|

|

|

PRINT FORM |

|

RESET FORM |

|

1350 |

|

|

|

|

|

|

|

STATE OF SOUTH CAROLINA |

|

|

|

|

|

|

|

|

|

DEPARTMENT OF REVENUE |

|

SC2848 |

|

|

POWER OF ATTORNEY AND |

|

|

|

|

(Rev. 2/2/18) |

dor.sc.gov |

|

DECLARATION OF REPRESENTATIVE |

3307 |

|

|

|

|

|

|

|

|

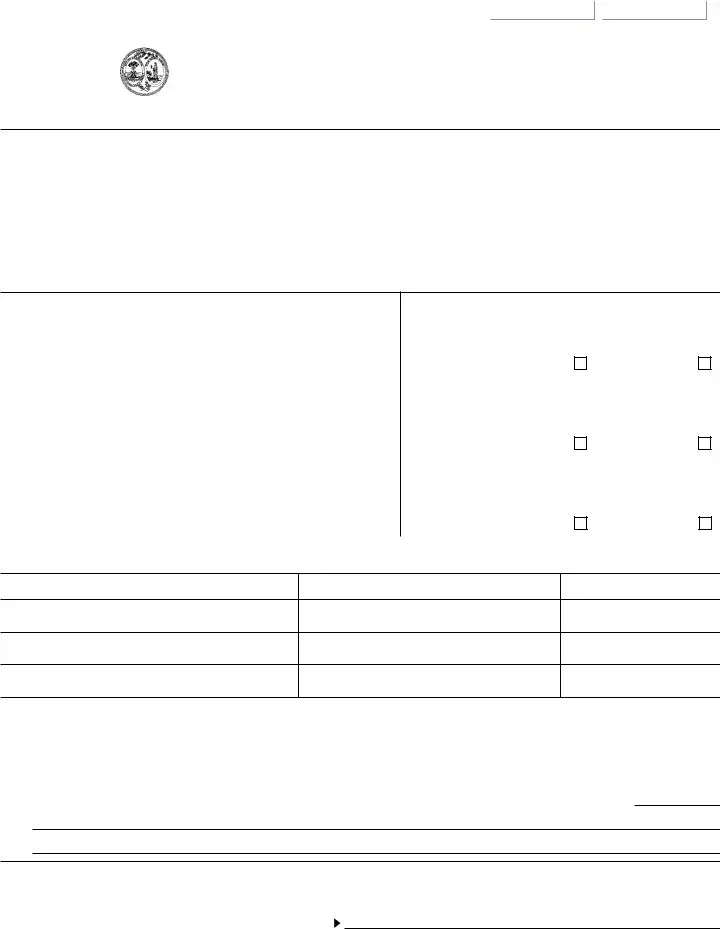

Part I Power of Attorney

1Taxpayer Information (Note: Taxpayer(s) must sign and date this form on page 2, line 8.)

|

|

|

|

|

|

|

|

* Taxpayer name(s) and address (Type or print.) |

*Social |

Security |

|

number(s) |

* Employer identification number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Plan number ( if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Daytime telephone number |

Email Address |

|

|

|

|

|

|

|

|

|

hereby appoint(s) the following representative(s) as attorney(s) - in fact: |

|

|

|

|

|

|

2Representative(s) (Type or print.)

*Name and address of specific individual

* Telephone No. |

|

|

|

|

Fax No. |

|

|

|

Check if new: |

Address |

Telephone No. |

|

|

|

|

Name and address of specific individual |

|

|

Telephone No. |

|

|

Fax No. |

|

|

|

Check if new: |

Address |

Telephone No. |

|

|

|

|

Name and address of specific individual |

|

|

Telephone No. |

|

|

Fax No. |

|

|

|

Check if new: |

Address |

Telephone No. |

|

|

|

|

to represent the taxpayer(s) before the SC Department of Revenue for the following tax matters: |

