|

Web-Fill |

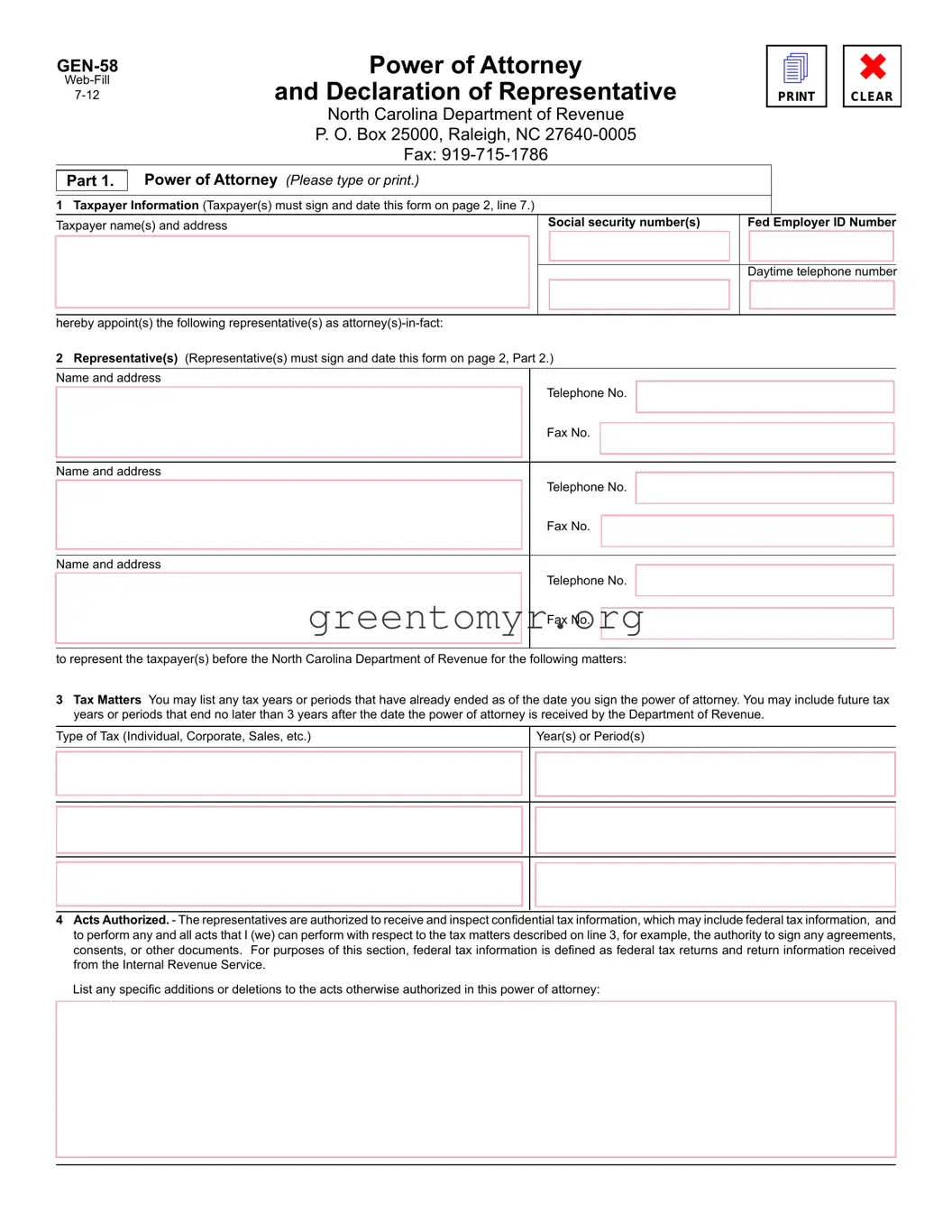

Power of Attorney |

|

4 |

|

✖ |

|

GEN-58 |

and Declaration of Representative |

|

|

|

|

7-12 |

|

|

|

|

PRINT |

|

CLEAR |

|

|

|

|

|

North Carolina Department of Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P. O. Box 25000, Raleigh, NC 27640-0005 |

