The Texas Affidavit of Gift form is a legal document used to transfer property ownership as a gift. It serves as a formal declaration of the intent to give property from one individual to another without any payment involved. This document is especially useful for ensuring the gift is recognized by the state and can facilitate the transfer process for real estate and personal property.

This form is typically used when one person (the donor) wishes to give property, such as land or a vehicle, as a gift. It is appropriate in situations where the donor wants to make a clear statement that they are transferring ownership without expecting compensation in return. It can be valuable during estate planning or when making gifts to family members or friends.

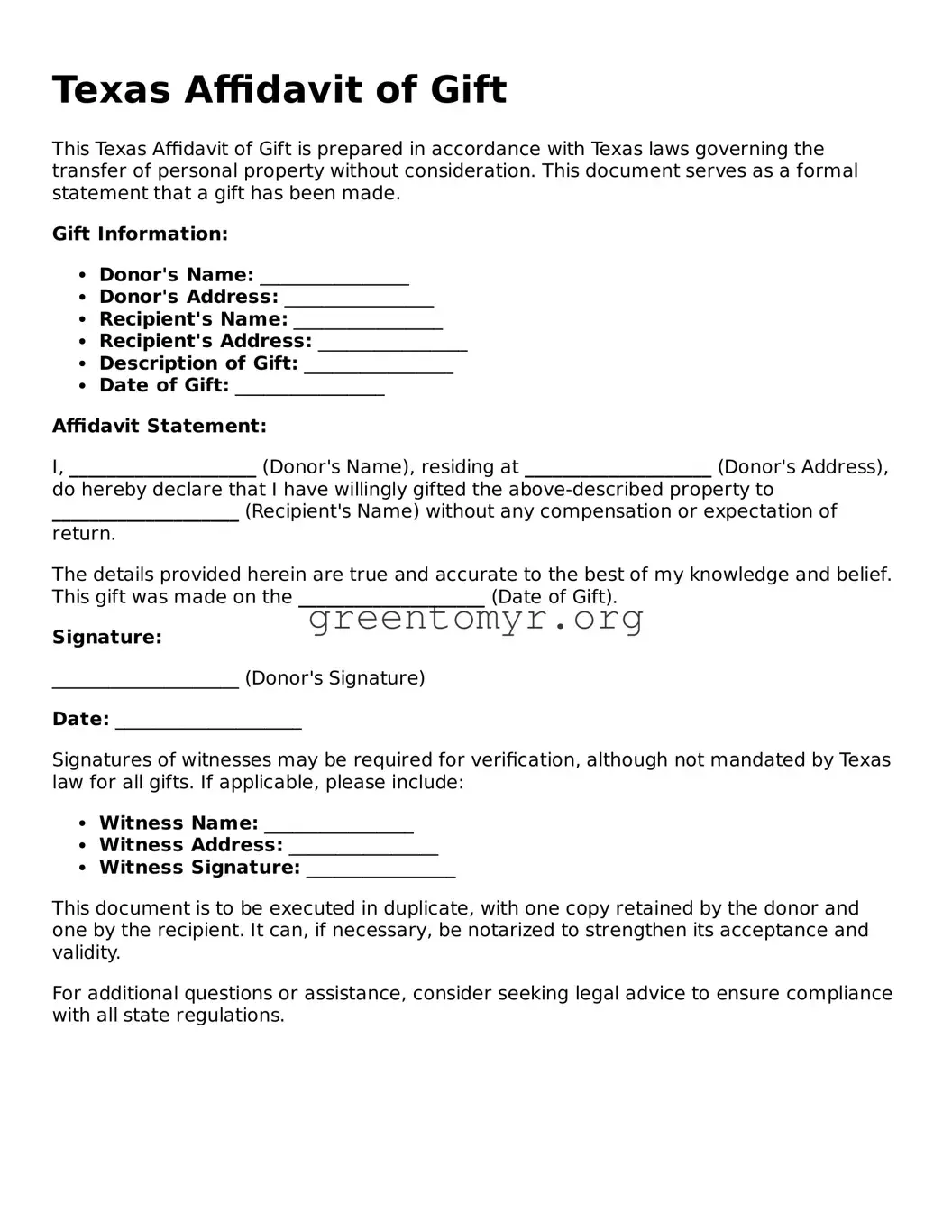

The donor must fill out and sign the Texas Affidavit of Gift form. Additionally, the recipient of the gift (the donee) may also be required to sign it, depending on the nature of the gift. To ensure proper execution, it may be advisable to have the document notarized. Notarization adds an extra layer of credibility and helps to validate the agreement legally.

Gifts may have tax consequences for both the donor and the recipient. Under federal law, individuals can gift a certain amount each year without incurring gift taxes. As of 2023, this annual exclusion amount is $17,000 per donor for each recipient. Gift amounts exceeding this threshold may require filing a gift tax return. It’s wise to consult a tax professional to understand the specific implications in each case.

Yes, when properly completed and executed, the Texas Affidavit of Gift form is legally binding. It creates a clear record of the intention to give a gift and outlines the terms of the transfer. However, to avoid potential disputes in the future, it is essential to ensure that all required parties sign the document and that it is notarized where necessary.

Once the Texas Affidavit of Gift form is executed and the gift is delivered, it may be challenging to revoke the gift. The intent behind the gift is typically seen as final. However, if there were issues such as fraud, undue influence, or incapacity at the time of execution, it may be possible to challenge the validity of the gift. Legal counsel should be consulted for guidance in such situations.

The completed Texas Affidavit of Gift form should typically be filed with the appropriate county office, such as the county clerk or the land records office if it pertains to real property. If the gift involves a vehicle, the form must be submitted to the Texas Department of Motor Vehicles (TxDMV). Filing ensures that the gift is officially recognized and protects the rights of both the donor and the recipient.

If the Texas Affidavit of Gift form is not used to document the gift, there may be difficulties in establishing the transfer of ownership legally. Without clear documentation, disputes may arise regarding the intent or the value of the gift. In situations where the gift is substantial, such as real estate, not having this form can lead to complications in property records and ownership claims.

Fees associated with submitting the Texas Affidavit of Gift form vary depending on the county and the type of property involved. For real estate gifts, there may be a recording fee. Vehicle gift transfers may incur fees through the TxDMV. It is advisable to check with the specific county or office where the form will be filed for the most accurate fee information.