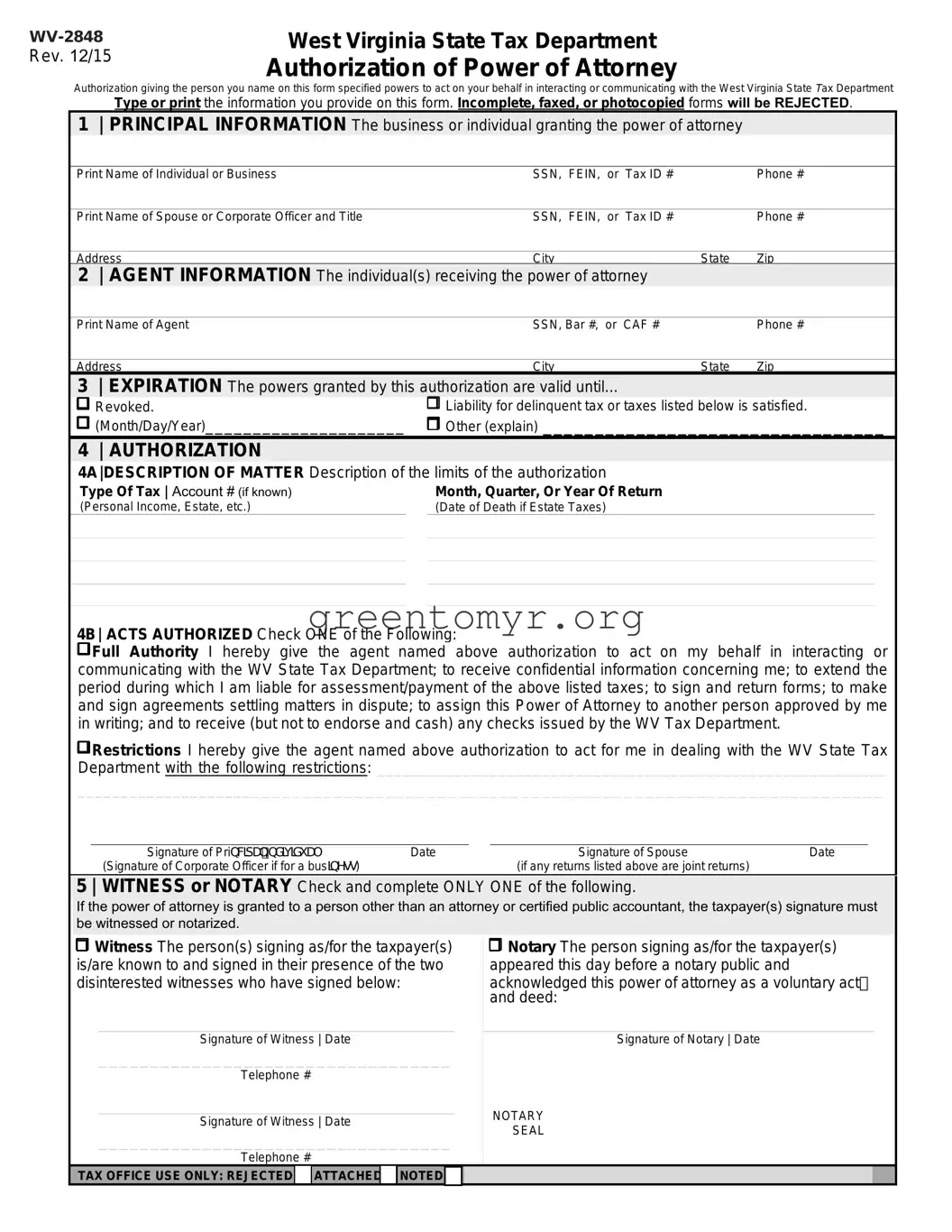

Filling out the Tax Power of Attorney (POA) WV-2848 form can be a crucial task for anyone needing to grant authority to another person regarding their tax matters. However, individuals often make mistakes that can lead to delays or complications. One common error is failing to include all required information. The WV-2848 form asks for specific details such as the taxpayer's name, Social Security number, and address. Omitting any of these can render the form invalid.

Another mistake people frequently make is not specifying the correct type of taxes. The form allows for the designation of particular tax years or periods, which must be clearly indicated. If a person neglects to check the appropriate boxes or adds the correct years, the representative may not have the authority to act during those times.

Additionally, signatures are a critical part of the form. A common issue arises when the taxpayer's signature does not match the name printed on the form. This discrepancy can cause delays as the IRS verifies the identity of the signer. It's essential to ensure that the signature is clear and corresponds accurately with the printed name.

Some users also fail to date the form properly. An unsigned or undated form may lead to questions about its validity, causing confusion about when the authority began. Always ensure that the date is included next to the signature.

A further complication occurs when personal representatives or agents are incorrectly designated. Sometimes, individuals think they can name multiple representatives without specifying their roles. This can lead to misunderstandings. Each representative needs to be distinctly named, and in the case of multiple representatives, clarity about who holds what responsibilities is crucial.

In some cases, people forget to submit the completed form. It's easy to fill out a form and assume it will be processed, but submission is a necessary step. Keeping a copy of the submitted form can be beneficial for future reference, should any questions arise.

Lastly, failing to review the completed form before submission can lead to unintended mistakes. Simple typographical errors, incorrect addresses, or typos in names can cause significant issues. Taking a final look at the entered information can save time and trouble.

Avoiding these common mistakes can help ensure that the WV-2848 form is filled out correctly. This diligence not only streamlines the process but also helps maintain clear communication between the taxpayer and the IRS.

___________________________________________________________

___________________________________________________________