|

|

|

|

|

|

|

|

Fax: 919-715-1786 |

|

|

|

|

|

|

|

I |

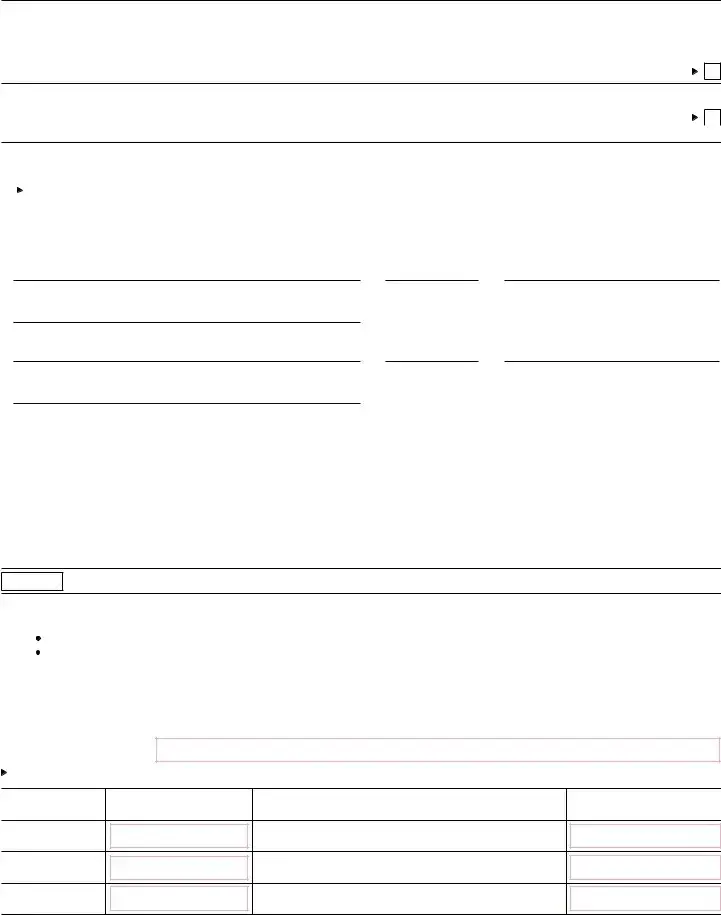

Power of Attorney (Please type or print.) |

|

|

|

I Part 1. |

|

|

|

|

|

|

|

|

|

|

|

1Taxpayer Information (Taxpayer(s) must sign and date this form on page 2, line 7.)

Taxpayer name(s) and address |

Social security number(s) |

Fed Employer ID Number |

|

|

|

|

|

Daytime telephone number

hereby appoint(s) the following representative(s) as attorney(s)-in-fact:

2Representative(s) (Representative(s) must sign and date this form on page 2, Part 2.)

Name and address

Telephone No.

Fax No.

Name and address

Telephone No.

Fax No.

Name and address

Telephone No.

Fax No.

to represent the taxpayer(s) before the North Carolina Department of Revenue for the following matters:

3Tax Matters You may list any tax years or periods that have already ended as of the date you sign the power of attorney. You may include future tax years or periods that end no later than 3 years after the date the power of attorney is received by the Department of Revenue.

Type of Tax (Individual, Corporate, Sales, etc.)

4Acts Authorized. - The representatives are authorized to receive and inspect confidential tax information, which may include federal tax information, and to perform any and all acts that I (we) can perform with respect to the tax matters described on line 3, for example, the authority to sign any agreements, consents, or other documents. For purposes of this section, federal tax information is defined as federal tax returns and return information received from the Internal Revenue Service.

List any specific additions or deletions to the acts otherwise authorized in this power of attorney:

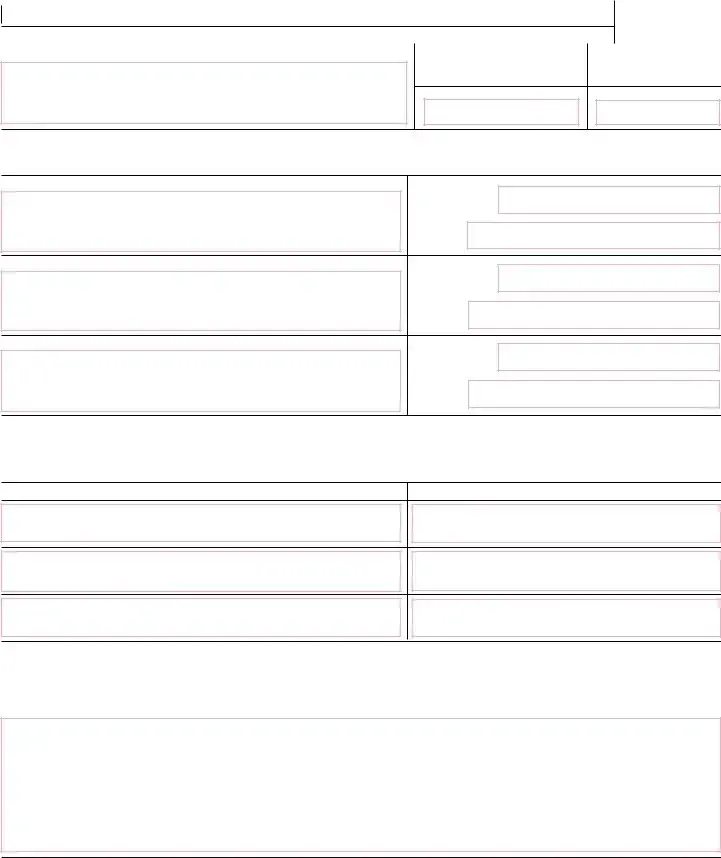

Page 2

Gen. 58

Web-Fill

7-12

5e-Business Center Account - Your tax representative can create an e-Business Center account with the Department of Revenue to perform online services on behalf of your business. The online services offered through the e-Business Center include filing a return and paying tax for certain business tax types, viewing online tax history, and managing tax payment information. Please select the Electronic Services tab on the