|

|

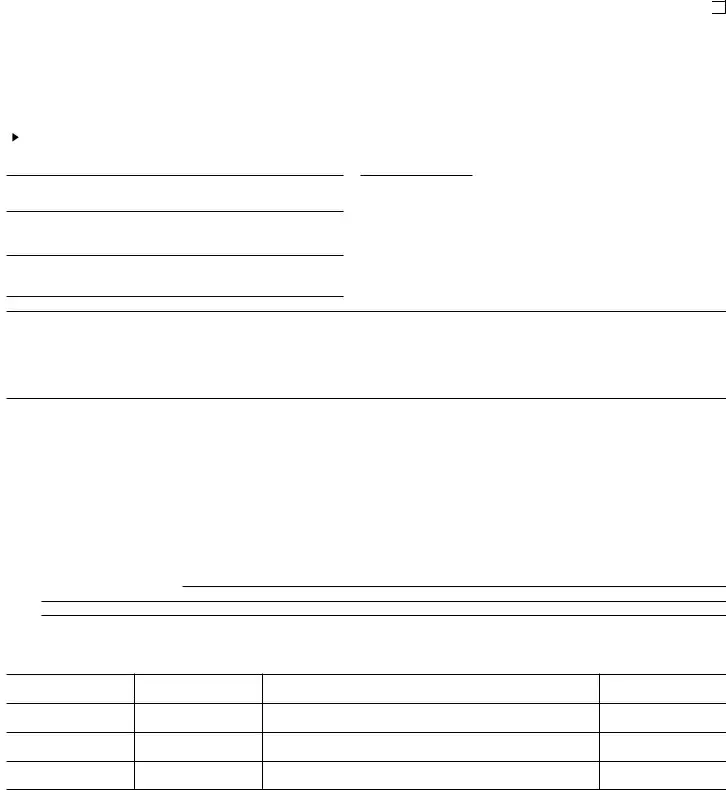

3Tax Matters - A general reference to "All years," "All periods," or "All taxes" is not acceptable.

*Type of Tax (Individual, Corporate, Withholding, Sales, etc.)

*Tax Form Number (SC1040, WH1605, ST-3, etc.)

Year(s) or Period(s)

*(See Line 3 instructions)

4Acts Authorized - A representative is an individual authorized to receive and inspect confidential tax information and to perform any and all acts on behalf of the taxpayer with respect to the tax matters described in line 3, including the authority to sign any agreements, consents or other documents. You may not use a Power of Attorney form to authorize a representative to receive refund checks. You may authorize a representative to sign a return ONLY as set forth in South Carolina Code Section 12-2-75.

List any specific additions to or deletions from the acts otherwise authorized in this power of attorney:

5Receipt of Refund Checks - If you want to authorize a representative named in line 2 to receive, BUT NOT TO

ENDORSE OR CASH refund checks, initial here |

|

and list the name of that representative below. |

Name of representative to receive refund check(s)

