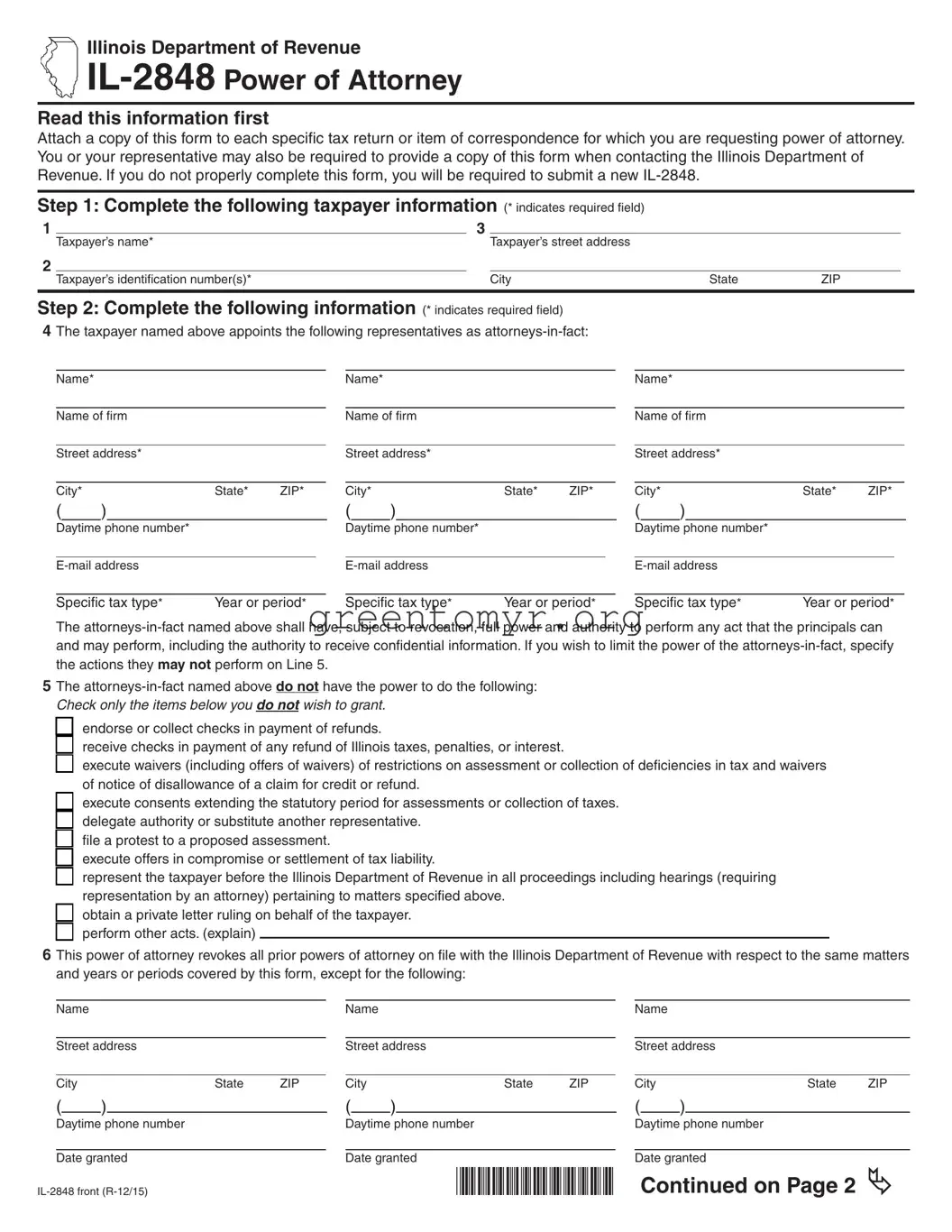

Illinois Department of Revenue

IL-2848 Power of Attorney

Read this information frst

Attach a copy of this form to each specifc tax return or item of correspondence for which you are requesting power of attorney. You or your representative may also be required to provide a copy of this form when contacting the Illinois Department of Revenue. If you do not properly complete this form, you will be required to submit a new IL-2848.