Department’s homepage for a list of the online services for businesses that require login to the e-Business Center. |

|

PLEASE CHECK THIS BOX IF YOUR REPRESENTATIVE WILL CREATE AN e-BUSINESS CENTER ACCOUNT TO PERFORM ONLINE |

SERVICES ON YOUR BEHALF |

---►□ |

|

6Retention/Revocation of Prior Power(s) of Attorney. - The filing of this power of attorney automatically revokes all earlier power(s) of attorney on file with the Department of Revenue for the same tax matters and years or periods covered by this document. If you do not

want to revoke a prior power of attorney, check here |

►□ |

|

|

YOU MUST ATTACH A COPY OF ANY POWER OF ATTORNEY YOU WANT TO REMAIN IN EFFECT. |

|

|

7Signature of Taxpayer(s). - If a tax matter concerns a joint return, both husband and wife must sign if joint representation is requested.

If signed by a corporate officer, partner, guardian, tax matters partner/person, executor, representative, receiver, administrator, or trustee on behalf of the taxpayer, I certify that I have the authority to execute this form on behalf of the taxpayer.

►IF NOT SIGNED AND DATED, THIS POWER OF ATTORNEY WILL BE RETURNED.

Signature |

Date |

Title (if applicable) |

Print Name |

|

|

Signature |

Date |

Title (if applicable) |

Print Name |

|

|

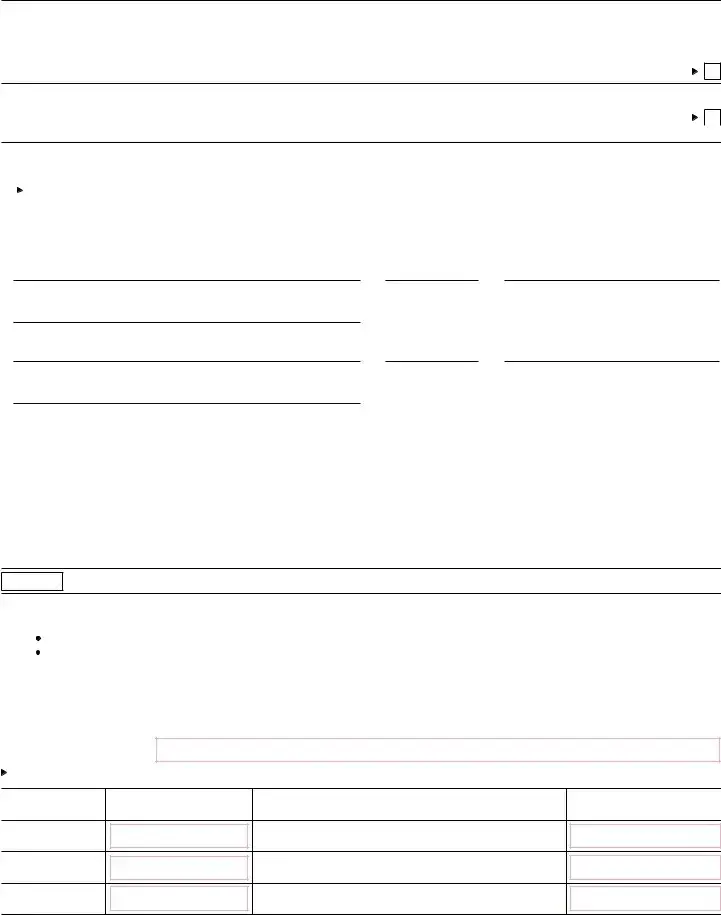

Declaration of Representative

Under penalties of perjury, I declare that:

• |

I am authorized to represent the taxpayer(s) identified in Part 1 for the tax matter(s) specified there; and |

• |

I am one of the following: |

|

a Attorney - a member in good standing of the bar of the highest court of the jurisdiction shown below. |

bCertified Public Accountant - duly qualified to practice as a certified public accountant in the jurisdiction shown below.

cEnrolled Agent - Enrolled as an agent under the requirements of Treasury Department Circular No. 230.

dOfficer - a bona fide officer of the taxpayer’s organization.

eFull-Time Employee - a full-time employee of the taxpayer.

fFamily Member - a member of the taxpayer’s immediate family (i.e., spouse, parent, child, brother, or sister).

gOther (explain) -

►IF THIS DECLARATION OF REPRESENTATIVE IS NOT SIGNED AND DATED, THE POWER OF ATTORNEY WILL BE RETURNED.

Designation - Insert

above letter (a-g)

Jurisdiction (state) or Enrollment Card No.