33071028

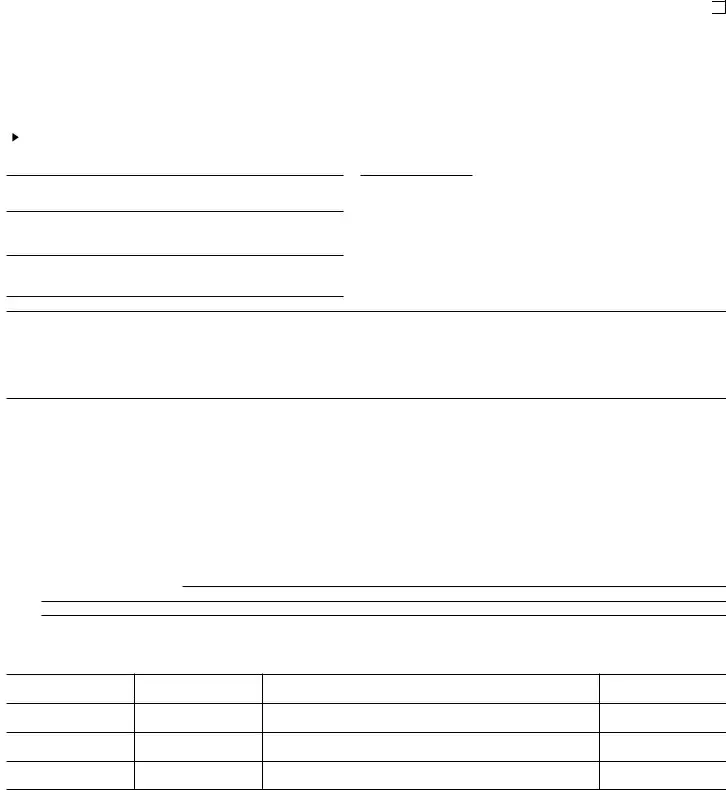

6Retention/Revocation of Prior Power(s) of Attorney - The filing of this power of attorney automatically revokes all earlier power(s) of attorney on file with the South Carolina Department of Revenue for the same tax matters for years or periods covered by this document .

If you do not want to revoke a prior power of attorney, check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YOU MUST ATTACH A COPY OF ANY POWER OF ATTORNEY YOU WANT TO REMAIN IN EFFECT.

7Signature of Taxpayer(s) - If a tax matter concerns a joint return, both taxpayers must sign if joint representation is requested; otherwise, see the instructions for SC2848 concerning signature of taxpayer(s). If signed by a corporate officer, partner, guardian, tax matters partner/person, LLC members, executor, receiver, personal representative, or trustee on behalf of the taxpayer, I certify that I have the authority to execute this form on behalf of the taxpayer.

The Department will not accept a Power of Attorney that is not signed.

|

* |

|

|

|

|

Signature |

Date |

|

Title (if |

applicable) |

|

|

Print Name |

|

|

|

|

|

|

|

|

|

|

|

Signature |

|

Date |

|

Title (if |

applicable) |

Print Name |

|

|

|

|

|

NOTICES AND COMMUNICATIONS

All Notices and Communications will be sent to the taxpayer only. However, if you are unable to forward a copy to your named representative, you may contact our office for assistance.

Part II Declaration of Representative

I declare that:

I am authorized to represent the taxpayer(s) identified in Part I for the tax matter(s) specified; and

I am authorized to represent the taxpayer(s) identified in Part I for the tax matter(s) specified; and  I am one of the following:

I am one of the following:

aAttorney - a member in good standing of the bar of the highest court of the jurisdiction shown below.

bCertified Public Accountant - duly qualified to practice as a certified public accountant in the jurisdiction shown below.

cEnrolled Agent - enrolled as an agent under the Requirements of the US Treasury Department Circular No. 230. d Officer - a bona fide officer of the taxpayer organization.

e Full-Time Employee - a full-time employee of the taxpayer.

f Family Member - a member of the taxpayer's immediate family (i.e., spouse, parent, child, brother, or sister). g Return Preparer.

h Other, please explain.

The Department will not accept a Declaration of Representative that is not signed.

The Department will not accept a Declaration of Representative that is not signed.

I declare that this return and all attachments are true, correct and complete to the best of my knowledge and belief. To wilfully furnish a false or fraudulent statement to the Department is a crime.

*Designation - Insert

above letter (a-h)

*indicates required field.

Instructions for SC2848

General Instructions

Purpose of Form

Use SC2848 to grant authority to an individual to represent you before the South Carolina Department of Revenue and to receive tax information. See the instructions for Part I, line 4 for limitations that may apply for certain representatives.

A fiduciary (trustee, executor, administrator, receiver, or guardian) stands in the position of a taxpayer and acts as the taxpayer. Therefore, a fiduciary does not act as a representative and should not file a power of attorney. If a fiduciary wishes to authorize an individual to represent or perform certain acts on behalf of the entity, a power of attorney must be filed and signed by the fiduciary acting in the position of the taxpayer.

