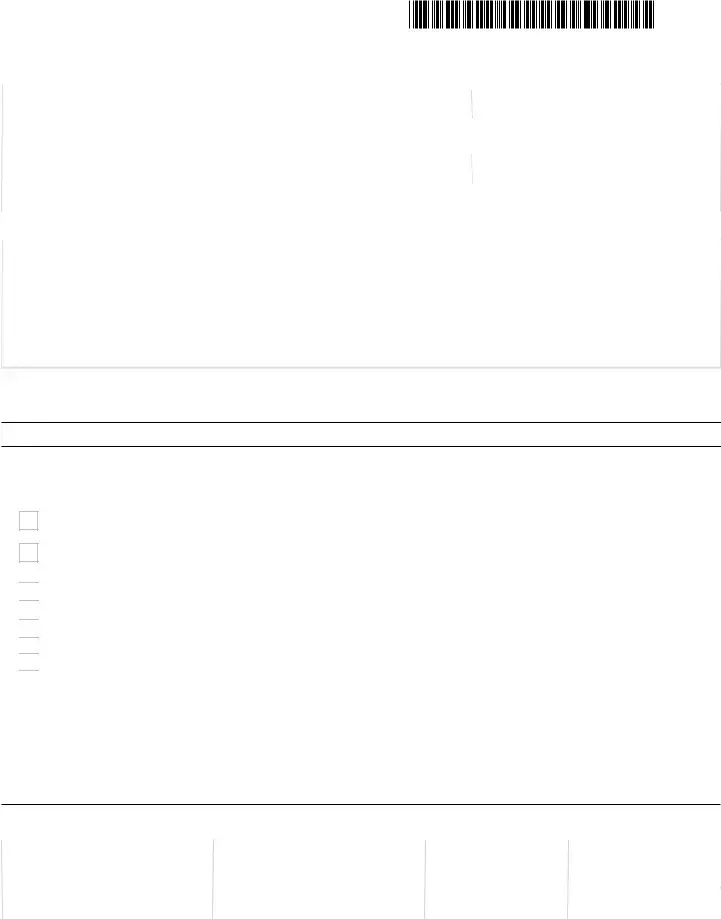

State of Rhode Island and Providence Plantations |

Illllll lllll lllll lllll lllll lllll lllll lllll lllll lllll lllll lllll 111111111111111111 |

■ |

Form RI-2848 |

|

Power of Attorney |

14103988880102 |

|

This declaration must be completed by the attorney, certified public accountant, licensed public accountant, or enrolled agent. I declare that I am not currently under suspension or disbarment from practice before the Division of Taxation and that:

I am a member in good standing of the bar of the highest court of the jurisdiction indicated below; or

I am duly qualified to practice as a certified public accountant in the jurisdiction indicated below; or

I am a licensed public accountant in the jurisdiction indicated below.

I am actively enrolled to practice before the Internal Revenue Service.

Designation |

Jurisdiction |

Signature |

Date |

(Attorney, CPA, LPA or enrolled agent) |

(State, etc) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If the power of attorney is granted to a person other than an attorney, certified public accountant, or licensed public accountant, or enrolled agent, it must be witnessed or notarized below.

The person (s) signing as or for the taxpayer (s): (Check and complete ONE.)

|

|

□ |

|

|

|

is/are known to and signed in the presence of the two disinterested witnesses whose signatures appear here: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of witness |

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of witness |

Date |

|

|

|

|

|

LJ |

|

appeared this day before a notary public and acknowledged this power of attorney as a voluntary act and deed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of notary |

Date |

NOTARIAL SEAL