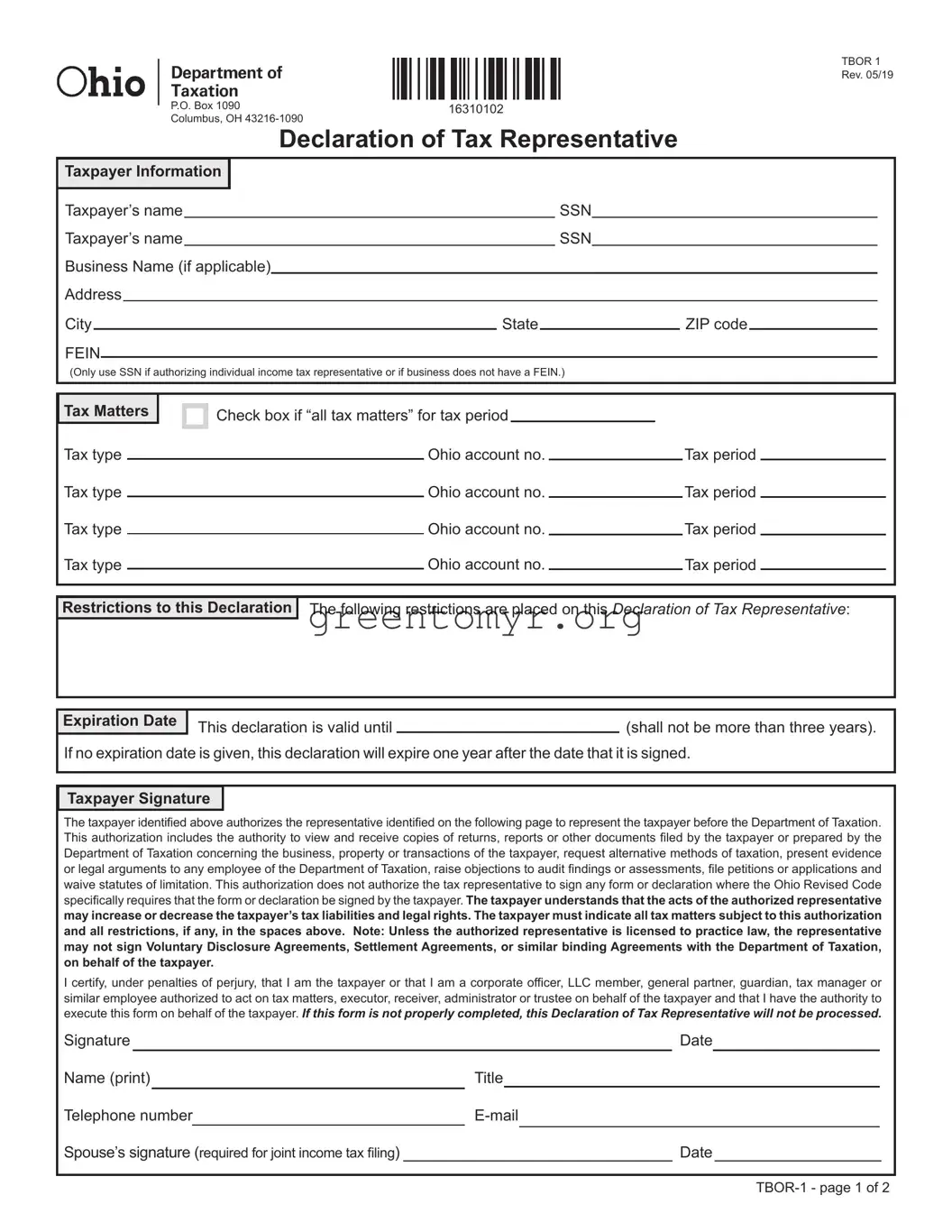

When people fill out the Tax POA tbor-1 form, mistakes can occur that may lead to delays or complications. One common error is providing incomplete information. It’s essential to submit all relevant details, such as your name, address, and taxpayer identification number, fully and accurately. Missing just one piece of information can halt the processing of your request.

Another frequent mistake is not signing the form. Many individuals overlook the requirement for a signature, thinking that submitting the form electronically makes this unnecessary. However, without a signature, the form is considered invalid, and the IRS will not process it.

Some people also select an incorrect power of attorney. The designated representative must have the appropriate authority to act on your behalf. Ensure that the person you are naming is capable of handling your tax matters. Otherwise, your authorization may be ineffective.

Failure to check the expiration date of the POA can lead to further complications. Once a power of attorney expires, your designated representative can no longer act on your behalf without a new form. Review the terms carefully to avoid disruptions in your representation.

It’s worth noting that many individuals neglect to use the most current version of the tbor-1 form. Tax laws and forms can change, so using an outdated version can create issues. Always verify that you have the latest form before submitting.

Lastly, some people make the mistake of not providing adequate documentation to support their request. Additional paperwork may be required, especially if you are appointing someone who has not acted as your representative in the past. Failing to include these documents could delay approval.

These common mistakes can be easily avoided by reviewing the form thoroughly and ensuring all information is correct and complete. Taking the time to fill out the Tax POA tbor-1 form properly will save you time and frustration in the long run.

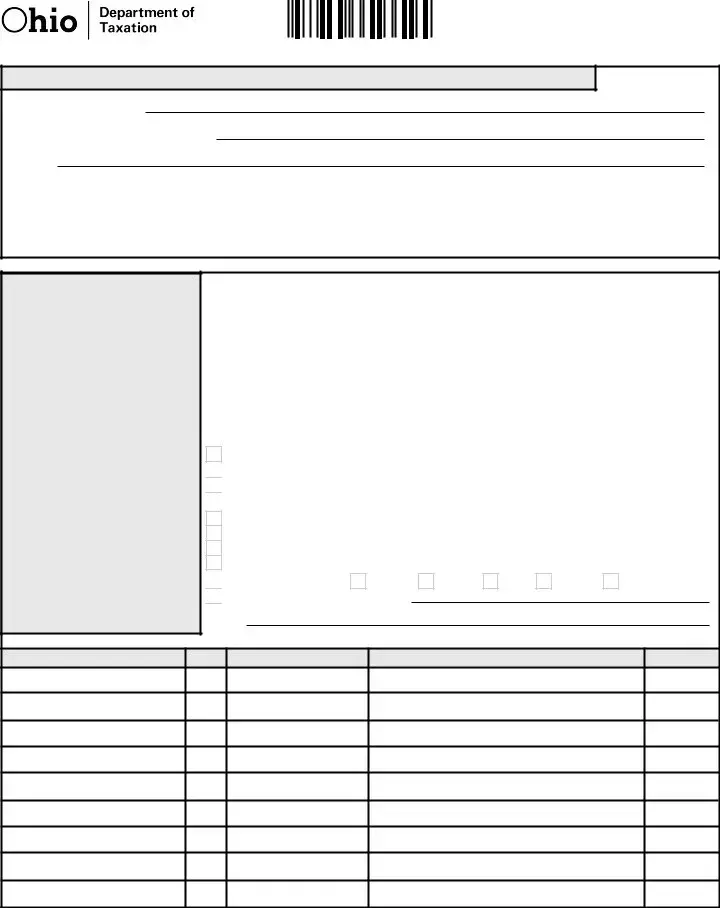

2. Certified public accountant or public accountant – duly qualified practice in the jurisdiction shown below.

2. Certified public accountant or public accountant – duly qualified practice in the jurisdiction shown below.

7. Other – provide explanation

7. Other – provide explanation