Authority Granted

This power of attorney authorizes the individual(s) named to perform any and all acts you can perform, such as signing consents extending the time to assess tax, recording the interview, or executing waivers agreeing to a tax adjustment. However, authorizing someone as your power of attorney does not relieve you of your tax obligations. Delegating authority or substituting another representative must be specifically stated on line 4. However, the authority granted to a power of attorney may not exceed that allowed under SC Code Section 12-60-90. See South Carolina Revenue Procedures 92-4 and 92-6. The power to sign tax returns can only be granted in limited situations. See Line 4 - Acts authorized for more information.

Filing the Power of Attorney

File the original or a photocopy or facsimile transmission (fax) with the applicable office (main or taxpayer service center). The applicable office is the office from which you request information or before which a matter, such as an audit, is pending. Paper forms can be mailed to P.O. Box 125 Columbia, SC 29214-0400.

Substitute SC2848

Federal Form 2848 may be substituted for SC2848 even though the instructions for the two forms differ somewhat. Be sure to note the differences and complete the Federal Form 2848 accordingly.

Specific Instructions

Part I - Power of Attorney

Line 1 - Taxpayer Information

Individuals. Enter your name, SSN (and/or EIN, if applicable), and address in the space provided. If a joint return is involved, and you and your spouse are designating the same representative(s), also enter your spouse's name and SSN, and your spouse's address if different from yours.

Social Security Privacy Act

It is mandatory that you provide your social security number on this tax form. 42 U.S.C 405(c)(2)(C)(i) permits a state to use an individual's social security number as means of identification in administration of any tax. SC Regulation 117-201 mandates that any person required to make a return to the SC Department of Revenue shall provide identifying numbers, as prescribed, for securing proper identification. Your social security number is used for identification purposes.

Corporations, partnerships, or LLC's. Enter the name, EIN, and business address. If this form is being prepared for corporations filing a consolidated tax return (SC1120), do not attach a list of subsidiaries to this form. Only the parent corporation information is required on line 1. Also, line 3 should only list SC1120 in the Tax Form Number column. However, a subsidiary must file its own SC2848 for returns that are required to be filed separately from the consolidated return, such as ST-3.

Trust. Enter the name, title, and address of the trustee, and the name and EIN number of the trust.

Estate. Enter the name, title, and address of the decedent's executor/personal representative, and the name and identification number of the estate. The identification number for an estate includes both the EIN, if the estate has one, and the decedent's SSN.

Line 2 - Representative(s)

Enter the name of your representative(s). Only individuals may be named as representatives. Use the identical name on all submissions. If you want to name more than three representatives, indicate so on this line and attach a list of additional representatives to the form. Be sure to sign and date all attachments.

Line 3 - Tax Matters

You must enter the type of tax, the tax form number, and the year(s) or period(s) in order for the power of attorney to be valid. For example, you may list "income tax, SC1040" for calendar year "2016" and "Sales tax, ST-3" for the "1st, 2nd, 3rd, and 4th quarters of 2016." A general reference to "All years," "All periods," or "All taxes" is not acceptable. The department will not accept a power of attorney with a general reference.

You may list the current year/period and any tax years or periods that have already ended as of the date you sign the power of attorney. However, you may include on a power of attorney only future tax periods that end no later than 3 years after the power of attorney is received by the Department of Revenue. The 3 future periods are determined starting after December 31 of the year the power of attorney is received by the department. You must enter the type of tax, the tax form number, and the future year(s) or period(s).

Line 4 - Acts Authorized

If you want to modify the acts that your named representative(s) can perform, describe any specific additions or deletions in the space provided. The authority to substitute another representative or to delegate authority must be specifically stated on line 4.

Certain Limitations:

If any representative you name is someone other than an attorney, CPA or enrolled agent, the acts that person can perform on your behalf may be limited by SC Code Section 12-60-90. See South Carolina Revenue Procedures 92-4 and 92-6. However, these representatives will be permitted to extend the statutory period.