Step 1: Complete the following taxpayer information (* indicates required feld)

1 |

|

3 |

|

|

|

|

|

Taxpayer’s name* |

|

Taxpayer’s street address |

|

|

|

2 |

|

|

|

|

|

|

|

Taxpayer’s identifcation number(s)* |

|

City |

State |

ZIP |

|

|

|

|

|

|

|

Step 2: Complete the following information (* indicates required feld)

4 The taxpayer named above appoints the following representatives as attorneys-in-fact:

Name* |

|

|

|

|

|

|

|

Name* |

|

|

|

|

|

|

|

Name* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of frm |

|

|

|

|

Name of frm |

|

|

|

|

Name of frm |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street address* |

|

|

|

|

Street address* |

|

|

|

|

Street address* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City* |

|

|

|

State* |

ZIP* |

City* |

|

|

|

State* |

ZIP* |

City* |

|

|

|

State* |

ZIP* |

( |

|

) |

|

|

|

|

( |

|

) |

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Daytime phone number* |

|

|

|

|

Daytime phone number* |

|

|

|

|

Daytime phone number* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E-mail address |

|

|

|

|

E-mail address |

|

|

|

|

E-mail address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Specifc tax type* |

Year or period* |

|

Specifc tax type* |

Year or period* |

|

Specifc tax type* |

Year or period* |

The attorneys-in-fact named above shall have, subject to revocation, full power and authority to perform any act that the principals can and may perform, including the authority to receive confdential information. If you wish to limit the power of the attorneys-in-fact, specify the actions they may not perform on Line 5.

5 The attorneys-in-fact named above do not have the power to do the following: Check only the items below you do not wish to grant.

□

endorse or collect checks in payment of refunds.

endorse or collect checks in payment of refunds.

□ receive checks in payment of any refund of Illinois taxes, penalties, or interest.

□ execute waivers (including offers of waivers) of restrictions on assessment or collection of defciencies in tax and waivers of notice of disallowance of a claim for credit or refund.

□

execute consents extending the statutory period for assessments or collection of taxes. □

execute consents extending the statutory period for assessments or collection of taxes. □

delegate authority or substitute another representative.

delegate authority or substitute another representative.

□

fle a protest to a proposed assessment.

fle a protest to a proposed assessment.

□

execute offers in compromise or settlement of tax liability.

execute offers in compromise or settlement of tax liability.

□

represent the taxpayer before the Illinois Department of Revenue in all proceedings including hearings (requiring representation by an attorney) pertaining to matters specifed above.

represent the taxpayer before the Illinois Department of Revenue in all proceedings including hearings (requiring representation by an attorney) pertaining to matters specifed above.

□

obtain a private letter ruling on behalf of the taxpayer. □

obtain a private letter ruling on behalf of the taxpayer. □

perform other acts. (explain)

perform other acts. (explain)

6 This power of attorney revokes all prior powers of attorney on fle with the Illinois Department of Revenue with respect to the same matters and years or periods covered by this form, except for the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

