When individuals fill out the Tax Power of Attorney (POA) form TC-737, they may encounter several common pitfalls that can lead to complications in the future. Understanding these mistakes can enhance the efficiency of the process and help avoid unnecessary delays or issues with the tax authorities.

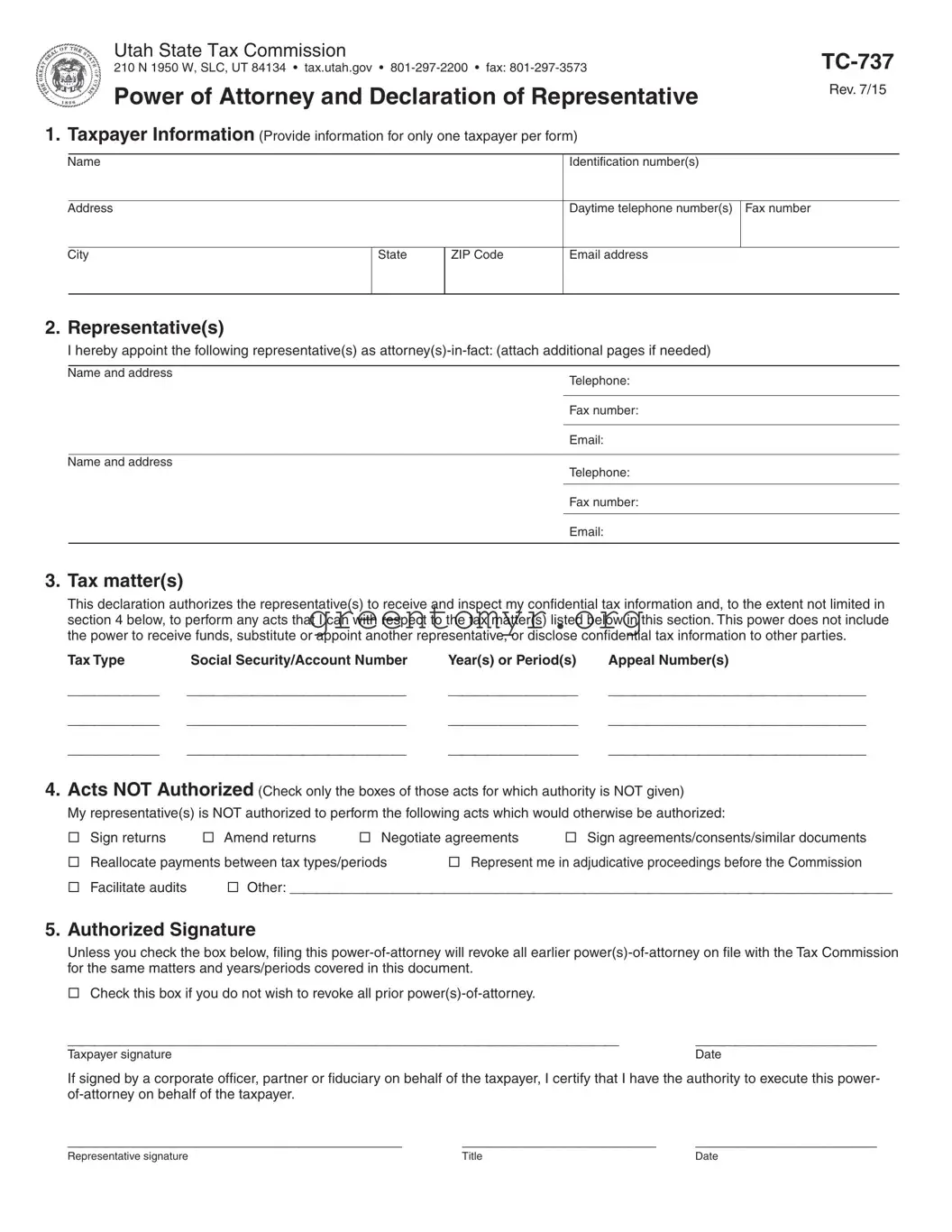

One prevalent mistake is neglecting to provide the necessary personal information. Taxpayers must ensure that both their details and those of the person they are designating as their representative are accurately filled in. This includes full names, addresses, and social security numbers. Omitting even a single digit or letter can cause issues with identification.

Additionally, selecting the wrong type of authority is another frequent error. The TC-737 form allows taxpayers to grant various types of powers. It’s vital that individuals clearly indicate whether they want to grant full power or limited authority. Choosing the incorrect option can prevent the designated representative from performing certain necessary tasks.

Another common mistake occurs when individuals forget to sign and date the form. A signature is a critical component that validates the document. Without it, the form is considered incomplete and may not be accepted by tax authorities. Moreover, failing to date the form can create confusion about its timeliness, which is important for any legal processes involved.

Inaccurate or incomplete information about the tax year can also lead to complications. The TC-737 form requires specific reference to the tax years or periods for which the power is granted. Omitting this information, or mistakenly including incorrect years, can limit the representative's effectiveness in managing tax matters for the taxpayer.

People might also overlook the necessity of checking for conflicts of interest. For instance, if a designated representative has a personal relationship with the taxpayer that might bias their representation, it should be reconsidered. Ensuring transparency and trust is essential for all parties involved.

Failing to understand the consequences of the powers granted can create challenges as well. Taxpayers should be fully aware that they are giving their representative the authority to act on their behalf, which can include making significant decisions. This understanding ensures that all parties are on the same page and reduces the risk of future disputes.

Lastly, individuals often do not keep a copy of the completed TC-737 form for their records. Retaining a copy is crucial, as it serves as verification of the powers granted and supports any inquiries or disputes that may arise in the future. Having this documentation can be invaluable, especially if questions about authority come up later.