Line 5 - Receipt of Refund Checks

If you want to authorize your representative to receive, but not endorse refund checks on your behalf, you must initial and enter the name of that person in the space provided. Treasury Department Circular No. 230 (31 CFR, Part 10) prohibits an attorney, CPA, or enrolled agent, any of whom is an income tax return preparer, from endorsing or otherwise negotiating a tax refund check. If you are in a licensed attorney/client relationship, your refund may be sent to your licensed attorney.

Line 6 - Retention/Revocation of Prior Power(s) of Attorney

If there is any existing power(s) of attorney you do not want to revoke, check the box on this line and attach a copy of the power(s) of attorney. If you want to revoke an existing power of attorney and do not want to name a new representative, send a copy of the previously executed power of attorney to each office where the power of attorney was filed. The copy of the power of attorney must have a current signature of the taxpayer under the signature on line 8. Write "REVOKE" across the top of the form. If you do not have a copy of the power of attorney you want to revoke, send a statement of revocation to each office where you filed the power of attorney. The statement must indicate that the authority of the power of attorney is revoked and must be signed by the taxpayer. Also, the name and address of each recognized representative whose authority is revoked must be listed. A representative can withdraw from representation by filing a statement with each office where the power of attorney was filed. The statement must be signed by the representative and identify the name and address of the taxpayer(s) and tax matter(s) from which the representative is withdrawing.

Line 7 - Signature of Taxpayer(s)

Individuals. You must sign and date the power of attorney. If a joint return has been filed and both taxpayers will be represented by the same individual(s), both must sign the power of attorney unless one spouse authorizes the other, in writing, to sign for both. In that case, attach a copy of the authorization. However, if a joint return has been filed and both taxpayers will be represented by different individuals, each taxpayer must execute his or her own power of attorney on a separate SC2848.

Corporations or associations. An officer having authority to bind the taxpayer must sign.

Partnerships. All partners or members of an LLC must sign unless one partner or member is authorized to act in the name of the partnership. A partner is authorized to act in the name of the partnership if, under state law, the partner has authority to bind the partnership. A copy of such authorization must be attached. For purposes of executing SC2848, the tax matters partner is authorized to act in the name of the partnership. For dissolved partnerships, see US Treasury Regulations section 601.503(c)(6).

Other. If the taxpayer is a dissolved corporation, deceased, insolvent, or a person for whom or by whom a fiduciary (a trustee, guarantor, receiver, executor, or administrator) has been appointed, see US Treasury Regulations section 601.503(d).

PART II - Declaration of Representative

The representative(s) you name must sign and date this declaration and enter the designation (i.e., items a-h) under which he or she is authorized to practice before the South Carolina Department of Revenue. In addition, the representative(s) must list the following in the "Jurisdiction" column:

aAttorney - Enter the two-letter abbreviation for the state (e.g., "NY" for New York) in which admitted to practice.

bCertified Public Accountant - Enter the two-letter abbreviation for the state (e.g., "CA" for California) in which licensed to practice. c Enrolled Agent - Enter the enrollment card number issued by the Director of Practice.

d Officer - Enter the title of the officer (i.e., President, Vice President, or Secretary). e Full-Time Employee - Enter title or position (e.g., Comptroller or Accountant).

f Family Member - Enter the relationship to taxpayer (i.e., spouse, parent, child, brother, or sister).

g Tax Return Preparer - Enter the two-letter abbreviation for the state (e.g., "KY" for Kentucky) in which the return was prepared. h Other - Enter professional title (e.g., real estate appraiser) or relationship to taxpayer (e.g., friend).

Note: If the representation is outside the United States, conditions a-h do not apply.

I am authorized to represent the taxpayer(s) identified in Part I for the tax matter(s) specified; and

I am authorized to represent the taxpayer(s) identified in Part I for the tax matter(s) specified; and  I am one of the following:

I am one of the following: The Department will not accept a Declaration of Representative that is not signed.

The Department will not accept a Declaration of Representative that is not signed.