Name |

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

Street address |

|

|

|

Street address |

|

|

|

Street address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

ZIP |

|

City |

|

|

State |

ZIP |

|

City |

|

State |

ZIP |

( |

|

) |

|

|

|

( |

|

) |

|

|

|

( |

|

) |

|

|

|

Daytime phone number |

Daytime phone number |

Daytime phone number |

|

|

|

|

|

|

|

Date granted |

Date granted |

Date granted |

IL-2848 front (R-12/15) |

*565201110* |

|

Continued on Page 2 |

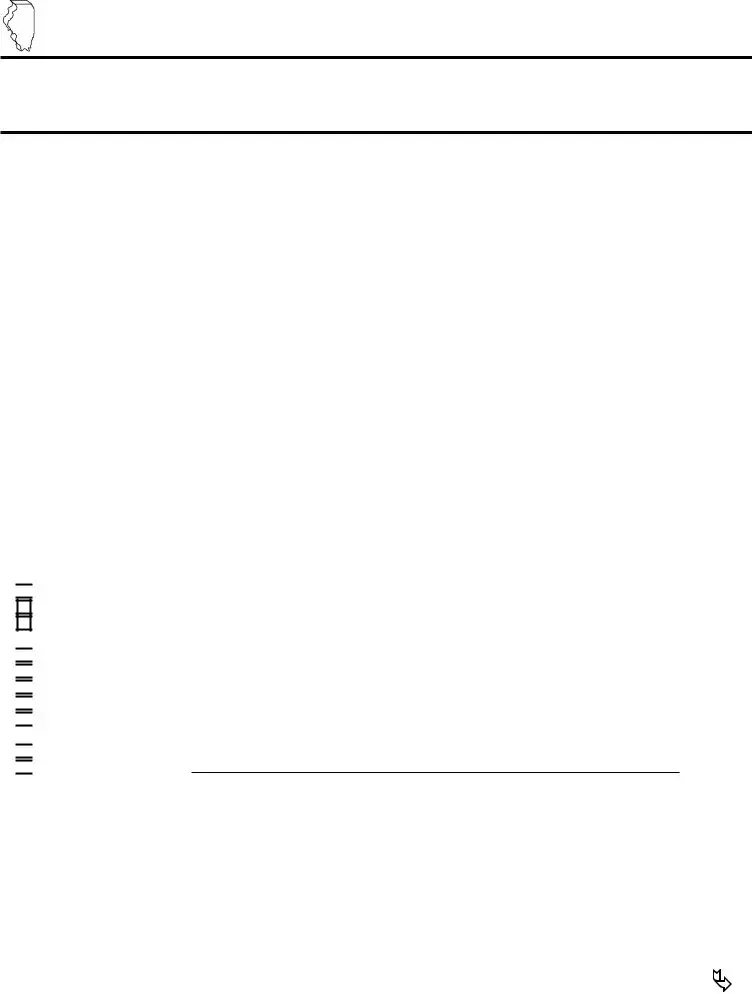

7 Copies of notices and other written communications addressed to the taxpayer in proceedings involving the matters listed on the front of this form should be sent to the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

Name |

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

Street address |

|

|

|

Street address |

|

|

|

Street address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

ZIP |

|

City |

|

|

State |

ZIP |

|

City |

|

State |

ZIP |

( |

|

) |

|

|

|

( |

|

) |

|

|

|

( |

|

) |

|

|

Daytime phone number |

|

|

|

Daytime phone number |

|

|

|

Daytime phone number |

|

Step 3: Complete the following if the power of attorney is granted to an attorney, a certifed public accountant, or an enrolled agent

I declare that I am not currently under suspension or disbarment and that I am

•a member in good standing of the bar of the highest court of the jurisdiction indicated below; or

•duly qualifed to practice as a certifed public accountant in the jurisdiction indicated below; or

•enrolled as an agent pursuant to the requirements of United States Treasury Department Circular Number 230.

Check one: □Attorney |

□C.P.A. □Enrolled agent |

|

|

|

Jurisdiction (state(s), etc.) |

Signature |

Date |

Check one: □Attorney |

□C.P.A. □Enrolled agent |

|

|

|

Jurisdiction (state(s), etc.) |

Signature |

Date |

Check one: □Attorney |

□C.P.A. □Enrolled agent |

|

|

|

Jurisdiction (state(s), etc.) |

Signature |

Date |

Step 4: Taxpayer’s signature

If signing as a corporate offcer, partner, fduciary, or individual on behalf of the taxpayer, I certify that I have the authority to execute this power of attorney on behalf of the taxpayer.

Taxpayer’s signature |

Print name |

Title, if applicable |

Date |

|

|

|

|

Spouse’s signature |

Print name |

Title, if applicable |

Date |

|

|

|

|

If corporation or partnership, signature of offcer or partner |

Print name |

Title, if applicable |

Date |

Complete the following if the power of attorney is granted to a person other than an attorney, a certifed public accountant, or an enrolled agent

If the power of attorney is granted to a person other than an attorney, a certifed public accountant, or an enrolled agent, this document must be witnessed or notarized below. Please check and complete one of the following:

Any person signing as or for the taxpayer |

|

|

|

□ |

is known to and this document is signed in the presence of |

|

|

the two disinterested witnesses whose signatures appear here. |

|

|

|

|

|

|

|

Signature of witness |

Date |

|

|

|

|

|

|

|

Signature of witness |

Date |

|

□ |

appeared this day before a notary public and acknowledged |

|

|

this power of attorney as his or her voluntary act and deed. |

|

|

|

|

|

Notary seal |

|

Signature of notary |

Date |

This form is authorized as outlined under the Illinois Income Tax Act. Disclosure of this information is required. Failure to provide information could result in a penalty.

endorse or collect checks in payment of refunds.

endorse or collect checks in payment of refunds.

execute consents extending the statutory period for assessments or collection of taxes.

execute consents extending the statutory period for assessments or collection of taxes.

delegate authority or substitute another representative.

delegate authority or substitute another representative.

fle a protest to a proposed assessment.

fle a protest to a proposed assessment.

execute offers in compromise or settlement of tax liability.

execute offers in compromise or settlement of tax liability.

represent the taxpayer before the Illinois Department of Revenue in all proceedings including hearings (requiring representation by an attorney) pertaining to matters specifed above.

represent the taxpayer before the Illinois Department of Revenue in all proceedings including hearings (requiring representation by an attorney) pertaining to matters specifed above.

obtain a private letter ruling on behalf of the taxpayer.

obtain a private letter ruling on behalf of the taxpayer.

perform other acts. (explain)

perform other acts. (explain)