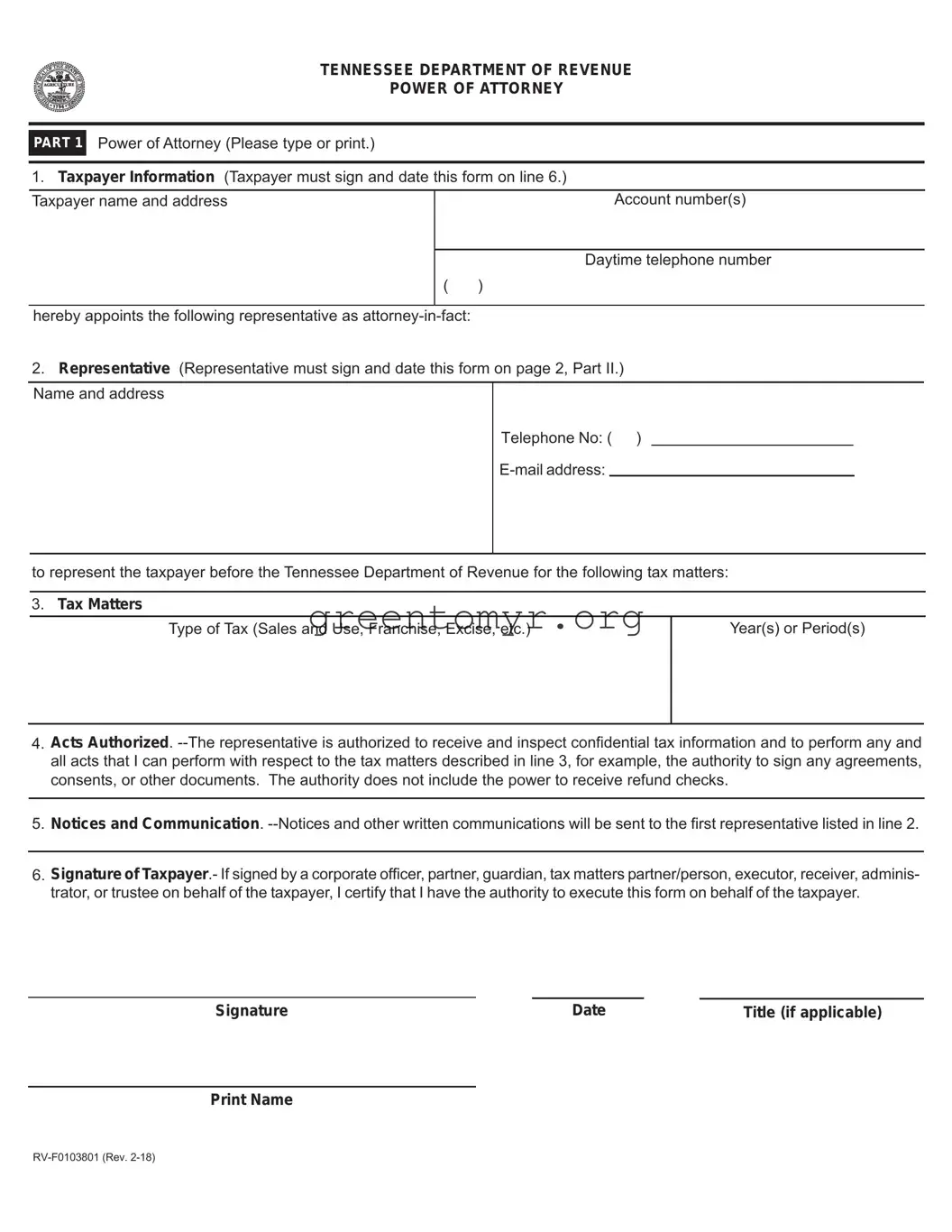

When it comes to filling out the Tax Power of Attorney (POA) RV-F0103801 form, many individuals inadvertently make mistakes that can complicate their tax matters. One of the most common errors is providing incorrect or incomplete taxpayer information. It is crucial that the name, Social Security number (SSN), and address are entered accurately to avoid any delays in processing.

Another frequent mistake involves improper selection of the representative. Taxpayers must ensure that the person designated as their representative meets the qualifications outlined by the IRS. If the representative does not have the appropriate credentials, the form may be rejected.

In addition, some people neglect to specify the tax years or period for which the POA is granted. This information is essential. Without clear dates, the IRS may not accept the authorization, leaving the taxpayer without necessary representation for their tax issues.

Many individuals also overlook the necessity of signatures. Both the taxpayer and the representative must sign the form. Failing to do so can result in processing delays or outright rejection.

A common oversight is not providing the appropriate documentation that supports the granting of power of attorney. While the form itself is straightforward, attaching necessary paperwork can help clarify the intent and validity of the POA.

Another critical mistake is failing to keep a copy of the submitted form. It is essential to have a record of what was sent, as this can serve as a reference in case any issues arise later with the IRS.

Those filling out the form should also pay attention to deadlines. Submitting the POA request late can lead to complications, especially if representation is needed urgently. It is wise to check submission timelines to ensure timely processing.

Lastly, individuals often underestimate the importance of reviewing the completed form carefully before submission. Errors or omissions that go unnoticed can lead to significant delays and might require resubmission, prolonging the time it takes to gain the necessary tax assistance.