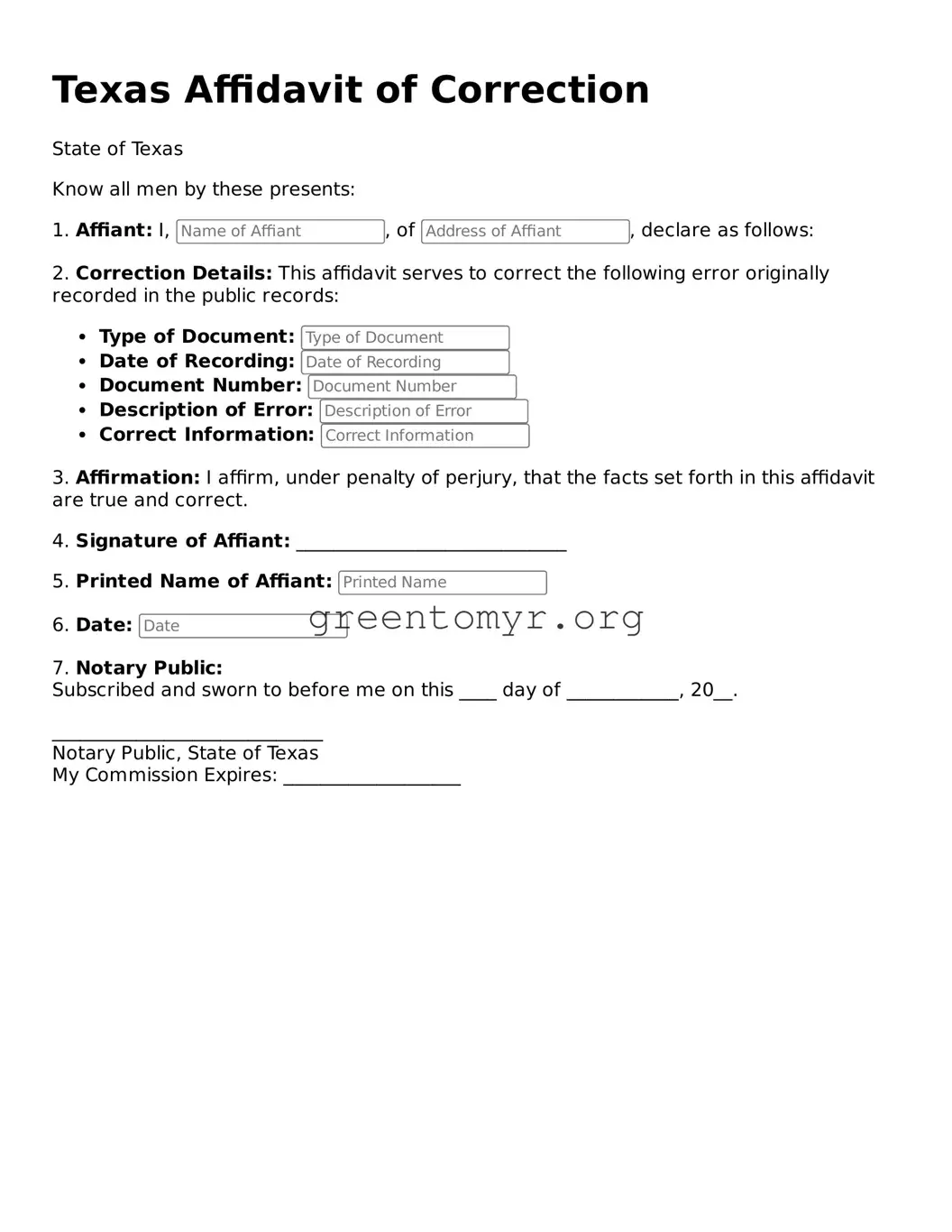

Affidavit of Correction Form for the State of Texas

The Texas Affidavit of Correction is a legal document used to rectify errors in official records. This form allows individuals to correct inaccuracies that may have occurred during document filings, ensuring that your records reflect accurate information. If you need to make a correction, consider filling out this form by clicking the button below.